Global investors and corporates are divided in their perception of sources of future environmental, social and governance (ESG) risks, according to a joint conducted by CRU and Fitch Ratings.

The 2020 Metals and Mining Survey obtained responses from more than 100 corporate issuers and investors active in the sector across diverse geographies and activities.

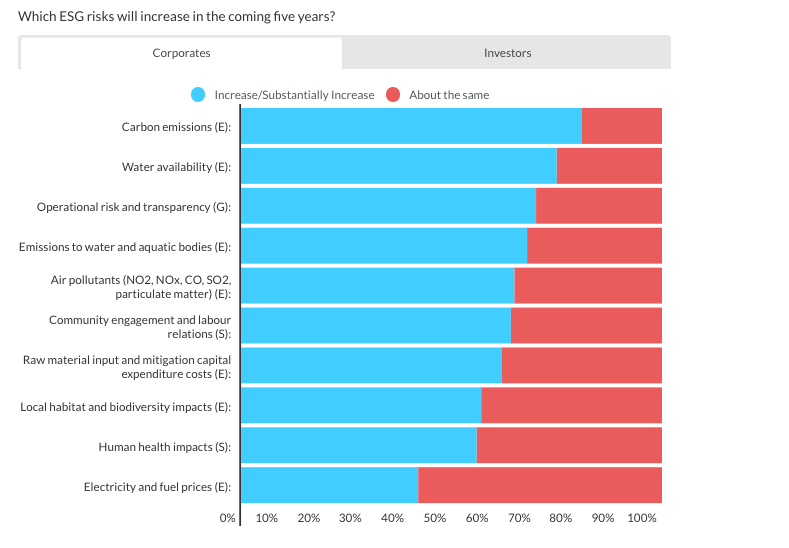

The survey revealed stark differences between corporate and investor respondents when asked to identify the most material ESG risks in the next five years.

Corporates point to carbon, air and water emissions as key risks, while investors identify concerns regarding water scarcity, labour relations and human health as those most likely to increase or substantially increase in the next five years.

Corporates point to carbon, air and water emissions as key risks, while investors identify concerns regarding water scarcity, labour relations and health

The report reveals corporates view carbon emissions, hazardous waste management and air and water pollutants as key emerging risks, but investors are increasingly concerned about water scarcity, labour relations and health risks.

Survey respondents across the corporate and investor base of the

metals and mining sector point to a greater focus on ESG in the

investment process as a key driver of risk to a “high impact” sector.

Fitch and CRU’s survey reveals that ESG controversies and media coverage

influence investment policies. Nonetheless, physical climate risks

(such as droughts, floods and other natural disasters) are identified

as the top ESG risk across all sectors and regions in their survey.

Researchers observed strong regional trends. Some coal mining companies operating in the developed market in Canada and the US have elevated scores for greenhouse gas (GHG) emissions and air quality, driven by compliance costs as coal production and power face increasing regulatory pressure.

The survey also found some steel producers and processors have elevated ESG risks for labour relations and practices. Several European miners have elevated scores for the governance structure and group structure categories.

Hazardous waste management is a prominent credit-relevant issue in particular for Latin American miners. Labour relations and practices and exposure to social impacts also have higher credit relevance in Latin America, in part due to previous operational disruptions and labour disputes. Social impacts may be more acute in these regions because of their relatively high-income inequality, disputes over rising utility costs and competition for privatised water resources.

Financing affected

Major mining companies and processors show how ESG risks can affect credit profiles. The survey found several rating downgrades and negative outlooks have followed major ESG controversies.

The survey also found growing scrutiny of ESG risk could increase the cost of capital for issuers deemed to have insufficiently managed these risks, particularly those that lack country and business-model diversification.

Read the full report here.