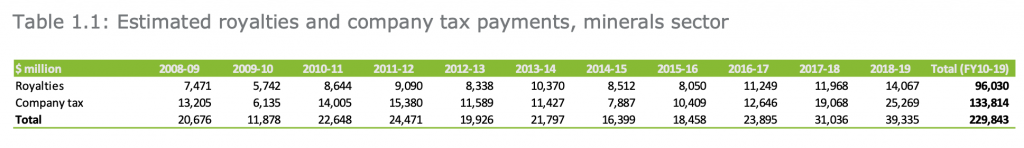

Company taxes and royalties paid by Australia’s minerals sector increased by $8 billion in 2018-19 to a record $39.3 billion, a new Deloitte Access Economics report commissioned by the Minerals Council of Australia revealed.

According to the report, in the period analyzed, the minerals sector did the heavy lifting on company tax collections, contributing close to 30% of all company tax.

“When combined with royalties, these contributions support stronger communities by helping to fund hospitals, schools, doctors, nurses, police, teachers and other essential services and infrastructure,” Tania Constable, the Council’s CEO, said in a media statement.

The study reveals that over the last 11 financial years, the minerals industry paid $230 billion in royalties and company tax – enough to build 8850 schools or 320 hospitals.

“High and consistent payments across the commodity cycle show that the minerals sector is a reliable and significant tax and royalty contributor,” Constable said.

The report follows the recent release of the Productivity Commission’s Trade and Assistance Review 2018-19 which stated that tariff and budgetary assistance to mining are ‘disproportionately small’, with the effective rate of assistance for mining – the ratio of total assistance to output – just 0.2% in 2018-19, the same low rate as the last three years.