The back story on how China came to dominate the lithium-ion battery to electric vehicle (EV) supply chain by building capacity in metal refining, battery-grade chemicals production and cathode and anode making is being told via new data from Benchmark Mineral Intelligence.

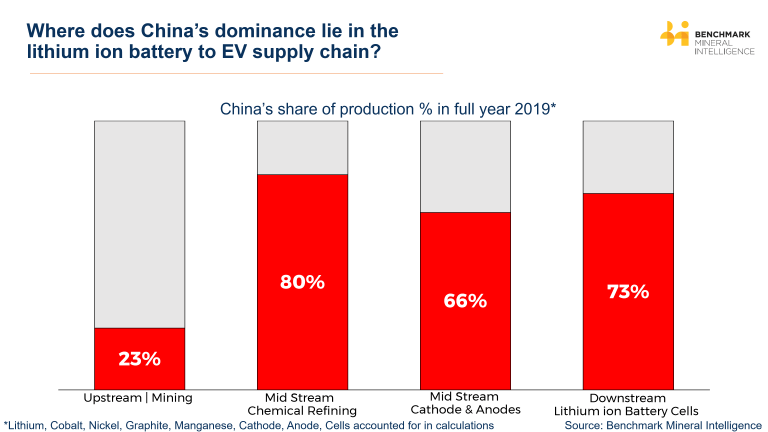

The data demonstrate China’s share of global total production in 2019 for each stage of the battery supply chain.

The chart combines Upstream: key battery raw materials of lithium, cobalt, nickel, graphite, manganese and where they are extracted through traditional mining or brine operations, based on location and does not include the origin country of the operator.

Midstream refers to refining or battery-grade chemical production from these raw materials, cathode and anode production from these chemicals while Downstream breaks down lithium-ion battery cell production.

The research firm says that while there is a misconception that China hosts a majority of natural resources, only 23% of global supply of all battery raw materials is actually coming from China.

But its dominance in chemical production of battery-grade raw materials stands at 80% of total global production as China has invested significantly in its lithium carbonate and hydroxide, cobalt sulphate, manganese and uncoated spherical graphite refining.

The rise of the battery megafactories has predominantly been taking place in mainland China so it comes as little surprise that 73% of production last year was within China

Capacity ownership of this crucial chemical conversion refining step ensures the global raw material flows point towards China for value-added production, Benchmark says.

Meanwhile, the core building blocks of the lithium-ion battery – cathodes and anodes – are similarly dominant at a combined 66% of global production in 2019.

This breaks down as 61%

for cathodes, but significantly higher for anodes: 86% of all anodes (natural

and synthetic graphite) are produced in China while 100% of all natural

graphite anode is made in China.

Another step down the value chain is lithium-ion battery cell manufacturing.

The rise of battery megafactories, says Benchmark, has predominantly been taking place in mainland China so it comes as little surprise that 73% of output last year was within China.

Of the 136 lithium-ion battery plants in the pipeline to 2029, 101 are based in China.

Coming out of the coronavirus pandemic, China’s supply chain dominance puts it in the driver’s seat for the future of the automotive industry as EV investments scale and legacy ICE technologies falter.

The data demonstrate its dominance from last year, a picture that is set to grow in favour of China out to 2025.

Simon Moores, Managing Director of Benchmark Mineral Intelligence will present the keynote: The Global Battery Arms Race: What next? On the World Tour East & World Tour West. The sessions are free, dates are: World Tour East, Tuesday 26 May, 8am London and World Tour West, Wednesday 27 May, 4pm London.