With both the population and the workforce aging, the mining sector needs to reposition itself to secure social licences (SLO) and attract the in-demand millennial talent pool, BDO said in a recent report.

According to Sherif Andrawes, BDO’s Global Head of Natural Resources, stakeholders are demanding stronger engagement, transparency and accountability, so much so that a social license will soon be akin to a mining license.

“If we want to combat climate change, we need the mining sector to supply the raw material for the manufacture of electric vehicles, wind turbines and solar panels,” Andrawes says.

“Stakeholders are demanding stronger engagement, transparency and accountability, so much so that a social licence will soon be akin to a mining license”

Sherif Andrawes, Global Head of Natural Resources, BDO

“To meet the aspirations of consumers, mining is essential in the making of communications devices, consumer electronics and food production. Social license is the key to unlocking these positive mining outcomes. ”

“People see phones, cars, TVs but the link back to mining is often not made,” Andrawes says.

Green economy

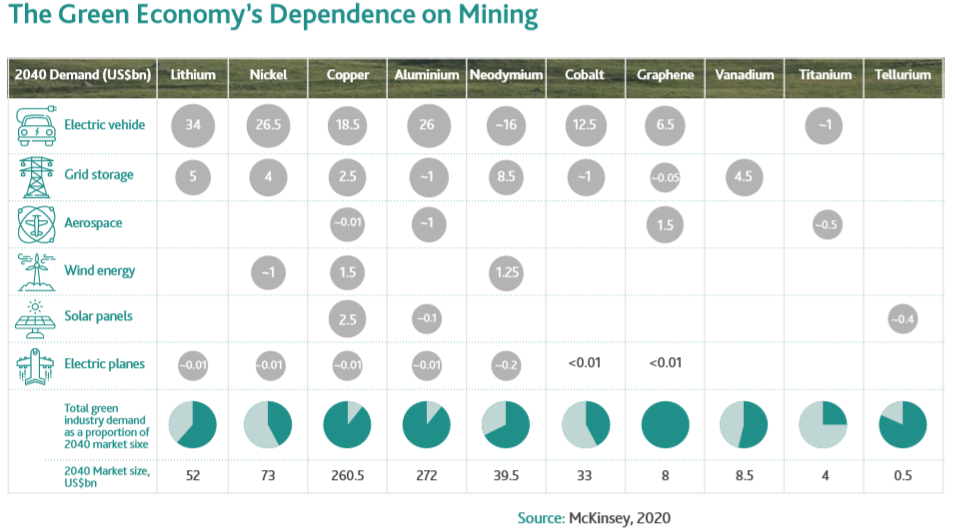

Global demand for strategic minerals is expected to skyrocket, as will demand for copper iron and many others, according to the World Bank.

The metals needed to make the rechargeable batteries used in devices and EVs, as well as the green infrastructure needed to generate and store the electricity needed to run them, include graphite, manganese, vanadium, nickel, cobalt, copper, rare earths, and lithium.

Mining companies will increasingly be called upon to address climate change by directly reducing their carbon footprint and also by encouraging stakeholders to integrate climate change into their planning, according to BDO’s report.

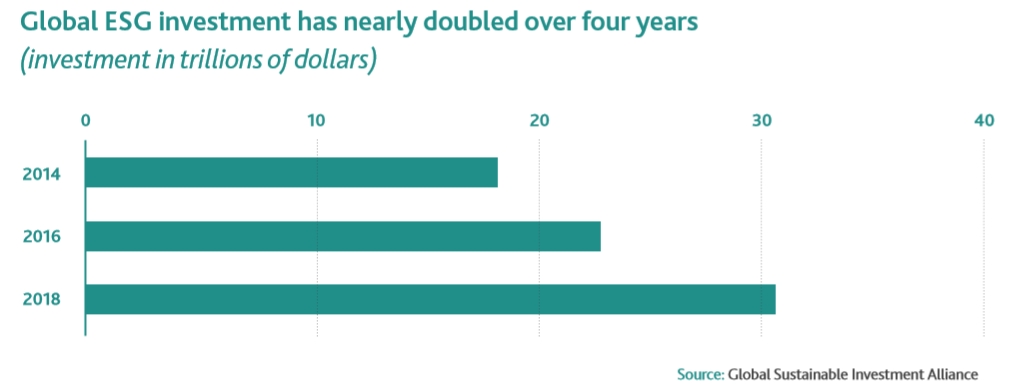

“No longer are social license and community engagement afterthoughts. Sustainable, socially aware funding has reached a tipping point in mining company board rooms. ESG is already a key concern for fund managers facing tighter restrictions on where funds can be deployed,” Sherif says.

Global investment in sustainability reached $30.7 trillion in 2018 according to the biennial Global Sustainable Investment Review, a 34% increase in two years.

In these scenarios, losing social support, or social license to operate (SOL), is seen as the main risk mining and metals firms are facing these days, a study published by Ernst & Young (EY) shows.

“Increased stakeholder pressure and the rise of ethical environmental, social and governance (ESG) investing continues to keep license to operate top of mind for the sector in Canada and abroad,” Jeff Swinoga, EY Canada Mining & Metals co-leader, says in the report.

Building a strong and sustainable social license with shared values among stakeholders requires time, commitment and cash.

“No longer are social license and community engagement afterthoughts. Sustainable, socially aware funding has reached a tipping point in mining company board rooms”

Sherif Andrawes, Global Head of Natural Resources, BDO

“The sector is looking at a long game – local communities are not going to wait for the transition to be cost effective, so the necessary disruption may mean a different profit horizon for transitioning mining companies,” Andrawes says.

Millennials

A new industry narrative will also play a crucial role in helping miners attract the in-demand millennial talent pool.

Data from BDO shows that currently 39% of the industry’s workforce is made up of Gen Y and millennials, currently between 25-39 years old, but Sherif says more will be needed as baby boomers retire and Gen X move into leadership positions.

A study by The Society for Human Resource Management showed that 94% of millennials want to use their skills to benefit a cause.

Millennials want to save the planet and mining doesn’t currently appear on their career radars

“Millennials want to save the planet and mining doesn’t currently appear on their career radars. It’s seen as a ‘sunset’ industry dominated by middle-aged managers, lacking in entrepreneurial endeavour,” Andrawes says.

Andrawes adds that millennials are also not aware of the mining sector’s urgent need for digital skillsets as it transitions to advanced technologies like AI and machine learning.