Chris Taylor has another great bear–but this one is a kodiak.

His last deal–Great Bear Resources (GBR:TSXV, GTBDF:OTC) — went from 15 cents to over $9 in 20 months as they discovered a huge gold deposit in Red Lake, Ontario. Then it soared further to $14!

That quick move to $9 was a 60-Bagger in the blink of an eye. If you were lucky, you turn $10,000 into $600,000. It’s a win that allows you to relax. It’s a win that lets you do anything you want for a year…or three.

Taylor is back doing the same kind of geological detective work he did with Great Bear—with Kodiak Copper. Kodiak is now trading at 43 cents. It’s in the same spot Great Bear was at 15 cents, right when they started and before their first discovery.

Kodiak is similar to Great Bear in many ways:

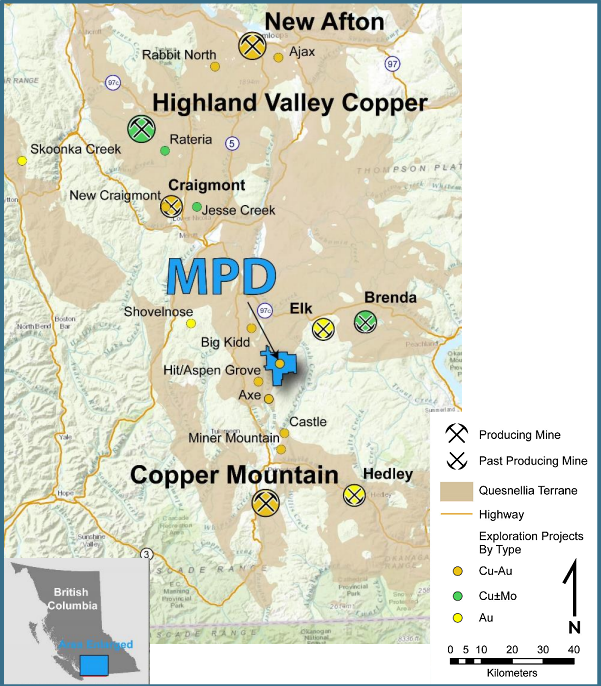

- Its main property is in Canada—in this case southern British Columbia

- And it’s located just off a highway. Lots of nearby services and infrastructure means low cost exploration

- It’s in a prolific porphyry district—There are SEVEN past and present mines in the district

- Taylor acquired a large land package which could hold multiple deposits

- There is lots of historical data

- Like Great Bear, Taylor has a geologic approach that is different and is already bearing fruit

- It has a tight share structure—just over 36 million shares outstanding

- In this hot junior market, just ONE drill hole can add BIG value to shareholders —just like Taylor did with Great Bear.

The two plays are SO similar! Exploration legend John Robins is an advisor here as he is at Great Bear. Not only is he one of Canada’s premier land stakers, he has monetized numerous plays—most notably selling Kaminak to Goldcorp for over half a billion dollars in 2016.

But Kodiak has one advantage over Great Bear for the early stage investors–Kodiak already has a discovery hole because of Taylor’s outside-the-box-thinking. I’m going to tell you about that as I explain their property and how it could be on the cusp of a major discovery.

