Today I’d like to start by lending my voice in support of those who seek to bring attention to and rectify the deeply rooted societal inequities that contributed to the senseless killings of George Floyd, Breonna Taylor, Ahmed Aubrey and others. Racism has no place in America. Full stop.

Many Americans understand and empathize with the outrage, even if they don’t necessarily agree with the looting and violence that have defined some of the protests.

A vast majority of the demonstrators want only to exercise their First Amendment rights peacefully, and it’s unfortunate when a few bad actors are allowed to hijack the protests.

Like the coronavirus pandemic and economic downturn, the civil unrest has generated a lot of fear and uncertainty among Americans.

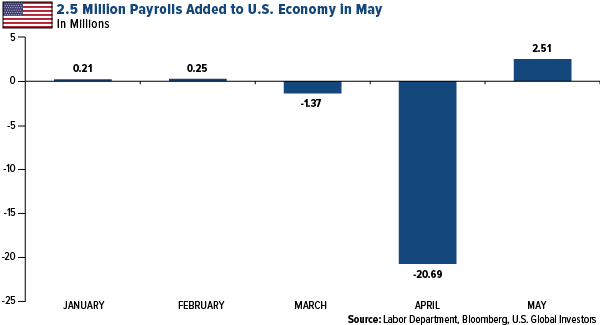

But there are signs that the worst is behind us. The daily rate of new coronavirus cases in the U.S. has been marginally decreasing. And on Friday, the Labor Department reported that the U.S. added a staggering 2.5 million payrolls in May, suggesting a strong economic recovery is underway.

Much work still needs to be done, but I’m equally confident a satisfactory solution to the unrest can be reached.

Airline Investors Rebuff Buffett

President Donald Trump addressed the blowout jobs numbers in a press conference Friday, comparing the U.S. economy to a “rocket ship.” Economists had been expecting the unemployment rate to jump higher in May, possibly to as much as 20 percent, but it ended up falling last month, from 14.7 percent in April to 13.3 percent.

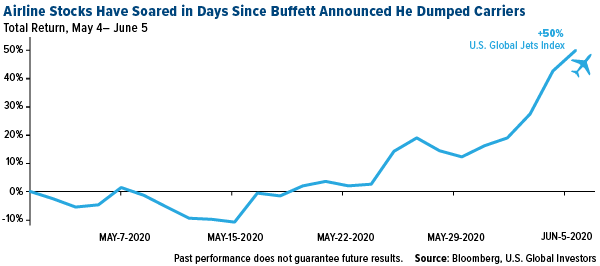

Trump praised the domestic airline industry, saying carriers are recovering nicely with the economic reopening. On Thursday, shares of American Airlines stock exploded an unbelievable 41 percent, the most on record for a single day, after the carrier said it would increase July flights 74 percent compared with this month. Meanwhile, more and more planes are returning to the sky, with the number of parked passenger aircraft dropping below 50 percent of all fleets in the U.S., Europe and China, according to Bloomberg.

A one-time airline operator himself, Trump also singled out Warren Buffett, who announced in early May that he sold his positions in the four major carriers due to the spread of the coronavirus.

Buffett “should have kept airline stocks because the airline stocks went through the roof today,” the president said.

He’s not wrong. I normally urge investors to follow the money, but it’s a good thing that they chose not to follow Buffett’s lead this time. Since we learned of his departure, investors have flooded into airline equities, pushing them up 53.5 percent in intraday trading Friday.

In fact, the S&P 500 Airlines Index just increased 35 percent this week alone, its “biggest on record and seven times the broader stock market’s five-day gain,” writes Bloomberg’s Nancy Moran.

As I shared with you last month, a recovery in commercial air travel is well underway. At the end of each business day, the Transportation Security Administration (TSA) reports on the number of passengers it screened in U.S. airports. As of yesterday, that number was more than 441,000, a more-than 400 percent increase in volume from the low of 87,500 on April 14. Wheels up!

Buying the Gold Dips Looks Attractive

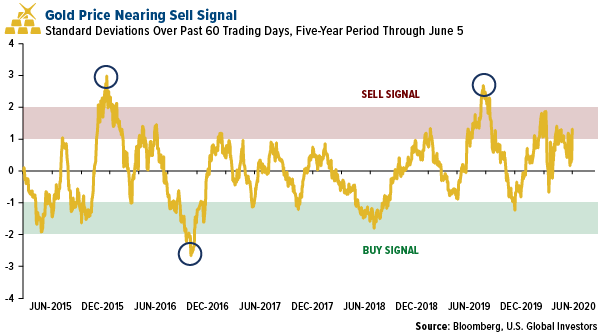

It’s risk-on again for investors. Thanks to the unexpectedly strong U.S. jobs report, stocks rallied on Friday, with gains led by energy producers Occidental Petroleum, Apache and Marathon Oil, as well as cruise lines such as Royal Caribbean, Carnival and Norwegian.

Gold sold off as a result, its price tumbling 2.5 percent. This marked the precious metal’s worst one-day decline since the end of March.

Based on fundamentals, the selloff was rational. Gold’s 60-day standard deviation over the past five years shows that the metal was nearing a sell signal in morning trading.

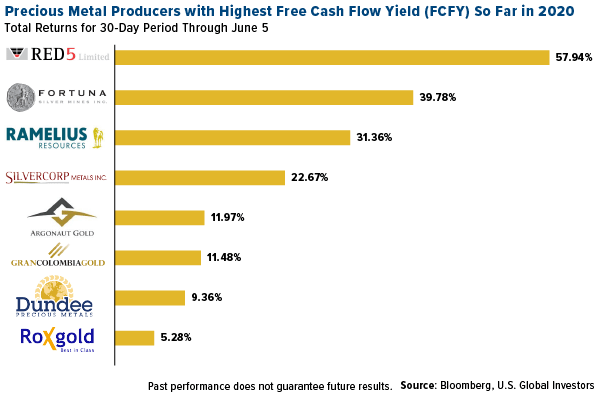

When it comes to selecting gold and precious metal mining stocks, we take a quant approach, focusing on a number of different factors.

Among those factors is free cash flow yield (FCFY), one of the best profitability indicators. General gold equity investors look for high free cash flow, which is why Newmont was one of the best performing S&P 500 stocks until recently.

I did some data mining on some of my favorite mining stocks and found that, year-to-date, the top 10 producers with a market cap between $200 million and $1 billion had a remarkable average of 33.2 in FCFY.

Australia-based Red 5 Limited was the best performing mining stock of the past 30 days, up almost 58 percent. This was followed by Fortuna Silver Mines, up nearly 40 percent, and Ramelius Resources, up 31 percent for the month.

Interested in learning more about investing in airlines in the age of COVID-19? Register for our FREE webinar, taking place June 17 at 1:00 Central time, by clicking on the banner below!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Standard and Poor’s 500 Airlines Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The U.S. Global JETS Index seeks to provide access to the global airline industry. The index uses various fundamental screens to determine the most efficient airline companies in the world, and also provides diversification through exposure to global aircraft manufacturers and airport companies. The index consists of common stocks listed on well-developed exchanges across the globe.

Standard deviation is a quantity calculated to indicate the extent of deviation from a group as a whole.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2020): American Airlines Group Inc., Red 5 Ltd., Ramelius Resources Ltd., Silvercorp Metals Inc., Argonaut Gold Inc., Gran Colombia Gold Corp., Dundee Precious Metals Inc., Roxgold Inc.