by Ellsworth Dickson

Argentina is known for its lithium resources as well as its copper and gold potential. The country also has resources of lead, molybdenum, silver, zinc, uranium and rare earths.

Joe Grosso, Executive Chairman, President and CEO of Golden Arrow Resources, who has spent the past 27 years exploring Argentina, commented, “Argentina is an huge country with a 5,150-km long border and some 24 provinces. The coronavirus has resulted in suspensions and the hampering of exploration and mining activities, including bringing machinery and people in to the various projects, although some exploration projects have been under way, including our projects in Rio Negro province such as Golden Arrow’s Flecha de Oro Gold Project.”

Grosso, who is Chairman of Blue Sky Uranium, said the Amarillo Grande uranium-vanadium project in Rio Negro is also active.

He noted that Argentina remains under-explored and under-developed relative to its western neighbour Chile and has four times the land area as Chile. “While agriculture is important to Argentina, there is twice the area that Chile offers that is prospective for minerals – an absolutely immense area. Lithium is also an important resource in Argentina; however, with the price of lithium dropping, our lithium projects held by Argentina Lithium & Energy are on hold for now awaiting higher prices.”

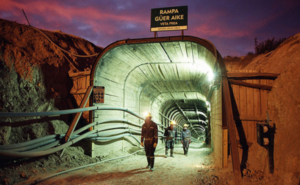

Austral Gold Ltd. [AGLD-TSXV; AGLDF-OTC; AGD-ASX] has a 70% interest and is operator (Troy Resources 30%) of the Casposo Mine, a low-sulphidation epithermal deposit of gold and silver located approximately 150 km from San Juan, capital of San Juan province.

Austral Gold Ltd. [AGLD-TSXV; AGLDF-OTC; AGD-ASX] has a 70% interest and is operator (Troy Resources 30%) of the Casposo Mine, a low-sulphidation epithermal deposit of gold and silver located approximately 150 km from San Juan, capital of San Juan province.

The mine consists of a 750 tonne-per-day underground mining operation and processing plant. Forecast annual production for life-of-mine is ~50,000 ounces per year at an average All-in Sustaining Cost $957/oz AuEq.

The company has an extensive portfolio of properties in Santa Cruz province, with the advanced project Pingüino as the flagship, and a series of greenfield projects: Condor, Contreras, 8 de Julio, Nuevo Oro and Diamante.

Blue Sky Uranium Corp. [BSK-TSXV; BKUCF-OTCQB; MAL2-FSE], part of the Grosso Group of companies, began a 4,500 metre reverse circulation drilling exploration program at its wholly-owned Amarillo Grande Uranium-Vanadium Project in Rio Negro Province. The program includes approximately 100 holes in two high-priority exploration target areas, Ivana Central and Ivana North, located 10 and 20 km north of the company’s Ivana Deposit.

Blue Sky Uranium Corp. [BSK-TSXV; BKUCF-OTCQB; MAL2-FSE], part of the Grosso Group of companies, began a 4,500 metre reverse circulation drilling exploration program at its wholly-owned Amarillo Grande Uranium-Vanadium Project in Rio Negro Province. The program includes approximately 100 holes in two high-priority exploration target areas, Ivana Central and Ivana North, located 10 and 20 km north of the company’s Ivana Deposit.

The Ivana deposit, which remains open for expansion, hosts Inferred Resources of 22.7 million pounds of U3O8 and 11.5 million pounds of V2O5 (28.0 million tonnes averaging 0.037% U3O8 and 0.019% V2O5 at a 100 ppm uranium cut-off) with a Preliminary Economic Assessment completed in 2019.

Fortuna Silver Mines Inc. [FVI-TSX, Lima; FSM-NYSE; F4S-FSE] provided an update on the resumption of its construction activities at the Lindero gold project, located in the province of Salta, Argentina. On March 19, 2020, the government of Argentina declared a period of mandatory national social isolation in relation to COVID-19 which was extended until May 10. Construction was temporarily halted at Lindero and a reduced task force remains on site to maintain critical activities including security and environmental monitoring over the extended isolation period.

Fortuna Silver Mines Inc. [FVI-TSX, Lima; FSM-NYSE; F4S-FSE] provided an update on the resumption of its construction activities at the Lindero gold project, located in the province of Salta, Argentina. On March 19, 2020, the government of Argentina declared a period of mandatory national social isolation in relation to COVID-19 which was extended until May 10. Construction was temporarily halted at Lindero and a reduced task force remains on site to maintain critical activities including security and environmental monitoring over the extended isolation period.

The company’s objective is to produce the first doré in Q3 2020. With the advanced stage of commissioning of the primary and secondary crushing circuits, crushed coarse ore is scheduled to be placed on the leach pad for cyanide irrigation starting in July.

Between 25,000 and 28,000 ounces of gold doré are scheduled to be produced from September to Dec. 31, 2020. Commercial production is expected to start in Q1 2021 with an AISC (all-in sustaining cost) of US$520/oz to US$620/oz gold.

