The effects of the global coronavirus pandemic to energy markets, which saw demand dropping to levels not seen in 70 years, as well as enduring behavioural changes caused by the crisis are expected to have lasting changes to energy consumption.

Researchers at Moody’s Investors Service said on Thursday that recessionary forces and weaker long-term growth expectations will likely place pressure on both corporate and household demand.

At the same time, habits changes, along with increasing use of biofuels, electric vehicles (EVs) and improved engine efficiency adds to the risk of oil demand eroding over time, the credit ratings agency believes.

Disruption to energy markets and enduring behaviour changes caused by covid-19 may deliver lasting change to energy consumption.

Those factors haves brought the generation of energy from fossil fuels to breaking point and could accelerate the transition to a low-carbon energy system.

“Changes in consumer behaviour and ongoing policy and technology changes could combine to deliver accelerated structural change to the global oil sector and coal-fired power generation,” Moody’s says.

The agency notes that economic recovery packages put in place by governments will also affect the speed of the energy transition.

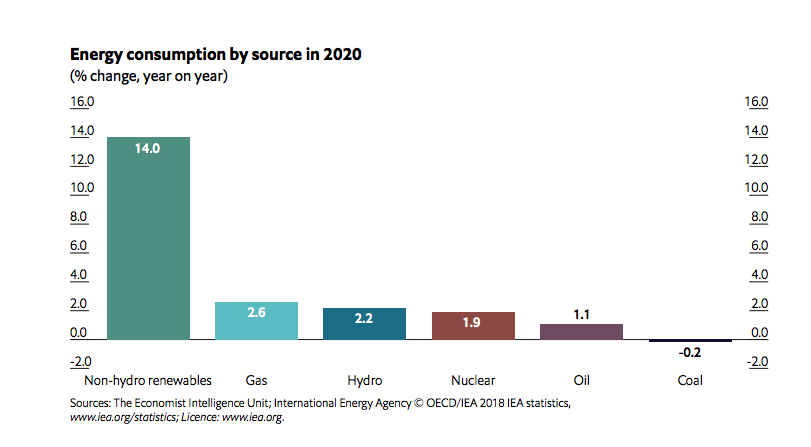

The International Energy Agency (IEA) estimates that overall energy demand decreased by 6% as lockdown measures were introduced. It also expects energy-related emissions to contract by 8% this year.

When it comes to fossil fuels, the IEA predicts a 9% drop in oil demand and 8% for coal this year. Both will happen in parallel to crude oil staying at record-low prices, it says.

Demand-driven fossil fuels crisis

“Previous energy crises provide insight into what happens when the oil price crashes and how the use of fossil fuels has subsequently rebounded,” said Nelson Mojarro, advisory board member of Partnering for Sustainable Energy Innovation at the World Economic Forum.

The current energy crisis, Mojarro claims, is different as it’s driven by demand. “The scale of the fall in demand, the speed of change, and how widespread it has been have generated a radical shift that seems to be more than a temporary short-term drop in demand for fossil fuels, at least in the power sector,” Mojarro, who is also a former vice-chair at the IEA Committee of Energy Research and Technology, wrote this week.

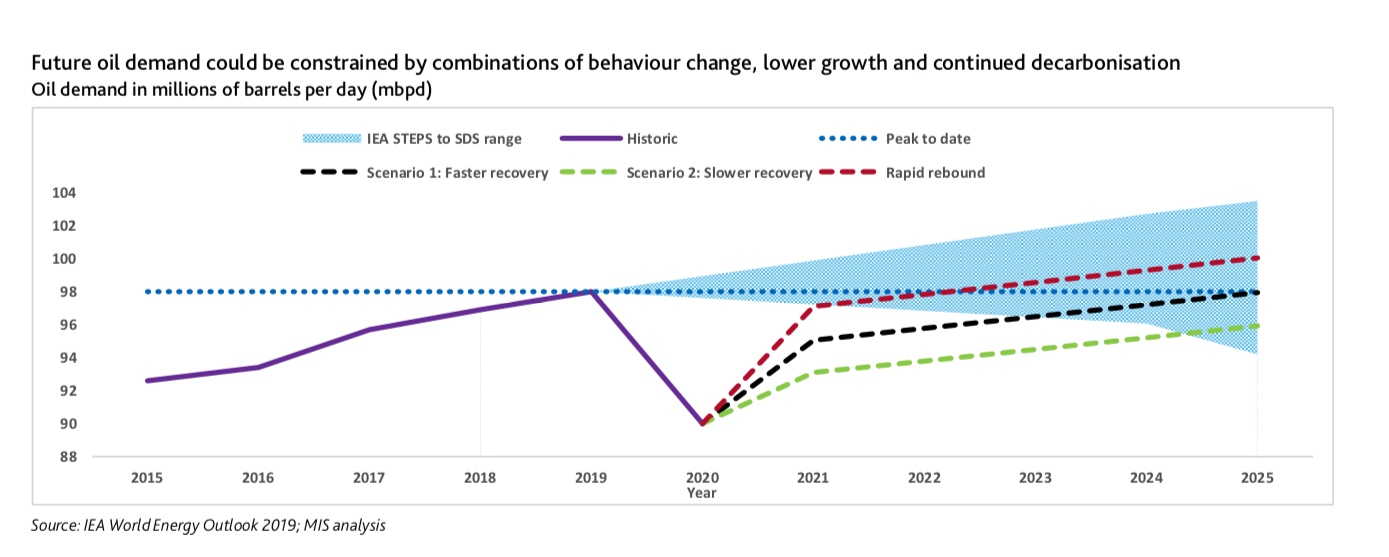

As the covid-19 pandemic leads to a drop in demand for coal and oil, Moody’s says some of key questions include how much of that lost demand will return and over what period of time.

“In 2020, we are not expecting energy demand to rebound as much as economic growth, as covid-19 disruption dampens the normal effect that low oil prices would have to stimulate demand, “ it says. “Our base case does not expect global real gross domestic product in level terms to return to the pre-coronavirus levels till the end of 2021, and, for some oil intensive activities like aviation, a recovery will take longer.”

Based on predictions by the IEA and experts from The Economist Intelligence Unit (EIU), renewable energy is here to stay. As of 2019, it already overtook coal as a source of electricity generation and dropping prices for gas, solar and wind would help cement that victory.