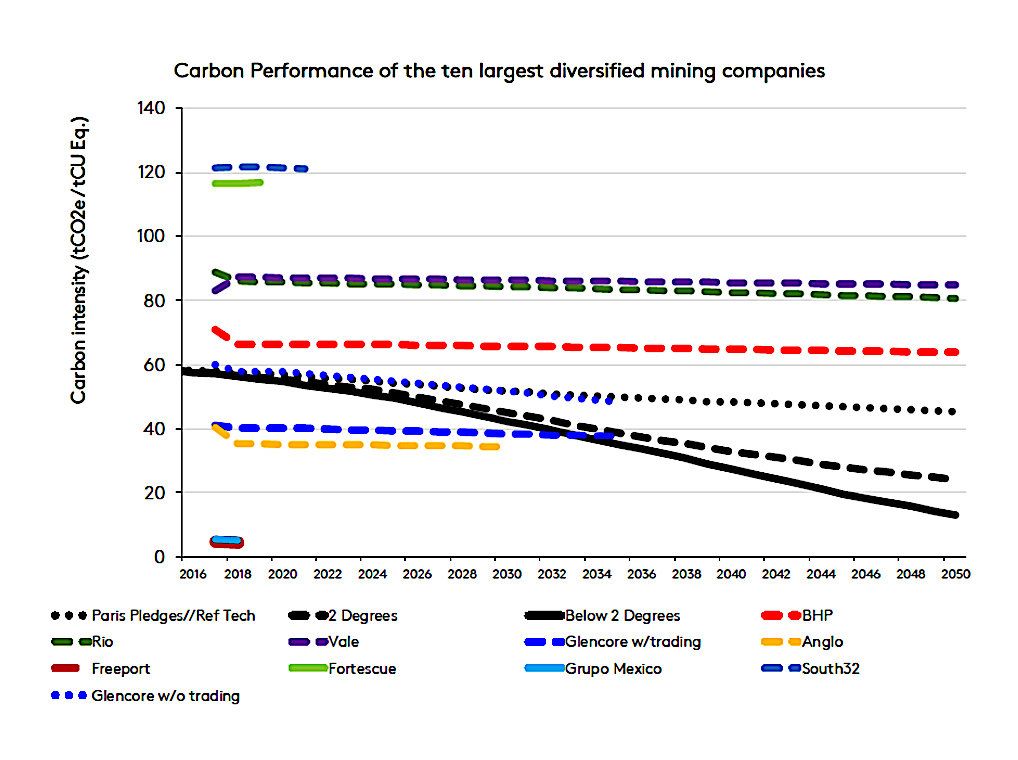

Eight of the world’s top ten largest mining companies are not doing enough to help meet international climate goals, research by a UK-based investor initiative set up by the Church of England reveals.

The Transition Pathway Initiative (TPI)’s study, published on Monday, shows that only Freeport-McMoRan (NYSE: FCX) and Grupo Mexico (BMV: GMEXICOB) have lowered carbon emission enough to keep global temperatures from increasing by less than 2 °C a year by 2050.

TPI’s report shows that Glencore (LON:

GLEN) and Anglo American (LON: AAL) are currently within the 2 °C benchmark set

in the 2015 Paris Agreement on climate change. Their emissions pathways,

however, are too flat to keep them on track to comply with the accord’s goals, it

said.

Glencore’s plans to cut “Scope 3” emissions — those produced when customers burn or process a company’s raw materials — by 30% by 2035 are promising, but do not include its marketing activities.

TPI noted that stated net zero ambitions from BHP (ASX, LON, NYSE: BHP), Rio Tinto (ASX, LON, NYSE: RIO) and Vale (NYSE: VALE) only cover operational emissions, typically just 6% of the emissions the entity measures.

As a result, the miners, which are the world’s three largest iron ore producers, are actually further away from alignment in 2050 than they are today, the study notes.

The highly polluting process of

making steel, involves adding coking coal to iron ore to make the alloy, and is

responsible for up to 9% of global greenhouse emissions.

Rio Tinto’s new carbon emissions reduction targets have triggered

heated criticism from some investors and environmental groups, despite the

company vowing to spend $1 billion over the next five years to reduce its

carbon footprint.

Market Force, a subsidiary of activist investor Friends of the Earth, said in March that the company’s announcement was a “simply a reflection of business-as-usual” energy cost savings and efficiency measures.

“Rio Tinto is essentially telling

its shareholders it is aware of a massive financial liability sitting on its

books, but isn’t planning to manage that risk down,” executive director Julien

Vincent said.

TPI is a global initiative founded

in 2017. It’s now supported by over 60 investors with combined assets of over $18

trillion under management.