Brazil’s Vale (NYSE: VALE), the world’s No. 1 iron ore

miner, has launched a legal action in New York to determine whether funds paid to

BSG Resources within the framework of their former Simandou partnership in

Guinea were used for property investments in the United States.

The Rio de Janeiro-based mining giant alleges that BSGR,

diamond tycoon Beny Steinmetz’s mining arm, fraudulently funnelled $500 million

into Manhattan real estate’s magnates Aby Rosen and René Benko, Africa

Intelligence reported.

The case is the latest in a series of efforts Vale has made

to have BSGR pay a $1.2 billion arbitration award. The amount was granted to

the Brazilian miner on the grounds of “fraud and breaches of warranty” when

including it in the Simandou iron ore joint venture.

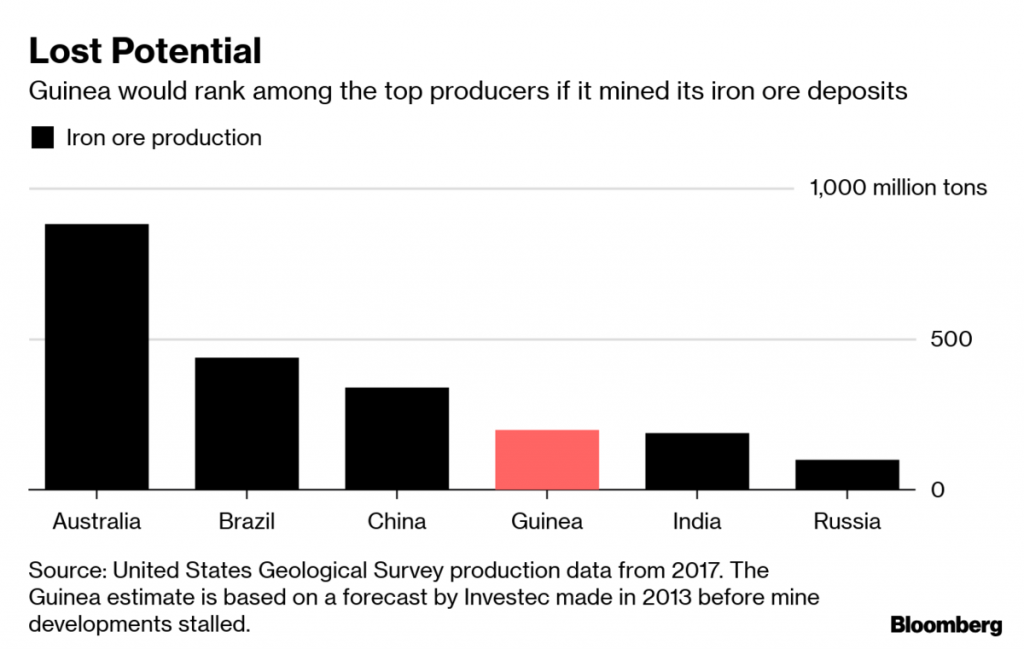

At two billion tonnes of iron ore with some of the highest

grades in the industry, Simandou is one of the world’s biggest and richest

reserves of the steelmaking material, but it has a controversial past.

For more than a decade, it was the centre of a bitter

dispute that involved Rio Tinto, Vale and BSGR.

It began in 2008, when one of Guinea’s former dictators

stripped Rio’s rights over two of the four blocks the deposit had been divided

on and handed them BSGR. Rio was able keep to the two southern blocks, but only

after paying $700 million to the government in 2011. The deal guaranteed the miner

tenure for the lifetime of the Simandou mine.

Vale steps in

Vale came into the picture when it acquired a 51% stake in

the northern half of Simandou from BSGR for $2.5 billion. Later, Guinea revoked

BSGR’s project rights due allegations of bribery and corruption accusations surrounding the deal to acquire the

rights.

BSGR and Steinmetz were able to put an end to the series of

issues stemming from Simandou in February last year, through a deal with Guinean President Alpha Conde.

As part of the agreement with Guinea, BSGR agreed to walk

away from blocks one and two of the Simandou project, but retained the right to

mine the smaller Zogota deposit.

A few weeks later, a London arbitral court ordered BSGR to

pay $1.2 billion to Vale. The judge based its decision partly on the fact that

the government revoked the concession in 2014 after finding that BSGR

had obtained it by bribing officials.

In November 2019, Steinmetz’s company lost an appeal to

overturn the arbitration award it was ordered to pay Vale.

Simandou today

Rio Tinto currently holds a 45% stake in blocks three and

four of Simandou, which it is actively planning to develop. China-controlled Chinalco

owns 40% and the Guinea government 15%.

Both companies are said to be trying to persuade authorities to let them use ArcelorMittal’s railway to a port in neighbouring Liberia.

A joint venture between Guinea’s Société Miniere de Boke

(SMB) and Singapore’s Winning International Group is

close to securing approval from Beijing to start developing Simandou’s

northern blocks.

China’s resource dependence on Guinea has increased in

recent years. In 2017, Beijing agreed to loan President Condé’s administration

$20 billion over almost 20 years in exchange for bauxite concessions.

Analysts say Guinea’s population has so far seen little

benefit from Chinese investment.