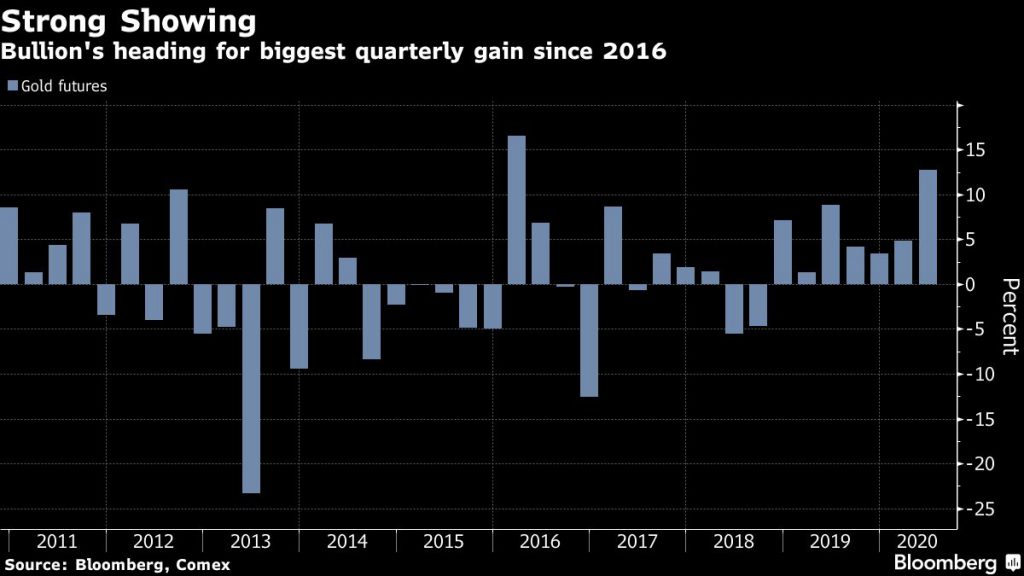

Gold prices surged again on Tuesday to its highest in more than seven years as fears of a resurgent coronavirus pandemic continue to mount, guiding the precious metal towards its biggest quarterly gain since March 2016.

Spot gold was up 0.5% to $1,780.64 per ounce by 2 p.m. EDT, after reaching $1,785.85 an ounce earlier in the session — its highest since October 2012.

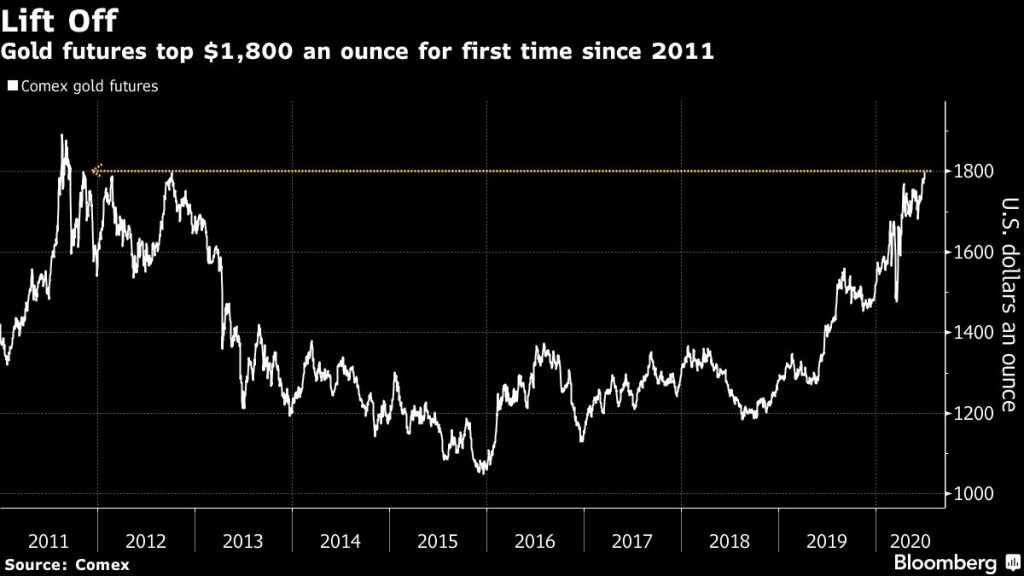

US gold futures also surpassed the $1,800 per ounce mark for the first time since 2011, with bullion for August delivery rising as much as 1.3% to $1,804 an ounce, as the recent upturn in covid-19 cases drove up demand for the precious metal as a haven.

“The $1,800 level is a psychological hurdle,” Howie Lee, an economist at Oversea-Chinese Banking Corp. in Singapore, told Bloomberg. “Low interest rates, monetary policies and the coronavirus are all at play.”

New virus hotspots are emerging, and the World Health Organization is warning that the worst of the pandemic is yet to come because of a lack of global solidarity.

Bullion is headed for its third straight month of gains, driven by stimulus measures to support economies decimated by the pandemic as well as ongoing US-China trade frictions. So far this year, price of the yellow metal has risen by 17%.

“The big picture view, is that gold is in the middle of a regime shift from a safe-haven asset to an inflation hedge asset,” Daniel Ghali, commodity strategist at TD Securities, told Reuters.

“US yields have continued to grind lower and the result of that is that real rates are printing new lows,” which he believes has boosted the precious metal, long considered a hedge against inflation and currency debasement.

(With files from Bloomberg and Reuters)