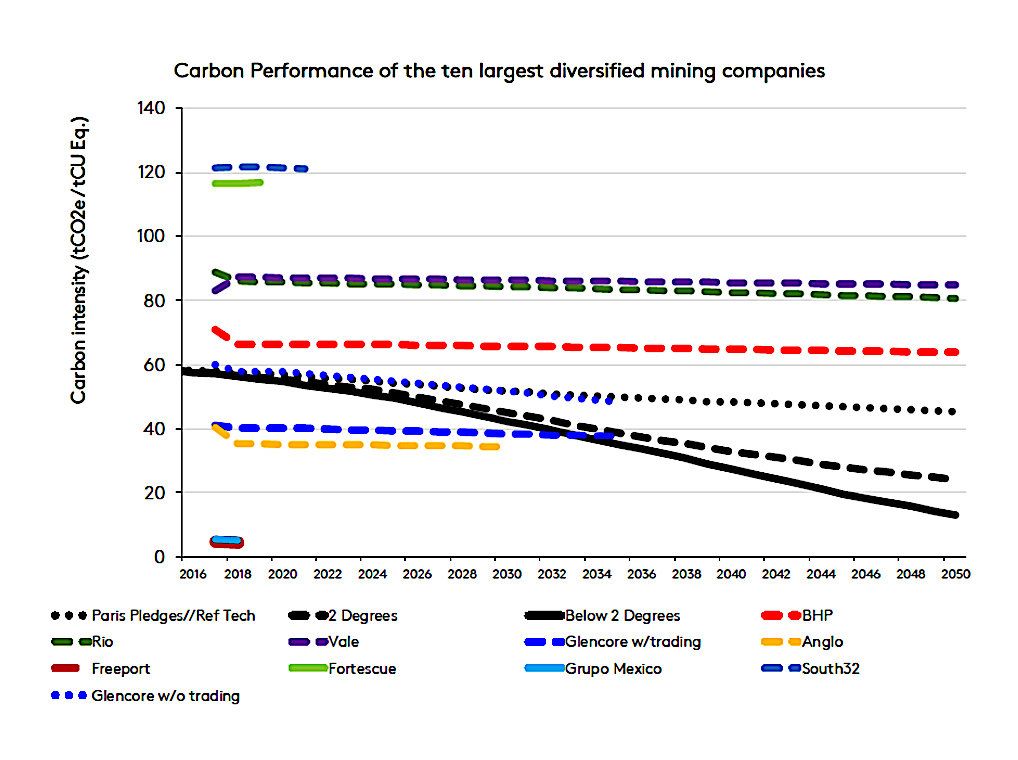

Fortescue Metals Group (ASX: FMG), the world’s fourth largest iron ore producer, has brought forward a self-imposed deadline to be carbon-neutral by 2040, about 10 years earlier than its closest rivals BHP, Rio Tinto and Vale.

The Australian miner expects to slash by 26% its own operational emissions by 2030, from current levels. Fortescue had previously signalled it intended to be carbon-neutral by the “second half of the century”.

The fresh target, part of the company’s climate change strategy, only considers Scope 1 and Scope 2 greenhouse emissions — those directly generated by an organization as well as indirect emissions from the power it buys to run its operations.

Scope 3 emissions, caused when a company’s product is used, processed or shipped to customers, were not mentioned in the update.

Chief executive Elizabeth Gaines said the company had announced investments of about $800 million since October in projects to reduce reliance on fossil fuels. Those initiatives include adopting solar power and a solar-gas hybrid systems, she noted.

“Mining is one of the most innovative industries in the world and Fortescue is harnessing this technology and capability to achieve carbon neutrality with a sense of urgency,” Gaines said.

“In addition to the development of gas technology and renewables for our stationary energy requirements, we are working towards decarbonizing our mobile fleet through the next phase of hydrogen and battery electric energy solutions,” she added.

Not enough

Climate-focused investors welcomed Fortescue’s strengthened policies, but believe the company needs to do more.

Shareholder activist Market Forces, which last month gained the backing of one in three Rio Tinto shareholders calling for the miner to include Scope 3 targets, said Fortescue’s 2040 net-zero goal was a step in the right direction, but did not go far enough.

While Fortescue does not extract fossil fuels such as coal, Market Forces estimates the company’s Scope 3 emissions from the use of the iron ore it produces are equally bad. The carbon-heavy steelmaking process, it says, accounts for at least 90% of the emissions in Fortescue’s value chain.

The Perth-based miner’s efforts follow similar announcements made by major mining companies.

BHP (ASX, LON, NYSE: BHP), the world’s No. 1 miner, has committed $400 million over five years to reduce greenhouse gas emissions from its operations and mined commodities.

It has also vowed to reduce its Scope 3 emissions, which are 40 times greater than those generated by its mines and oilfields.

Rio Tinto (ASX, LON, NYSE: RIO), the world’s second-largest mining company, will spend $1 billion over the next five years to reduce its carbon footprint and have “net zero” greenhouse gas emissions by 2050.

As FMG, Rio is not tackling emissions generated when customers burn or process the raw materials it mines.

Other top miners, including Brazil’s Vale (NYSE: VALE) and Canada’s Teck Resources (TSX, NYSE: TECK) recently set targets to be carbon-neutral by 2050.

Anglo American (LON: AAL), , which has taken actions such as installing floating solar panels on a copper mine’s waste pond, has a vision to achieve carbon neutral mining by 2040.

Since early this year, roughly 800 financial services organizations with $118 trillion in assets under management have committed to making climate-risk disclosures about their portfolio investments.

“Despite the business case in support of decarbonization, many mining companies continue to see it as a cost rather than an opportunity — making it difficult for proponents to unlock the capital required to move forward,” Tim Biggs, Mining & Metals Leader, Deloitte UK, told MINING.COM in February.

“A massive shift toward electrification could also change the way employees work, requiring companies to obtain buy-in not only at the management level, but at the operations level,” Biggs concluded.