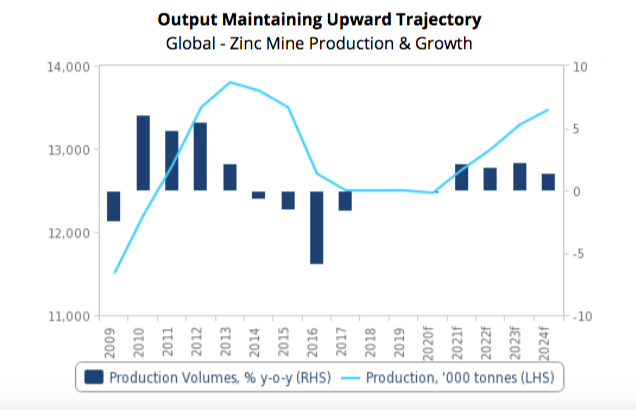

Globally, mined zinc production will continue to ramp up over the coming years as elevated prices encourage miners to restart idled capacity and begin production at key new mines, according to Fitch Solutions‘ latest industry report.

Global mined zinc production is poised for gains over the coming years, Fitch predicts.

Elevated zinc prices relative to historical levels will incentivise investment in new projects, expansions and restarts as the economics of the projects maintain their attractiveness, says Fitch.

“We also see scope for some idled capacity to be restarted. We forecast global zinc mine production to increase by an average of 1.7% y-o-y over our forecast period to 2029, reaching 14.8mnt of mineral production.”

China

Fitch expects China’s zinc mine production will stagnate over the coming years due to declining ore grades and increasingly stringent environmental regulations. The conservation of minerals and increasing consolidation of mining industries outlined in China’s 13th Five-Year Plan will weigh on zinc output, analysts assert.

Jiangtong Copper Group began construction on the Yinzhushan underground lead-zinc- silver mine in the Jiangxi Province in July 2019. The reports suggest the project has a mine capacity of 1.0mnt per annum, of which it is expected to produce 29.6kt of lead concentrate and 44.5kt of zinc concentrate.

Fitch predicts China’s position will erode from 31% of global mine production in 2020 to 26% by 2029

As such, the project represents a slight upside risk to Fitch’s forecast over 2021-2023, depending on when the mine commences operations and how quickly production ramps up.

Fitch forecasts the country’s zinc production to edge higher, from 3.8mnt in 2020 to 3.9mnt by 2029. Despite this muted growth rate, China will remain the largest global producer of zinc by a wide margin. Fitch predicts China’s position will erode from 31% of global mine production in 2020 to 26% by 2029.

Peru

Fitch forecasts Peru to remain a top zinc concentrate producer over the coming years. The country is home to approximately 57 mining firms according to the Ministry of Energy & Mines, which consist of both international firms such as Teck Resources and Glencore and as well as domestic miners.

Despite a large number of players, Peru’s zinc sector is dominated by the Antamina operation, which produced 409kt in 2018 and Nexa Resources’ Cerro Lindo and El Porvenir operations.

Over the short-medium term, Fitch analysts expect Antamina to continue driving production higher as the mine transitions to more copper-zinc ore and less copper-only ore between 2020-2022. Production is expected to ranged from 440-490kt per annum. Alongside Antamina, Korea Zinc’s expansion at Pachapaqui and Nexa Resources beginning production at the Shalipayco mine will also support growth, says Fitch.

Australia

Following 2019’s year of robust growth, Fitch expects Australia to maintain it’s positive trajectory over the coming decade. Over 2019, the ramp up of MMG’s Dugald River mine and the restart of Glencore’s Lady Lorreta mine at Mount Isa led the increase in Australia’s zinc mine output by an estimated 14% y-o-y.

The ramp up of MMG’s Dugald River mine and the restart of Glencore’s Lady Lorreta mine at Mount Isa led the increase in Australia’s zinc mine output

“Over 2020, we expect New Centruy Resources to be a significant driver of growth as the firm ramps up its Century mine asset and refurbishes its second train of flotation cells over 2020. We estimate the operation is on pace to produce approximately 120-132kt per annum, based on expected run rates achieved in December 2019, up from 94kt in 2019. Furthermore, the operation has the potential for further expansion, which is currently being evaluated by the firm and a feasibility study is expected by Q220.”

Given the country’s healthy pipeline of projects, Fitch expects the country to average the second-fastest growth rate globally to 2029.

India

India will increasingly drive global zinc mine production growth, Fitch asserts, as the country’s key miner Hindustan Zinc Limited (HZL) implements a large-scale expansion plan aimed at increasing the firm’s mined production output to 1.2mnt per annum by 2020 from 950kt previously.

Fitch estimates zinc mine production accounts for approximately 75-80% of the firm’s mined production output each quarter, the remaining proportion consisting of lead and silver. Various expansion projects were commissioned over 2019 and are expected to be completed by 2020, allowing for zinc mine production gains to feed through over 2020 and 2021.