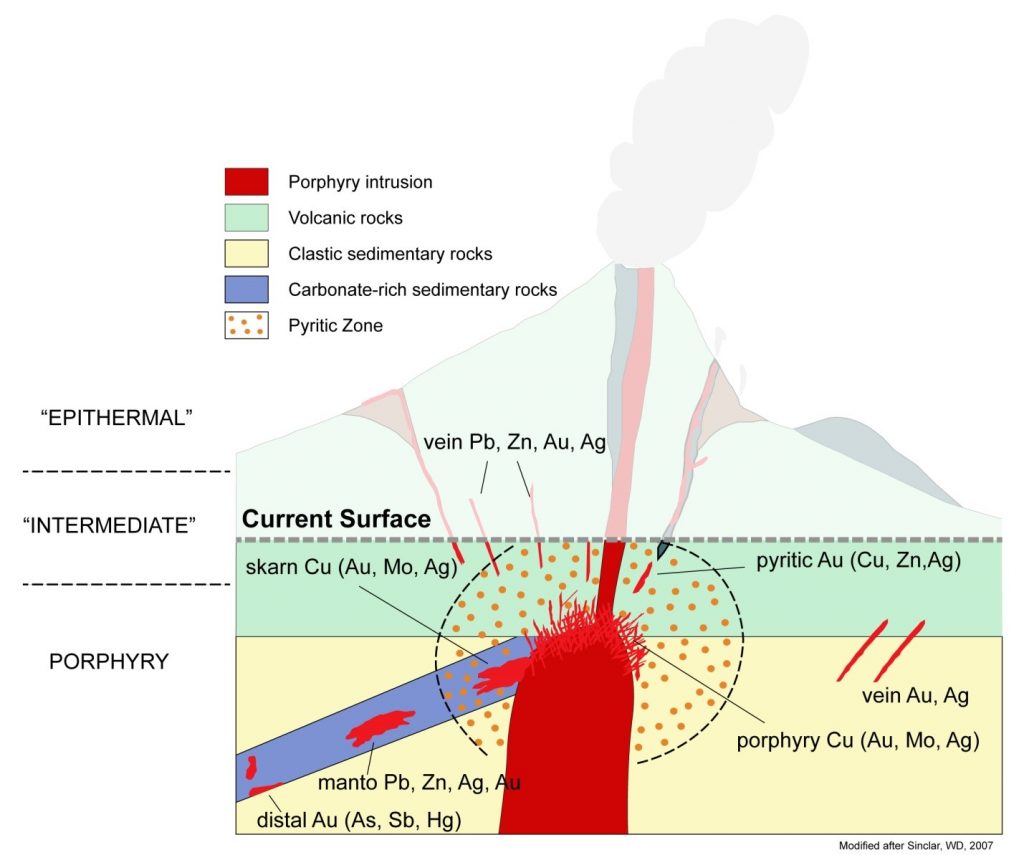

Great Bear is high grade gold in northern Ontario, but Taylor’s expertise is actually in large, lower grade copper-gold deposits called “porphyries”.

There is one very important thing to know about porphyry deposits–they are consistently mineralized over a VERY large area. They are one of, if not THE largest mined deposits in the world.

What that means is—when your drill hole hits porphyry-style mineralization, especially in a world class mining district—you may be onto something big. That’s why early drilling success can add A LOT of shareholder value.

And for the first time in a long time–I love copper right now. Copper prices have bounced back hard and fast since the COVID crisis, and China’s copper refineries “are sucking in concentrate at higher rates than the record setting 2019 total of 22 m tonnes” says mining.com.

Did I mention the stock is only 43 cents?

Porphyries are found up and down the west coast of the Americas–from northern BC right to Tierra del Fuego in southern Chile.

The porphyry asset that Taylor has locked down for Kodiak Copper is called MPD and it covers a sizeable footprint. At MPD, copper and gold have already been found over an area of 10 square kilometers. Major mining companies love these deposits because they produce incredible cash flow for decades. They’re that BIG.

Taylor bought Great Bear’s Dixie asset for $200,000 and turned it into a project that is now worth more than half a billion dollars today. The Dixie project area was large, had over 100 historic drill holes, was right beside the highway, good infrastructure and not well understood.

The MPD project is also large, is also located right beside a highway in southern BC, and also has over 100 historic holes. Similarly, Taylor bought 100% of the MPD property for only $200,000 and $100,000 in shares.

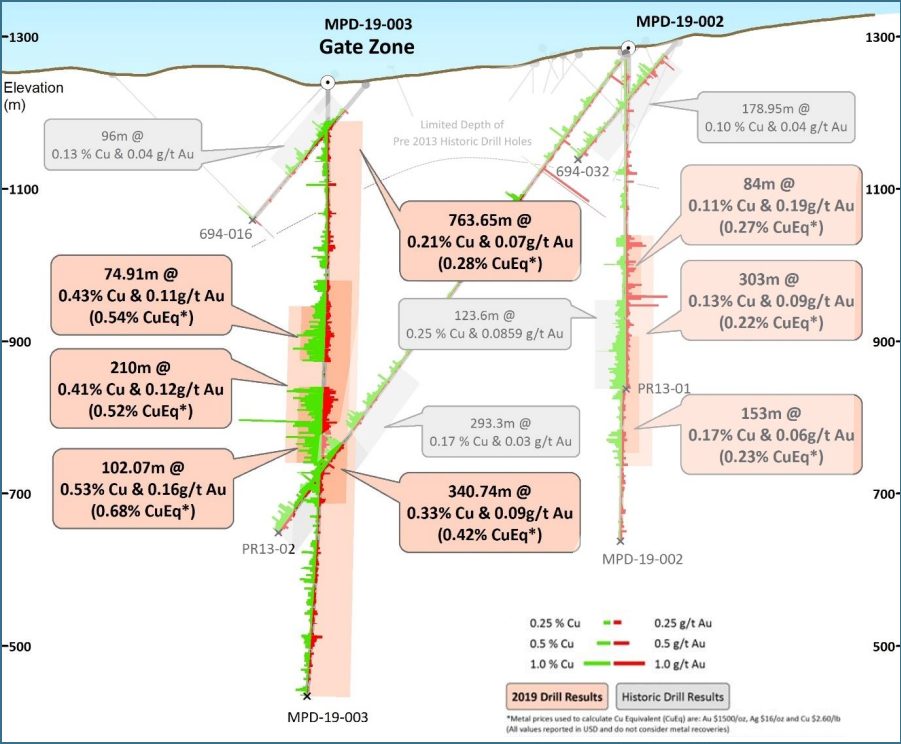

Those holes confirmed the property had huge potential—but after going over the historic work, Taylor realized that the past drilling rarely tested below 200 meters depth.

