Source: Ron Struthers for Streetwise Reports 04/28/2020

Ron Struthers of Struthers’ Resource Stock Report details the value proposition of Bam Bam Resources and its flagship prospect.

With gold, we have witnessed the first test of gold’s support level, around $1,700/ounce, which I highlighted earlier in April. My next upside target remains the same around $1,900.

What is quite significant is the HUI Gold Bugs Index testing the 2016 high. I am sure it will break above and also consider that gold prices were about $400 cheaper in 2016. Gold stocks remain far undervalued.

It is very rare to obtain an advanced-stage project in Nevada, let alone one with high grade potential. This is what Bam Bam Resources Corp. (BBR:CSE; NPEZF:OTC) has and, in my view, with the very low market valuation makes it one of the best exploration plays in Nevada for 2020.

Bam Bam Resources’ recent price: $0.08/share

52-week trading range: $0.03 to $0.15/share

Shares outstanding: 48.7 million approx.

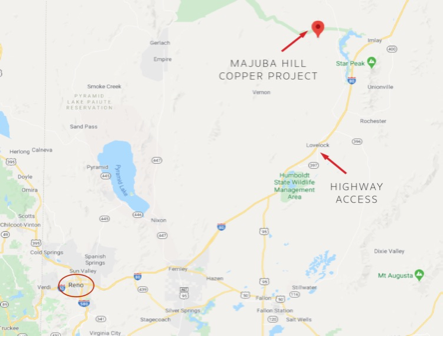

I have known CEO David Greenway for many years, and believe he will create shareholder value. The Majuba Hill project has a good address in Nevada and is an advanced copper-silver-gold project with historical work and a very special present-day opportunity.

Highlights

- New company; new story with tight share structure;

- Exceptional exploration expertise through Hunsaker Inc. (Buster Hunsaker);

- Very good address in Nevada with good access and infrastructure;

- First time the entire project area is under one ownership;

- Property held privately by Hunsaker since 2006;

vHistorical work and recent work since 2006 (35 drill holes) derisks exploration; - Current exploration plan and drilling fully funded;

vStock is under the radar with a very low valuation.

Management (from the company website)

David Greenway, CEO, brings more than two decades of experience in managing, financing and developing growth strategies for various TSX Venture Exchange- and Canadian Securities Exchange-listed companies, including involvement in acquisitions, business valuations and investor relations. His key expertise lies in the management and development of junior public resource companies, especially in the mining, and oil and gas sector. He has held directorships, senior management and business development positions, including his role as the chief executive officer of Stamper Oil & Gas Corp., Veritas Pharma Inc., Chief Consolidated Gold Mines, SNS Silver Corp., Moneta Resources Inc. and Sterling Mining Company and his board position in Mountain View Conservation Centre.

Bryson Goodwin, director, is a practiced international executive with over 25 years experience in finance, management, investor relations and operations in both private and public companies. His experience has demonstrated an operational, market and banking track record in the Resource, Oil/Gas, Technology and Biotechnology sectors. He has been engaged by a number of resource, energy, cleantech and technology firms in the departments of management, finance, business development and [public relations and investor relations]. Most recently Mr. Goodwin has held, “C” level executive positions in the resource and energy sectors. Mr. Goodwin [has become] well known for his early involvement in Klondex Mines, and [for] his instrumental role in its transition, finance and marketing from explorer to producer.

Buster Hunsaker, advisory board, has been engaged in exploration and evaluation of quality mineral deposits for 40 years in the western United States, Mongolia and Argentina. In 1995, Hunsaker Inc. was formed as a full-service, geological consulting business providing field services and all aspects of prospecting, early-stage exploration, and project management to mineral exploration companies. Hunsaker Inc. has been retained by numerous junior Canadian mining and exploration companies as well as major Nevada gold companies including Barrick Gold Corp., Newmont Exploration, AngloGold Mining, Vista Gold, and Kennecott. Prior to forming Hunsaker Inc. he was employed by mid-size and major mining companies, including Newmont, Atlas Precious Metals and Echo Bay, as project geologist, senior geologist, and chief mine geologist.

