Source: Streetwise Reports 06/18/2020

Ely Gold aims to emulate the early years of today’s royalty majors.

Ely Gold Royalties Inc. (ELY:TSX.V; ELYGF:OTCQB; I4U:FSE) features a unique business model: in addition to purchasing royalties outright, it engages in royalty generation, which is acquiring properties mostly through staking, optioning them out and retaining a royalty when the sale is completed.

Ely Gold’s market cap, around CA$250 million, places it in the middle range of junior royalty companies—junior royalties are usually defined as having market caps between $100 million and $500 million. At $250 million, Ely Gold’s market cap is roughly in line with Metalla Royalty & Streaming and Abitibi Royalties.

“We think Ely Gold offers attractive growth potential.” – Mark Reichman, Noble Capital Markets

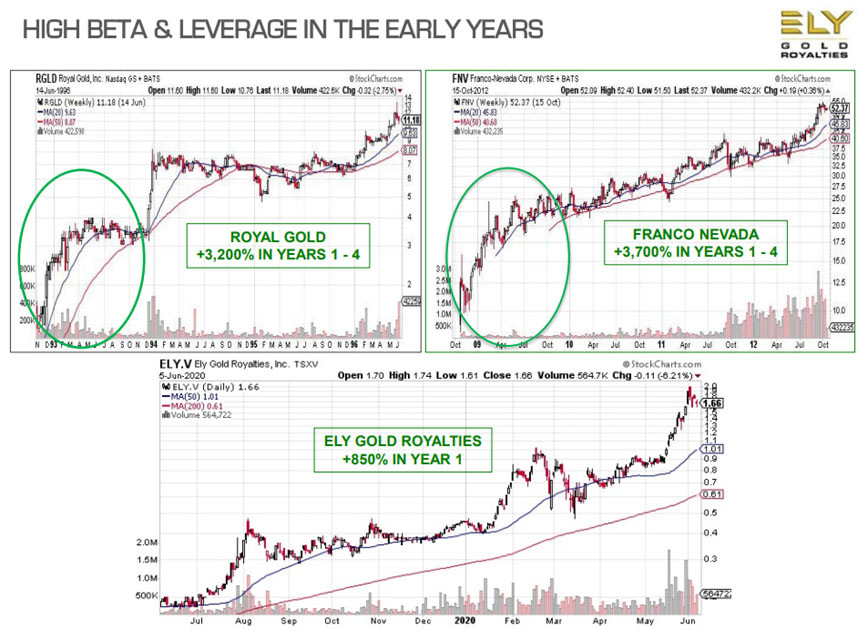

“While we are focused on becoming a mid-tier royalty company, we are really aspiring to be the next Royal Gold or Franco-Nevada by emulating what they did in their first four or five years,” Ely Gold’s President and CEO Trey Wasser told Streetwise Reports.

“Both Royal Gold and Franco-Nevada started with Nevada gold mining properties,” Wasser explained. “In their first four years in existence, they produced returns of 3,200% and 3,700%, respectively. Royal Gold, in the early 1990s, started with just one asset, the Cortez Pipeline royalty. They were a 30-cent stock that over the next few years became a $12 stock, and today they are a $135 stock. In the case of Franco-Nevada, they were a $2 stock that became a $55 stock in their first four years, fueled mostly by their Goldstrike royalties.”

“All that happened with a business plan very similar to Ely Gold’s: with projects located at some of Nevada’s larger gold mines,” Wasser said. “We’re picking up royalties on some of these same projects, so we believe that people are picking up on the comparisons to Ely Gold as the next Royal Gold or Franco Nevada. Is that aspiration too high? We have the potential, given the assets we are acquiring, and hope to generate those kinds of returns.”

Around 95% of Ely Gold’s assets are in Nevada, and the firm engages in royalty generation in addition to royalty purchases. The firm currently has an inventory of 34 properties for sale, which with royalty interests and properties being purchased brings the total number of properties to more than 100.

“That potentially makes us one of the largest property owners in Nevada, certainly by number of projects, that’s pretty compelling for a junior company and gives us a solid platform for growth,” Wasser stated.

Wasser differentiates his company from others by using three key metrics: business model, management execution and path to production.

Commenting on Ely Gold’s business model, “We differentiate ourselves from many of our peers in that we are generating royalties from property acquisition and sales that subsequently generate royalties,” Wasser said. “We never do joint ventures or earn-ins. We do straight 100% property sales. When a buyer has made all their options payments, we give them a mineral deed and they give us a royalty deed. If they don’t make all the payments, we get the property back 100%.”

The company is aggressively purchasing royalties. “The major and mid-tiers generally make royalty investments by being part of the financing package of new mine construction or mine expansion, where there’s a large capex requirement. The junior companies are mostly purchasing royalties, or in our case purchasing and organically generating royalties,” Wasser explained.

