Canada’s Lucara Diamond (TSX:LUC) has become the latest miner to show how hard the coronavirus is hitting the sector as it posted a net loss of $3.2 million, or $0.01 a share, for the first three months of the year.

The figure is in sharp contrast with the $7.4 million in net

income, or $0.02 in earning per share, the Vancouver-based diamond producer

reported in the same period last year.

Production for the quarter was in line with guidance. Lucara

said it recovered 91,536 carats from 900,000 tonnes of ore mined, with eight

diamonds greater than 100 carats each found in the period.

Lucara’s finds so far this year include an unbroken 549-carat white diamond of “exceptional purity”, dug up at its prolific Karowe mine in Botswana. That’s the same operation that last year yielded the 1,758-carat Sewelô (“rare find”), the second-largest diamond ever mined.

“Declared an essential service by the Botswana government on

April 2, our Karowe mine continues to operate safely and at full production,”

the company’s president and chief executive, Eira Thomas, said.

Cash flow, however, didn’t match production results. It

totalled $2.4-million, compared with $10.6 million in the first quarter of 2019,

largely owing to a weaker pricing environment and a decrease in revenue between

the periods, Lucara said.

Due to current market uncertainty, the company is evaluating

how much cash flow expected from its operations it can put into the proposed $514

million underground expansion of Karowe. The project is expected to extend

the operation’s life for 20 years — until 2040.

“Most of the previously approved capital spend of $53

million for the Karowe underground expansion project was scheduled to be

invested in the latter part of the year and funded through cash flow from

operations,” the company said. “Given the uncertainty in global markets

resulting from covid-19, these capital expenditures will be reduced until more

certainty exists around Lucara’s cash flow projections.”

Diamond market distress

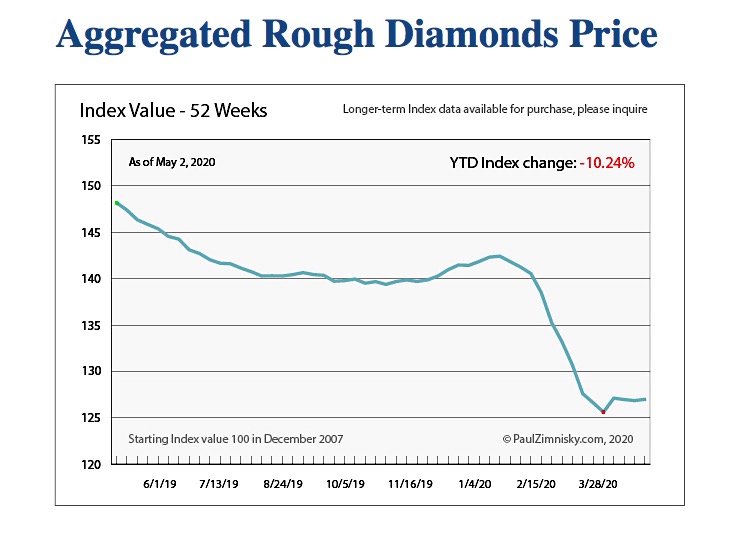

The diamond market began suffering from the effects of the

covid-19 spread in early March, and measures to contain it have already pushed big

and small miners over the edge.

The pandemic has already squashed diamond miners’ dawning

hopes of a recovery in a sector already reeling from weak prices and demand

since late 2018.

Russia’s Alrosa (MCX: ALRS), the world’s no.1 miner by

carats, halted

production this week at two of its assets, citing falling demand and sales

for diamonds as the main reason behind the measure.

De Beers, the world’s largest producer by value cut 2020 production guidance by a fifth last month. It had earlier cancelled its April sales event.

Canada’s Dominion Diamond Mines, the controlling owner of

Ekati mine and a 40% partner to Rio Tinto in the Diavik mine, filed for

insolvency protection.

South Africa’s Petra Diamonds (LON:PDL) has recently delayed

interest payments to

borrow $21 million in new debt, a crucial move to keep the company afloat.

Investment banks are increasingly reluctant to extend credit

to diamond producers, as inventory is not being sold and defaults are possible,

analysts have warned.

“We are concerned about oversupply of rough diamonds

following the reopening of economies, as a lot of inventory could potentially

be flooded into the system and the market might not be able to absorb all of

it, resulting in increased pricing pressure,” Citi said in a note last week.