Cheap renewable energy, climate policies and the coronavirus-triggered slowdown are likely to slash the value of oil, gas and coal companies by nearly two-thirds over the next three decades, a study published Thursday shows.

According to London-based think tank Carbon Tracker, the value of fossil fuel companies will plummet from $39 trillion to just $14 trillion by 2050. Such decline could trigger a new financial crisis unless regulators act, the report says.

“Technological innovation and policy support is driving peak fossil fuel demand in sector after sector, and country after country, and the COVID-19 pandemic has accelerated this,” Kingsmill Bond, analyst and co-author, says.

“We may now have seen peak fossil fuel demand as a whole,” he notes.

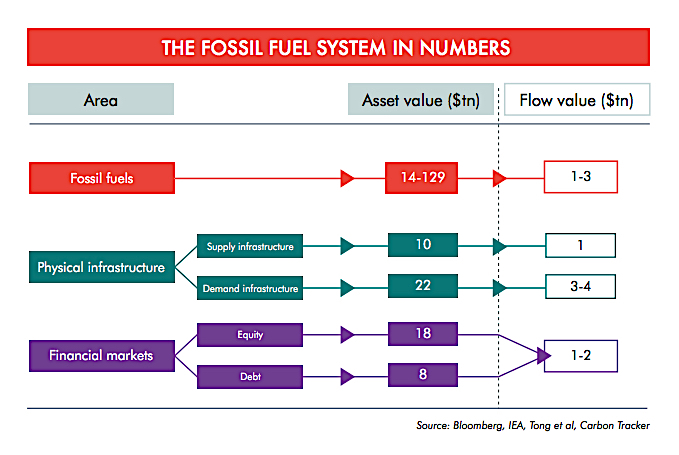

Fossil fuel companies are currently worth $18 trillion in listed equity, making up a quarter of the total value of global equity markets, according to Carbon Tracker’s estimates. They account for $8 trillion of corporate bonds, more than half the non-financial corporate bond market.

Unlisted debt — mostly owed to banks — could be four times greater, reaching almost $32 trillion, the study suggests.

Don’t try to “sustain the unsustainable”

With the global economy increasingly vulnerable to disruptions, regulators must ensure that companies properly account for the likely impact of the 2015 Paris climate accord on their future profitability, the report says.

Many companies will be forced to write off assets, cancel investment or even go bust.

Even firms that remain profitable will make far less money than before, the study says.

“Now is the time to plan an orderly wind-down of fossil fuel assets and manage the impact on the global economy rather than try to sustain the unsustainable,” it notes.

Carbon Tracker analysts modelled three scenarios to illustrate the impact of the energy transition on global fossil fuel value based on annual fossil fuel rent as a proportion of global GDP and a discount rate reflecting risk and demand.

The study also warns that a collapse in fossil fuel profits could threaten global security, further destabilizing petro-states — those whose economies rely on oil export income, such as Saudi Arabia, Russia, Iraq, Iran and Venezuela.