Source: Bob Moriarty for Streetwise Reports 07/02/2020

Bob Moriarty of 321gold discusses the resource calculations at this company’s gold project in Brazil and explains why he’s an investor.

I fully approve of garimpeiro miners. Rarely can they read and write. They can live under conditions that the majority of us could never handle. They mine in a totally different way than do the junior resource companies in the space. They all make money. That’s right, 100% of garimpeiro miners make money regardless of what the price of the commodity is. They have to, because if they don’t, they don’t eat or provide food for their family.

Junior mining companies believe that spending money for twenty years and never making a dime in profit makes perfect sense. In fact, most geologists believe that geology is all about spending money. And they will spend money until frustrated investors finally give them the boot.

Garimpeiro miners think that spending money and not producing profit is daft. Because it is daft. When they can’t make money on a project, they stop spending money and time in fruitless activity. The “professionals” in the junior mining space don’t think much of the artisan miners but they could learn a lot from them.

One thing they could learn is where the gold is. If you go back to what I had to say about TriStar Gold in January, our newest sponsor, Cabral Gold Inc. (CBR:TSX.V; CBGZF:OTCBB) is in the same boat. They both followed the garimpeiro miners to the mother lode.

Cabral Gold has doubled since the crash lows in mid-March and is still cheap. The company has a 100% interest in the 36,000 square km Cuiú Cuiú

project with a million ounces of gold in 43-101 resources. The region was the world’s largest gold rush in the last 100 years with the artisan miners taking out somewhere between 20 and 30 million ounces of gold from near surface and surface mining. Their Cuiú Cuiú deposit produced 2 million of those ounces already. No doubt the locals left a few ounces, artisan mining leaves a lot of gold behind.

As a matter of general interest, Eldorado Gold is going into production at their 2.1 million ounce gold deposit only 20 km away. For many years infrastructure has been one of the biggest hurdles junior mining companies face in Brazil but the government put in a new road within the last five years that Eldorado linked into. Cabral has built a spur road from that. Brazil plans new hydroelectric plants in the area so power costs will drop and there will be more interest in the area.

The president, one of the largest shareholders of Cabral, Alan Carter, contacted me a year ago and pitched me on the project. My response to him was that all he needed to do was increase his visibility and the market would bid up the shares. He ignored me. The stock went down in spite of having compelling economics.

He called back this year. I told him the same thing. He’s on board now. The company just completed a major private placement and is sitting on $3 million cash reserved for drilling and exploration. Recent results that are now incorporated in the 43-101 show wonderful numbers including 3.4 meters of 36.9 g/t gold and 2.8 meters of 19.5 g/t Au. Surface samples from a newly discovered region called Alonso show grades of 11.6 to 200.3 g/t Au.

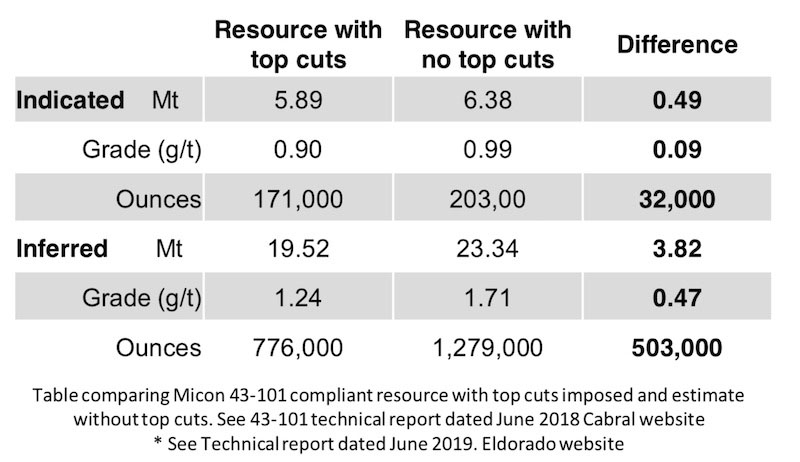

I highly suggest potential investors download the corporate presentation and go to page 11. I totally disagree with how Micon calculated the resource. When you are dealing with this form of gold, it has large nuggety gold in the saprolite layer at the surface decreasing to a tiny size in the laterite lower down: you get a really wide variation in size. Most investors, indeed most geologists don’t understand this but gold is highly mobile. In a very wet area such as Brazil half the year, the gold actually grows at surface in chemical remobilization. So using a top cut where you just ignore the very high grade simply is not accurate.

So I don’t buy the current 1 million ounce 43-101. It’s really 1.5 million ounces using the existing numbers but not being so anal about being conservative. Perfection is being accurate, not being perfect.

So their market cap is about $10 million USD and they have for all real purposes, 1.5 million ounces. That makes gold under $7 an ounce. If you must be anal retentive, it’s still gold for under $11 an ounce USD.

Given that the FED has guaranteed hyperinflation and the banks are going to close one day soon, owning a real resource run by real management where their interests are aligned with that of shareholders is probably a very good idea.

Cabral has major drill programs scheduled for the next six months so expect a lot of news. And this year the company is going to keep telling people what they have and that’s a really good thing.

Cabral is an advertiser. I missed the pp but I have bought shares in the open market. Do your own due diligence.

Cabral Gold

CBR-V $0.155 (Jul 02, 2020)

CBGZF OTCBB 88 million shares

Cabral Gold website.

Bob Moriarty

President: 321gold

Archives

321gold

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Cabral Gold. Cabral Gold is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cabral Gold, a company mentioned in this article.

( Companies Mentioned: CBR:TSX.V; CBGZF:OTCBB,

)