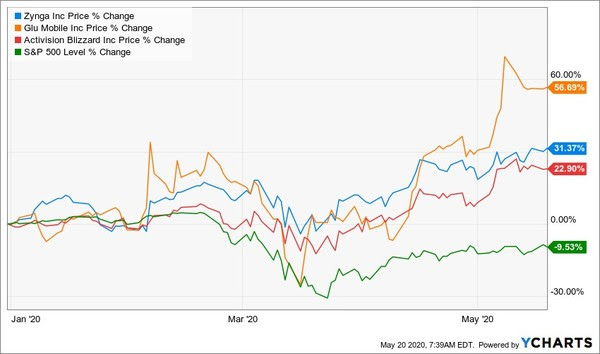

Stock prices for gaming companies are soaring in 2020.

Zynga (ZYNG-NASD), Gluu (GLU-NASD) and Activision Blizzard (ATVI-NASD) are all up big in 2020 despite the stock markets struggles.

No question that COVID-19 has been good for the gaming business. Since February, gaming analytics company AppsFlyer says that usage and revenue are up 35% for the industry.

You can literally see the 35% surge in the stock charts of these companies.

But this is not a short-term COVID-19 trade. The gaming industry was also growing quickly coming into 2020 BEFORE the pandemic. It will continue growing quickly once COVID-19 is gone.

Gaming is huge. According to Microsoft there are already 2 billion gamers worldwide. If Microsoft and Google are in your market, you know it is a big growth opportunity.

Americans now spend more time on their mobile devices than they do watching TV—an average of 3 hours and 43 minutes each day on their smartphones, feature phones and tablets this year.

Apps are the new prime time, and games have grabbed the lion’s share.

The data is convincing.

Analytics company SensorTower, is estimating that app spending overall will grow about 15% CAGR to 2024 to about $171 billion. They expect mobile gaming specifically to be roughly $98 billion of that, or 57% of total gross revenue.

That means that every company in the gaming industry will have a 15% annualized tailwind driving revenues and earnings—for years! Invest with big tailwinds.

GlobalData’s report projects even high growth—that the industry will hit $300 billion by 2025.

Whatever the exact number ends up—you get the picture. This industry is growing extremely fast.

That means mobile gaming stocks are a GREAT place to be now. They will increase revenues and profits at a rate that is multiples more than GDP growth. (The perfect millenials trade!)

And I think I have found one right at the investor sweet spot–where their games are moving fast up the charts at Android and Apple downloads.

That means revenue is soaring as well! They are on track to more than triple revenue Year-over-Year–and one of the reasons is because they are monetizing their players 4-5X more than the industry average.

And it’s trading at one-third recent M&A take-outs. The reason for this dis-connect is simple—the company has not been public for very long. No analyst coverage. No quarterly conference calls yet.

5X Better Than The Industry On The Most Important Measure

The single most important acronym in the gaming business is ARPDAU.

This is what drives value for gaming companies.

ARPDAU = Average Revenue Per Daily Active User

This is the #1 KPI (Key Performance Indicator) in gaming. It is the average amount of money each individual user generated while using your app within a certain 24-hour time period.

This is what determines how profitable a game is. Average ARPDAU for the mobile gaming industry—in the “casual” or “idle” sector is roughly 9 cents a day, according to GameAnalytics.com

Management says their average ARPDAU is now more than FIVE TIMES–5X–500% better!

That means that its games are 5X more profitable than the average competitor. Part of the reason for that is that two of their newer games are stunningly successful.

It follows naturally from their business plan. This company’s main focus is on counter-culture gamers.

Think surfers, LGBTQ, hippies, street culture…whatever.

These are folks who are proud to live life a little differently and feel part of their own special tribe. These groups of people are passionate about their lifestyle. As gamers, these passionate people are much better generators of revenue—5X better….the data proves it.

The main counterculture niche that this company has focused on is—cannabis. The results speak for themselves with the 5X industry norm ARPDAU.

This niche approach is not new for this recently-listed pubco. They have been successfully designing and launching games as a private company for a decade.

The return on investment for designing, building and operating games that have 5X the normal ARPDAU is exceptional. Historically the all-in cost of a game for this team is $700,000. The average total revenue that this $700,000 investment returns is $30 million over a 3 year growth cycle.

Now that is some kind of math.

The company’s newest game was just launched in April 2020 and will start hitting the financial results this quarter. History says that counter culture games have good longevity—as this company is still getting revenue from games developed in 2011.

But this industry is growing so rapidly–and this team is so good–they’re finding that new games are now on track to generate an entire legacy game’s revenue–in just their first year!

Do Not Miss My E-Mail Tomorrow!!!

This gaming company could not have gone public at a better time. The industry is growing faster than ever—it’s truly global. Revenue, cash flow and earnings are soaring in this sector.

That’s giving the industry BIG multiples—the three companies I mentioned above trade at 19-29x EBITDA.

Tomorrow I’m going to give you everything you need to know about the most exciting stock in the gaming sector.

You will get:

1 – the name of the company and ticker for the stock

2 – details on how they monetize so well

3 – a list of upcoming catalysts in 2020

This company is an amazing mix of artistic creativity and operational discipline. And it’s paying off in spades for shareholders.

Tomorrow it hits your inbox.

Sources:

- https://www.businessinsider.

com/video-game-industry-120- billion-future-innovation- 2019-9 - https://variety.com/2019/

gaming/news/video-games-300- billion-industry-2025-report- 1203202672/ - https://techcrunch.com/2019/

08/22/mobile-gaming-mints- money/ - https://newzoo.com/insights/

articles/newzoo-games-market- numbers-revenues-and-audience- 2020-2023/?utm_campaign=Games% 20Market%20Report&utm_source= email&utm_medium=update%20may% 202020