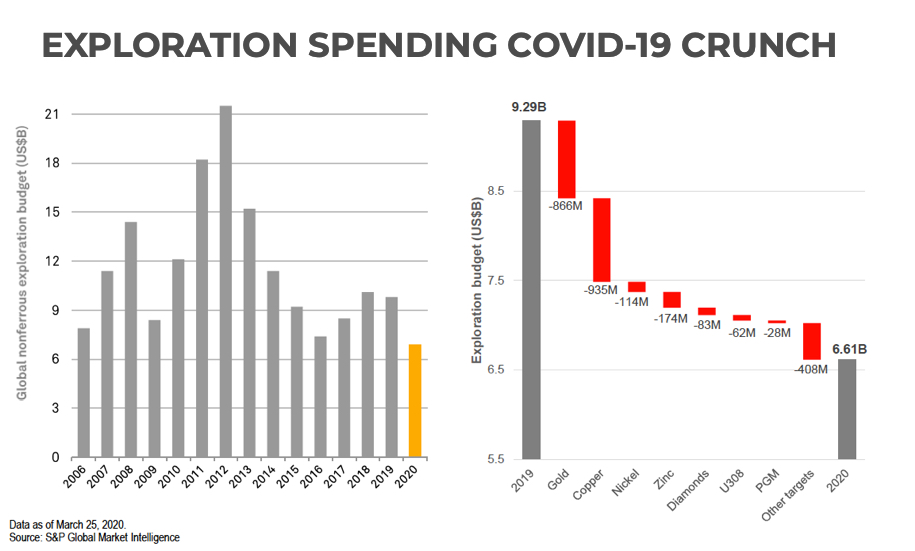

The rally in the price of gold will not be enough to prevent 2020 turning into the worst year in 15 for global exploration spending.

According to a new report by S&P Global Market Intelligence, outlays for exploration across the industry is set to drop from from $9.3 billion in 2019 to $6.6 billion this year.

Despite a gold price approaching seven year highs above $1,700 an ounce, money spent on drilling for the precious metal this year is likely to shrink by more than $800m compared to 2019.

Chris Galbraith, mining and metals analyst at S&P Global, says the vast majority of gold exploration is carried out by juniors and that sector remains under pressure.

According to S&P Global data, junior mining companies managed to raise $781m during the first quarter, much of it in debt form, an almost 50% drop from the $1.54 billion in financings racked up in the final quarter of 2019.

Global gold production declined last year for the first time in a decade, but before the outbreak S&P Global was expecting around 2m in additional ounces to be poured this year for a total just shy of 108m ounces.

Due to the impact of covid-19 the researcher now expects another down year for gold production with mine shutdowns resulting in almost 2.7m fewer ounces expected for the year.

Latin America and South Africa would be responsible for the bulk of the losses, although Russia appears to be in the early phase of the virus spread and its operational impact. Gold production is likely to return to positive growth next year.

Gold for delivery in June was last trading at $1,725 per ounce in New York, up more than $200 per ounce since the start of the year.

Copper market flashing orange

Copper budgets are also being slashed and is forecast to fall by $935m.

Galbraith points out that the copper price is still too subdued to incentivize exploration programmes by juniors while large companies are in capital preservation mode.

Mined copper production this year is expected to fall by 135,000 tonnes to 19.6m tonnes, and refined output by 75,000 tonnes due to falling concentrate supply, lower treatment charges and covid-19 related cutbacks.

The market is nevertheless expected to hit 182,000 surplus for 2020 according to S&P Global, up from previous estimates of a 72,000 tonne oversupply.

Despite the impact of covid-19 the company maintained its average copper price forecast of $5,700 a tonne ($2.59 a pound) for 2020, rising to $6,233 next year and $6,425 in 2022.

Copper was last trading at $2.43 per pound ($5,355 per tonne) on the Comex market in New York, down for the day but still up more than 20% from lows hit mid-March.

RELATED CHART: Global miners have cut their 2020 capital expenditure by about $6.4 billion, (almost 19%) and copper production outlook by 8% or just under 400,000 tonnes for the year.