Covid-19 has impacted the mining industry across the globe as governments enforce lockdowns and quarantines and companies halt operations because workers and contractors can’t get on site.

S&P Global Market Intelligence in a new report tallies the impact of these mine closures showing Africa and the Americas hardest hit in terms of the number of suspended operations.

South Africa had closed 54 mines as at the end of last week, the US 42 and Mexico and Canada 29 and 28 a piece. In total production at 260 mines in 33 countries have been halted since early March.

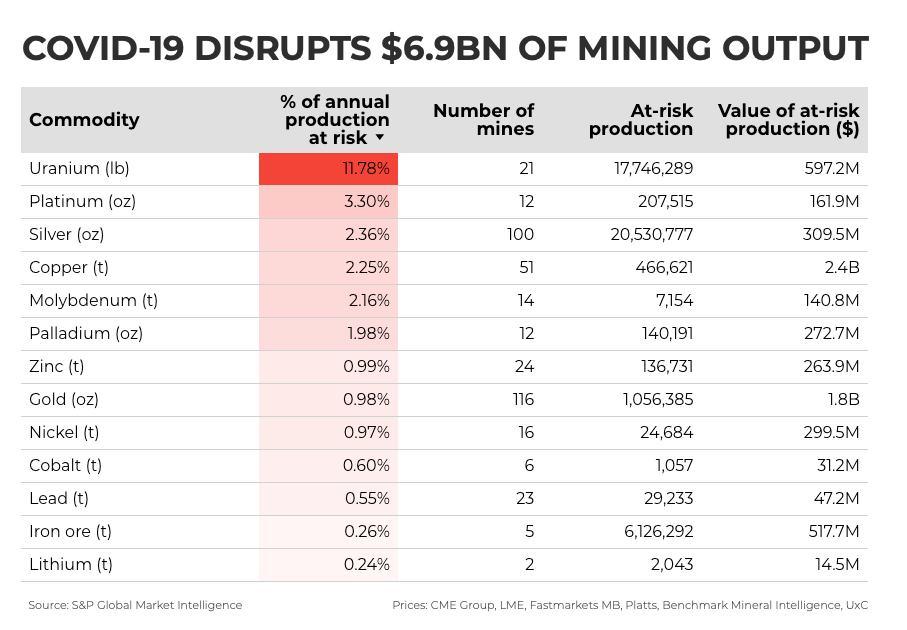

Most affected commodity in terms of the percentage of annual output suspended is uranium with nearly 12% at 21 mines affected. Platinum closures at 12 mines have affected 3.3% of output over the period while 100 mines producing silver has already impacted 2.4% of global annual production.

S&P Global points out however that at-risk production has started to level off without the notable exception of platinum.

The US-based mining analytics firms cautions that it is “too early in the pandemic’s spread to fully quantify impacts on the supply of commodities”:

Miners are making additional announcements daily, companies continue to withdraw 2020 guidance in light of the uncertainties, extensions to many suspensions are likely, and limited disruptions at certain mines may not even impact full-year production.