China could move to re-invest in its mining industry to secure its resource base in the post-covid-19 world, according to a new report from Fitch Solutions.

The pandemic shed light on supply chain weaknesses in general and on international dependence for strategic products. The issue is even more crucial in China, where the metals industry is largely reliant on ore imports.

Fitch says China could revise its 13th Five-Year Plan enacted in 2016, which implemented a strategy of consolidating its primary industries, including mining and moving up the value chain towards smelting of metals.

China’s steel association and major steelmakers have called for an increase in domestic iron ore production

In late May, China’s steel association and major steelmakers called for an increase in domestic iron ore production as well as greater investment in exploration overseas to ensure supplies.

“Post-covid-19 we believe China could move to re-invest in its mining industry to secure its resource base. The government could either increase exploration and development of minerals, or invest in technology to enable profitable mineral production from previously uneconomic, mineralised rock” said the research company.

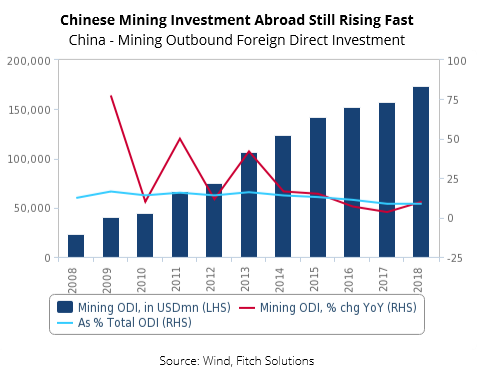

“As resource security becomes a pressing need, we expect mining investment under China’s Belt and Road Initiative (BRI) will accelerate in the coming five years,” Fitch says.

China’s structural deficit in key minerals such as iron ore, copper and uranium will sustain the long-held strategy of securing direct access to mines in the developing world, Fitch adds.

In particular, the research company expects the investment appeal of Sub-Saharan Africa (SSA) to Chinese firms will increase as diplomatic relations between China and developed markets deteriorate.

“Diversifying away from Australia will be particularly appealing given that the country accounted for around 40% of China’s total mining imports in 2019. Investment into SSA markets such as the Democratic Republic of the Congo (copper), Zambia (copper), Guinea (iron ore), South Africa (coal) and Ghana (bauxite) will be one avenue through which China could reduce this reliance.”

Domestic Technology

While China is the largest global producer of primary metals, it still needs to import most of the higher-value secondary metals used in autos and aerospace industries.

“As we expect China’s relations with the West to deteriorate, the country will face an increasing need to secure its technological base by funding more research and development domestically.”

Fitch analysts believe that Chinese overseas investments are now going to face increasing restrictions from regulatory bodies globally, especially in sensitive areas involving technology and resources.

“In the coming years, both state-owned enterprises (SOEs) and privately held firms in China will continue to attempt investing in foreign markets for downstream metal investment opportunities, but we expect to see a concurrent increase in technological investments domestically as the former becomes more difficult.”

Weaker economic prospects in the coming years, however, will pose challenges to China’s investments, Fitch concludes.