Golden Arrow Resources Corp. [GRG-TSXV; GARWF-OTCQB; GAC-FSE], part of the Grosso Group of companies, has a number of projects in Argentina: Flecha de Oro (Au), Caballos (Cu-Au), Don Bosco (Cu-Au), Mogote (Cu-Au-Ag), Pescado (Au), and Potrerillas (Au-Ag).

Golden Arrow Resources Corp. [GRG-TSXV; GARWF-OTCQB; GAC-FSE], part of the Grosso Group of companies, has a number of projects in Argentina: Flecha de Oro (Au), Caballos (Cu-Au), Don Bosco (Cu-Au), Mogote (Cu-Au-Ag), Pescado (Au), and Potrerillas (Au-Ag).

Flecha de Oro is comprised of two separate properties: Esperanza and Puzzle. Recent sampling and mapping at the Esperanza property identified high-grade and visible gold hosted in epithermal quartz veins. Highlights include four chip samples across quartz veins ranging from 0.15 to 0.70 metres in width that returned results of 18.00, 5.05, 4.12 and 4.10 g/t gold. Visible gold was observed in the vein sample which assayed 18 g/t gold. At Esperanza, Golden Arrow’s target is to define high grade mineralized zones within the 16 km of identified quartz and chalcedony veins.

Golden Opportunity Resources Corp. [GOOP-CSE] has signed a definitive agreement with Mirasol Resources Ltd. to acquire a 100% interest in Mirasol Resources’ 73,411-hectare Virginia silver project (3% NSR) located in Santa Cruz province for cash, shares and exploration commitments.

An initial silver Mineral Resource Estimate was prepared October, 2014 and a report date of February 29, 2016 defined seven outcropping bodies of high-grade silver mineralization, constrained within conceptual pits, with an Indicated Mineral Resource of 11.9 million ounces of silver at 310 g/t silver and a further Inferred 3.1 million ounces of silver at 207 g/t silver.

Josemaria Resources Inc. [JOSE-TSX, Sweden; NGQRF-OTC] is advancing the 100%-owned Josemaria copper-gold project in San Juan province. Highlights from a 2018 pre-feasibility study:

Josemaria Resources Inc. [JOSE-TSX, Sweden; NGQRF-OTC] is advancing the 100%-owned Josemaria copper-gold project in San Juan province. Highlights from a 2018 pre-feasibility study:

• A $2.0 billion after-tax NPV using an 8% discount rate and an IRR of 18.6% at $3.00/lb copper;

• A 3.4-year payback period;

• An Initial Probable Mineral Reserve of 1,008 Mt of 0.29% copper, 0.21 g/t gold, and 0.92 g/t silver (or 0.41% CuEq);

• Pre-production capital cost of $2,750 million (excluding costs prior to a construction decision);

• Average annual production (rounded) of approximately 125,000 tonnes copper, 230,000 oz gold, and 790,000 oz silver per year at a C1 cost of $1.26/lb CuEq;

• First 3 years full years of annual production average 170,000 tonnes of copper, 350,000 oz gold and 1,000,000 oz silver;

• 20-year mine life producing over 5.4 billion lbs of copper and 4.6 million oz gold;

• Low strip ratio of 0.71:1 (waste:ore);

• Excellent metallurgy producing copper concentrate;

McEwen Mining Inc.’s [MUX-TSX, NYSE] San José Mine is owned and operated in partnership between McEwen Mining (49% interest) and Hochschild Mining (51% interest).

Located approximately 20 km north of Newmont’s Cerro Negro Project in the northwest corner of the Deseado Massif region of Santa Cruz Province,, the mine is a high -rade underground gold and silver operation in production since 2007.

Mirasol Resources Ltd. [MRZ-TSXV; M8R-FSE] has a number of exploration projects in Argentina: Santa Rita, Claudia, La Curva, La Libanesa, Nico, Sascha, and Virginia (see Golden Opportunity item above).

Mirasol Resources Ltd. [MRZ-TSXV; M8R-FSE] has a number of exploration projects in Argentina: Santa Rita, Claudia, La Curva, La Libanesa, Nico, Sascha, and Virginia (see Golden Opportunity item above).

Neo Lithium Corp. [NLC-TSXV; NTTHF-OTCQX; NE2-FSE] reports that its 3Q Project salar peration was reduced to a minimum and focused on environmental and safety team due to the COVID-19 pandemic. On April 3, 2020, the Argentinian government issued a second decree allowing for certain exemptions and declaring mining an essential activity. The company worked with provincial and federal authorities to establish protocols and obtain required approvals to resume operations at the 3Q Project salar, while the city offices have remained closed.

The company’s objectives are to continue to produce 3-4% lithium brine at the 3Q Project in the Lithium Triangle, continue the optimization of the processing at the pilot plant in Fiambala and move the 3Q Project closer to full development.