Right away, he knew what to do. Last November Taylor’s Kodiak Copper team drilled hole MPD-19-003—which went deeper than the 100+ historic holes ever had on the property.

Deeper was better–MUCH better.

That drill hole hit almost double the copper and gold grades over 200+ meters depth —just below where previous drilling had stopped – and discovered what Kodiak now calls the “Gate Zone”.

Not only did this new discovery increase the value of MPD—but drilling suggested they were close…really close…to the core (read: higher grade) of a system with one or more porphyry centres.

The new Gate Zone discovery even beat the expectations of Taylor and his team. The deeper drilling at Gate returned:

1) higher grades over longer intervals than all earlier holes,

2) the length of mineralization was also the longest reported to date (mineralization now goes down 800 metres vertical depth!)

The grades at the new Gate Zone now compare very favorably to those from nearby producing mines – and this is elephant country for copper-gold mines.

The Copper Mountain mine is located only 35 kilometres (20 miles) to the south and the prolific Highland Valley Copper mine is situated just 80 kilometres (50 miles) to the northwest.

That means that this is a very, very small company could be sitting on something very valuable. Just as Taylor thought at the beginning of Great Bear’s Dixie project.

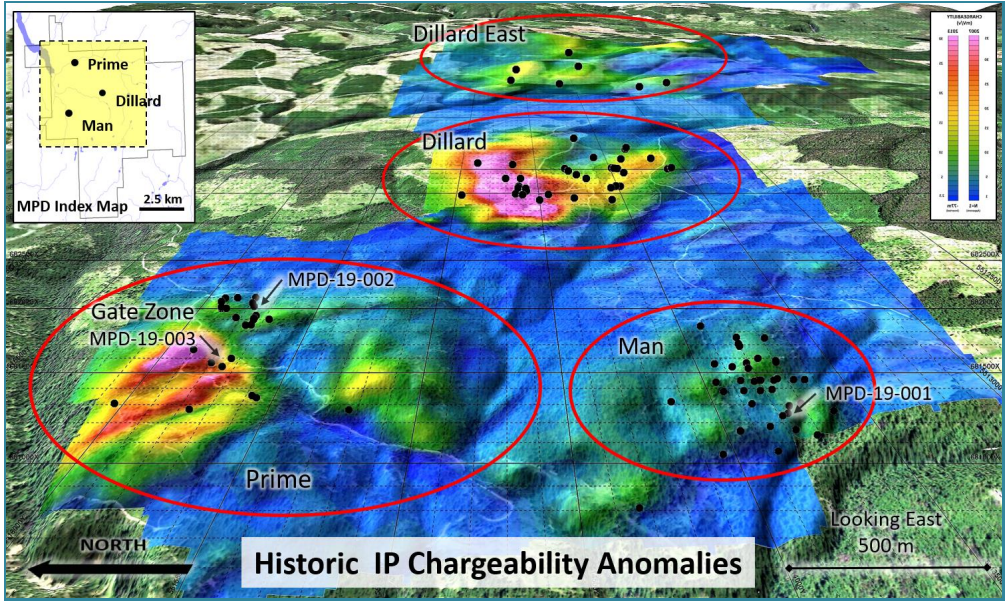

Based on what Taylor and his team are seeing from reworking the historic data, they interpret there could be at least three or four porphyry centres clustered underneath the MPD property. To be clear —— the more the better!

The single discovery hole at the Gate Zone last fall did not hit the porphyry center, but rather they think they just clipped the side of it. That means that the best drilling results are likely yet to come.

Past exploration has found copper and gold all over the surface at MPD and covering more than 10 square kilometers–a major sign that this is likely a big system.

Taylor and his team also believe this system is probably upright and intact, making it simpler to explore

Kodiak is drilling early this summer. I want to repeat—we are now in a rare junior market where exploration can be richly rewarded.

In a perfect world, this summer Taylor’s team will:

1) Build on the best drill holes ever found on the property, and find even higher grades over a larger area at the Gate Zone

2) Test the TWO other priority zones at other porphyry centres with deeper drilling, below copper/gold zones from earlier shallow drilling.

CONCLUSION

Great Bear’s Dixie property and Kodiak’s MPD property have freakishly similar set-ups.

Like investors saw with Great Bear’s success, any drill results this summer– that continue to show economic grades and widths–will likely have a HUGE impact on the stock—and we have seen what Taylor’s stocks can do.

Kodiak has a tight share structure, hot management team, big project, great initial results and a low-cost development path. There are no guarantees in the resource sector but getting in early on potential big discoveries like this is why investors like us love this sector.

You get one chance to get in on the ground floor on Chris Taylor’s next deal. That chance is right now.

Kodiak Copper has reviewed and sponsored this article.The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.

Keith Schaefer is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.