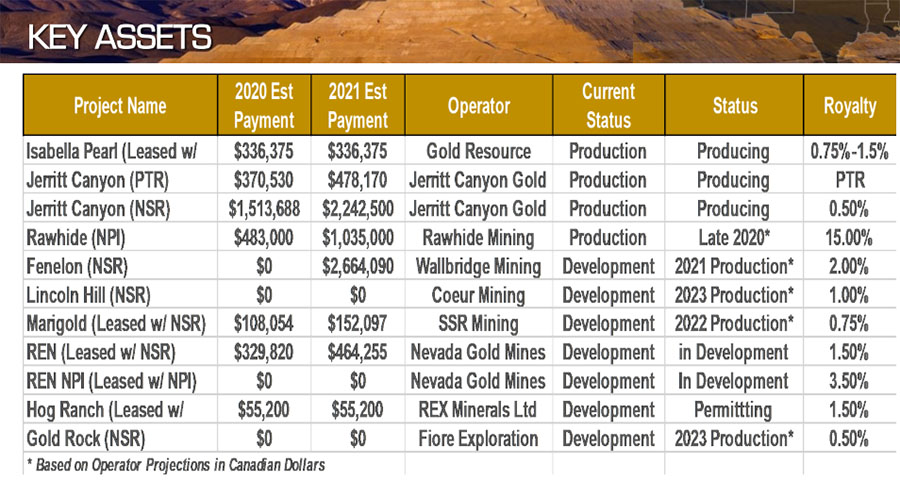

Management execution is the second metric in evaluating a royalty company. “Our focus is on adding net asset value to the portfolio. Net asset values are based on the cash flow that the royalties should generate in the future. The longer that revenue stream is from starting, the lower the net asset value on the asset. We are very active and have closed nine royalty transactions so far this year. Four of them are pretty significant royalties on three of Nevada’s largest gold mines,” Wasser said.

The third metric is the path to production. “First, you have to look at the project and determine if it can be developed at current gold prices emphasizing the ‘what and when’ of the potential cash flow,” Wasser stated. “But the second part is the operator of the project. Is it owned by a junior company that has never built or operated a mine before? Does the operator have the capital to build the mine or borrow to finance the construction, or is it going to take a corporate miracle for that to happen? Or, as is the case with our key assets, is the operator a seasoned operator, a mine builder, a well-financed major or mid-tier producer? That’s where our portfolio is being differentiated and it is really shaping up with our recent acquisitions.”

In February, Ely Gold announced the acquisition of VEK Associates, a privately held company. VEK’s portfolio holds a 50% interest on leases on five properties. Four are leased to Nevada Gold Mines, the Barrick-Newmont joint venture: REN, Lone Tree, Pinson and Carlin Trend. The other, Marigold, is leased to SSR Mining. “Two of the properties are near-term producing assets,” Wasser said. “SSR Mining is a standout mid-tier producer. There are two deposits on the acquired Marigold claims and lease that are in the current mine plan to start production in 2022. The Marigold Mine is an open pit, heap leach operation running at 200,000 tonnes per day and has over 3 million ounces in reserves.”

The other near-term producing asset is operated by Nevada Gold Mines, at its Goldstrike mine. “The REN property is the extension of the underground ore body,” Wasser stated. “Centerra outlined a mineralized resource of 2 million ounces on our REN claims between 2000 and 2010 in a JV with Barrick. In 2010, Barrick bought out Centerra’s interest and really hasn’t done any exploration on the property since. It now is looking at plans to bring the REN property into production and explore the entire property from underground. It is a very deep high-grade deposit and is already permitted for mining. In addition to the REN lease, ELY Gold purchased a 3.5% net profit interest royalty on REN.”

Wasser noted, “Goldstrike and Marigold were important assets for Franco-Nevada’s growth. Goldstrike has produced over 45 million ounces of gold, including over 12 million from the underground mine near REN. Marigold has produced over 3 million ounces of gold. Franco Nevada has multiple royalty interests on both assets. We are following in their footsteps.”

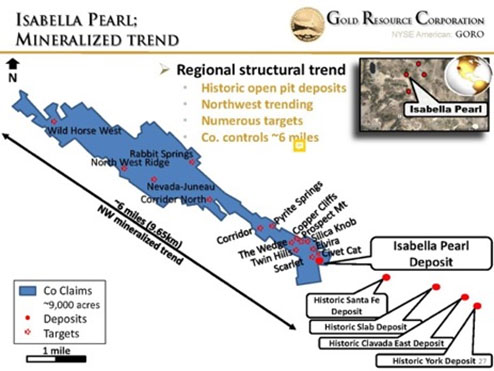

Ely Gold currently has three producing assets. At the privately operated Jerritt Canyon mine, Ely Gold holds a Per Ton Royalty Interest on all material that goes through the mill, and a 0.50% Net Smelter Return (NSR) royalty on production from the entire property package. The third asset is a 0.75% NSR royalty on the Isabella Pearl property, operated by Gold Resource Corp. Ely Gold also has a 2.5% royalty on 6 miles of expansion ground at Isabella Pearl that was generated from their property portfolio.