Pan American Silver Corp. [PAAS-TSX, NASDAQ] has a 100% interest in the Manantial Espejo silver-gold mine in Santa Cruz province, a 2,150 tpd underground mine. Reserves are 18.7 million oz silver and 101,000 oz gold.

Pan American Silver Corp. [PAAS-TSX, NASDAQ] has a 100% interest in the Manantial Espejo silver-gold mine in Santa Cruz province, a 2,150 tpd underground mine. Reserves are 18.7 million oz silver and 101,000 oz gold.

The company also has two advanced exploration projects: Cap-Oeste Sur and Navidad. As of June 2019, the Cap-Oeste Sur Project in Santa Cruz had reserves 2.2 million oz silver and 43,300 oz gold. The Navidad Project in Chubut province has eight separate deposits and a positive PEA that showed a 17-year mine life with total silver production of 275.5 million oz silver.

Patagonia Gold Corp. [PGDC-TSXV; HGLD-OTC] has a large number of mineral properties in Argentina, including the past-producing Martha silver-gold mine in Santa Cruz province.

Patagonia Gold Corp. [PGDC-TSXV; HGLD-OTC] has a large number of mineral properties in Argentina, including the past-producing Martha silver-gold mine in Santa Cruz province.

The company’s short term objectives are development of Cap Oeste high-grade, underground Measured and Indicated Mineral Resource of 298,000 AuEq ounces averaging 19.42 g/t AuEq.; double the processing capacity of the Martha plant to 480 tpd, which will allow for toll processing and processing of advanced exploration and development projects; complete Calcatreu gold and silver project feasibility study – Calcatreu contains 746,000 AuEq oz at 2.36 g/t AuEq in the Indicated category and a further 390,000 AuEq oz at 1.50 g/t AuEq in the Inferred category as well as completing purchase of Mina Angela project in Chubut Province from Latin Metals Inc.

SSR Mining Inc.’s [SSRM-TSX, NASDAQ] Puna Operations Inc. is comprised of the Chinchillas Mine and the Pirquitas property, which includes the Pirquitas processing facilities in Jujuy Province.

The Chinchillas Mine is a silver-lead-zinc deposit, which achieved commercial production in December 2018. It is expected to supply ore to the Pirquitas processing facilities over an 8-year active mining period. Open pit mining is conducted using conventional drill, blast, truck and loading operations. The ore is transported 40 kilometers to the Pirquitas processing facilities, which produce a silver-lead concentrate and a zinc concentrate that are shipped to international Mineral Reserves of 49.7 million ounces of silver at an average grade of 149 g/t as at December 31, 2019.

Measured and Indicated Mineral Resources are 110.7 million ounces of silver averaging 119 g/t as at December 31, 2019. Mineral Resources are inclusive of Mineral Reserves.

The mine produced 7.7 million ounces of silver, 24.0 million pounds of lead and 8.4 million pounds of zinc in 2019.

Turmalina Metals Corp. [TBX-TSXV; TBXXF-OTCQX] has received approval from the regulatory authorities in San Juan province of its recently submitted biosecurity protocols and can mobilize to the San Francisco gold-silver-copper project to bgin drilling.

Turmalina Metals Corp. [TBX-TSXV; TBXXF-OTCQX] has received approval from the regulatory authorities in San Juan province of its recently submitted biosecurity protocols and can mobilize to the San Francisco gold-silver-copper project to bgin drilling.

The upcoming drill program is a concurrent blend of drilling at the San Francisco de Los Andes (SFdLA) breccia pipe and exploration drilling of newly discovered gold-copper-silver mineralized breccia pipes.

This Phase Two drill program will follow up on a successful initial drill program while also commencing exploration on multiple newly identified and sampled breccias that present high-priority exploration targets.

Two diamond drill rigs will be utilized to drill a total of 4,500 metres. Approximately 2,500 metres will be drilled at the SFdLA breccia pipe, testing for extensions to high-grade gold-copper-silver mineralization encountered in the first phase of drilling. The remaining 2,000 metres will test mineralized breccia pipes identified during the recently completed mapping program.

Yamana Gold Inc.’s [YRI-TSX; AUY-NYSE] 100%-owned Cerro Moro Mine is a gold-silver operation located in the Santa Cruz province. The operation began feeding ore to the 1,000 tonne per day processing plant in April 2018.

The property contains a number of high-grade epithermal gold and silver veins, which are mined through a combination of open pit and underground mining. Cerro Moro is expected to produce 117,000 ounces of gold and 7.5 million ounces of silver in 2020.

At the 100%-owned Agua Rica advanced exploration project in Catamarca province, Proven and Probable Gold Mineral Reserves have increased by 13% to 7.4 million ounces, while Proven and Probable Copper Mineral Reserves increased from year end 2018 by 21% to 11.8 billion pounds. Mineral resources decreased marginally on the conversion of ounces to mineral reserve.