Australia-focused market analyst Resources Monitor issued a short report stating that the island country is bound to overtake China in 2021 as the world’s largest gold producer.

According to Resources Monitor, Australia’s role as a cost-effective producer is giving it the advantage it needs to take the leading position.

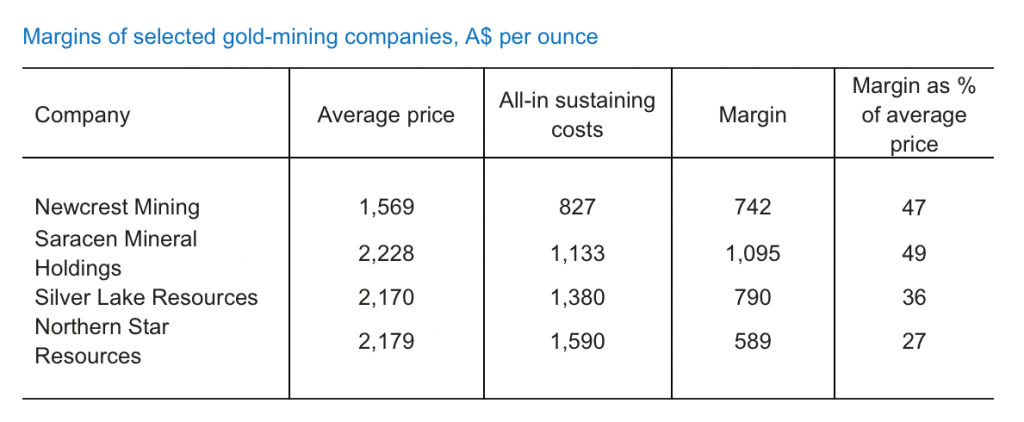

The analyst backs such an assessment by looking at the margins that most gold-mining companies have been making for the past 18 months. In particular, the firm focuses on the performance of Newcrest, Saracen, Silver Lake and Northern Star.

In the view of Resources Monitor, these margins paired with gold prices that, despite recent pressures, have been rising for the past year and a half, propel miners Down Under to go on with planned new mines or expansions.

Significant expansions include:

- Newcrest Mining’s Cadia Valley mine in New South Wales, expected to produce 840 Koz of doré in 2020;

- Saracen Minerals’ Carosue Dam project in Western Australia, expected to produce +500,000oz in 2020;

- Red5’s King of the Hills project in Western Australia, expected to produce around 100,000oz in 2020;

- Newmont Australia’s Tanami operation in the Northern Territory, whose annual gold production is expected to be approximately 150,000 to 200,000 ounces per year once the expansion is completed in 2023.

New mines that are expected to start operating are:

- Bardoc Gold’s Bardoc project in Western Australia, which hosts a total mineral resource estimate of 49.4Mt @ 1.9g/t Au for 3.02Moz of contained gold;

- Capricorn Metals’ Karlawinda project in Western Australia, which hosts a total resource estimate of 50Mt @ 0.93g/t Au for 1.5 Moz of contained gold;

- Regis Resources’ Mcphillamys project in New South Wales, which hosts a total resource estimate of 68.9Mt @ 1.04g/t Au for 2.30 Moz of contained gold.