Wasser is also excited about Wallbridge Mining’s Fenelon project, located in Quebec. “The project is growing quickly. This past year as Wallbridge has outlined a large underground ore body and it’s looking like it’s going to get much bigger.”

“Jerritt Canyon and the REN property both have mineralized resources of about 2 million ounces of gold and we believe they have the potential to become tier one mines, which means 5 million ounces or greater. Fenelon also has that potential. And all have a clear path to production. As mentioned, Jerritt Canyon is currently producing and the way we structured that purchase we’ll see nearly a full year of royalties in this year,” Wasser stated. “Two other key assets, the Gold Rock project of Fiore Gold and the Lincoln Hill project with Coeur Mining, are satellite mines and due to be in production sometime in 2023.”

“When you talk about that path to production, we have some of the best properties, with the best operators in the best mining jurisdictions in the world. All, except Gold Rock and Hog Ranch, are current operations where the mine and processing plant does not need to be built,” Wasser said.

“We do not buy longer term exploration royalties with no real net asset value. We generate those as either development or exploration assets in our portfolio. All our 21 development assets are at or near producing mines and of our 33 exploration assets, eight of them are currently being drilled. Most were generated internally through property sales. This allows us to focus on purchasing royalties with a clear net asset value by buying royalties that are at or near production. You will rarely see us spending shareholder equity for anything that doesn’t add a clearly defined net asset value to our portfolio,” Wasser concluded.

On May 21, Ely Gold closed a brokered private placement for gross proceeds of CA$17.25 million, at CA$0.80 per unit, with one unit composed of one common share and one-half of a purchase warrant to acquire one common share at a CA$1.00 exercise price for three years. Ely Gold has about 157 million shares outstanding, and 197 million fully diluted. In May, the company up-listed to the OTCQB Market, and trades there under the symbol ELYGF. It trades on the TSX Venture Exchange under the symbol ELY.

Ely Gold has caught the attention of industry analysts. Noble Capital Markets analyst Mark Reichman awards Ely Gold an Outperform rating and wrote on June 16, “In 2020, the company has announced the purchase of 8 producing or near-term producing royalties and option/sale agreements on several properties, including Olympic and White Rock. We believe potential exists for the company to announce additional royalty purchases this year and also increase the company’s exposure to projects in which the company already holds royalty interests.

“In our view, Ely Gold offers shareholders leverage to gold prices through its growing portfolio of long-term gold royalties. …Ely has made several significant transactions in recent months that are expected to accelerate revenue and cash flow growth. …Based on the company’s successful record of growing its project portfolio coupled with a constructive gold price outlook, we think Ely Gold offers attractive growth potential,” Reichman concluded.

Analyst Jay Taylor wrote in Hotline on May 8, “I think there is a lot more upside for Ely Gold given their pipeline of near-term producing projects as well as a large number of attractive exploration projects located mostly in Nevada.”

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Ely Gold Royalties. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Ely Gold Royalties and Newmont, companies mentioned in this article.

Additional disclosures:

Disclosures for Noble Capital Markets, Ely Gold Royalties, June 16, 2020

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

The Company in this report is a participant in the Company Sponsored Research Program (“CSRP”); Noble receives compensation from the Company for such participation. No part of the CSRP compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed by the analyst in this research report.

The Company has attended Noble investor conference(s) in the last 12 months.

Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) within the next 3 months.

Noble is not a market maker in the Company.

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Senior Equity Analyst focusing on Basic Materials & Mining. 20 years of experience in equity research. BA in Business Administration from Westminster College. MBA with a Finance concentration from the University of Missouri. MA in International Affairs from Washington University in St. Louis. Named WSJ ‘Best on the Street’ Analyst and Forbes/StarMine’s “Best Brokerage Analyst.” FINRA licenses 7, 24, 63, 87.

Disclosures from J Taylor’s Hotline, May 8, 2020

The opinions expressed in this message are those of Jay Taylor only and they do not necessarily represent the opinions of Taylor Hard Money Advisors, Inc., the publisher of J Taylor’s Gold, Energy & Tech Stocks. The management of THMA may, from time to time, buy and sell shares of the companies recommended in J Taylor’s Gold, Energy & Tech Stocks newsletter and in this Hotline message. No statement or expression of any opinion contained either in this Hotline or in J Taylor’s Gold, Energy & Tech Stocks newsletter constitutes an offer to buy or sell the securities mentioned herein.

Companies are selected for presentation in J Taylor’s Gold, Energy & Tech Stocks strictly on their merits as perceived by Taylor Hard Money Advisors, Inc. No fee is charged to the company for inclusion. The editor, his family and associates and THMA are not responsible for errors or omissions. They may from time to time have a position in the securities of the companies mentioned herein.

( Companies Mentioned: ELY:TSX.V; ELYGF:OTCQX; I4U:FSE,

)