Majuba Hill Project Summary (from the company website)

- Majuba Hill is a porphyry copper-silver prospect located 70 miles southwest of Winnemucca, Nev., and 156 miles east-northeast of Reno

- Previous drill results include: 113m [113 meters] at 0.45% Cu [copper], 72.5m at 0.38% Cu, 86.8m at 0.27% Cu, 47.4m at 1.06% Cu

- Majuba Hill has a history of production, a database of previous drilling, encouraging geochem results and good tonnage potential

- A staged exploration program will target the original mine area and at depth below the historic workings

Historical Work

There was historical production in the early 1900s of 2.8 million pounds copper, 184,000 ounces silver, 991,000 pounds lead/zinc and 5,800 ounces lode gold. Exploration that occurred since the 1970s recognized and defined the porphyry system. Modern exploration began in 1971, with Mine Finders Inc. of Lakewood, Colo., initially looking at Majuba Hill as an analog to the porphyry molybdenum orebodies mined in Colorado.

Since 1970, 38,498 feet of core and RC [reverse circulation] drilling was completed. This was composed of 19,834 feet of core by Mine Finders (1970–1974), 8,560 feet of RC by Minterra Resource Corp. (MTR:TSX.V; 2006–2008), and 10,104 of core by MAX Resource Corp. (MXR:TSX.V; MXROF:OTCBB; 2011-2014). Drill logs and assays for the historic drilling are available in various formats. The modern (2007 and later) drilling records are in very good condition and have been converted to electronic format, along with all assay certificates and results.

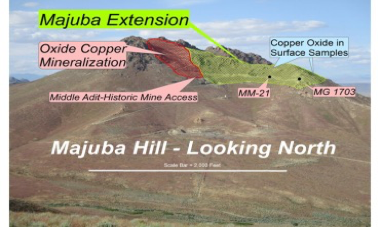

This graphic is a good picture of how zones are located on the mountain.

On March 25, Bam Bam Announced Its Exploration Plans

David Greenway, president and CEO, reports: “I couldn’t be happier with this exploration update. Drilling plans and contractors have been finalized for the Majuba Hill copper project. With copper coming back into the forefront and investor sentiment on the rise, we are very excited to tell our shareholders about our plans to drill and update the NI-43-101 technical report for Majuba Hill. The previous results and our new interpretation of data has led us to pick the most advantageous locations for a mixture of core and RC holes. Very exciting times at Bam Bam.”

Also from the website and press release: “The company plans to use Delong Construction and Drilling to build drill sites and access. Pending the acceptance of the drill notice by the Bureau of Land Management, Delong will also provide reverse circulation drilling for step-out and exploration drill holes. Delong is based in Winnemucca, Nev.

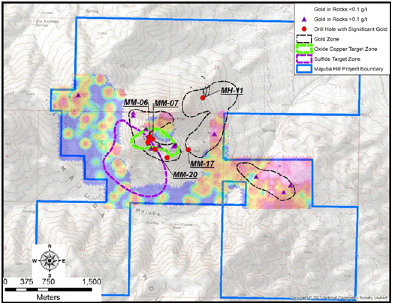

“Historic surface drilling has delineated an outcropping copper and silver oxide zone. Historic core holes drilled by Max Resources and described in the technical report prepared for Galileo Exploration Ltd. in May 2017, returned good oxide copper in a discrete area around the historic underground workings. These include:

- MM-05: 89.2 meters at 0.27% Cu from 0m to 89.2m;

- MM-06: 47.4m at 1.06% Cu from 0m to 47.4m;

- MH-7: 97.5m at 0.33% Cu from 25.9m to 123.4m;

- MG1703: 20.4m at 0.71% Cu from 102.9m to 123.3m;

- MMX-24: 112.8m at 0.45% Cu from 222.5m to 335.3m.

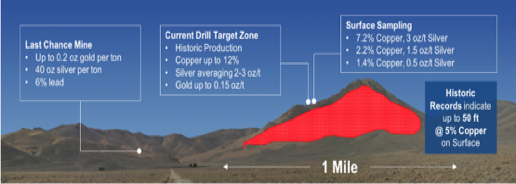

This graphic will also give you a good idea of the target and large potential. Another key point is that practically all the drilling has been on the surface oxide material and the rich sulphide zones that will be deeper have not been explored.

Financial

Last financials show little cash and no long-term debt. Bam Bam closed a $1.4 million private placement at $0.05 per share on February 5, 2020. David Greenway and associated accounts subscribed to almost 6 million shares of this financing.

Summary

One thing about bear markets: they bring opportunity. And now those that act in the early stages of the next bull market, like Bam Bam, can reap huge rewards, and for their shareholders.

Previous work on the property almost guarantees success now. I spoke at length about the project with Buster Hunsacker, who has been familiar with the project for decades and knows it like the back of his hand. Some key and important points are that in the past, different entities owned different parts of the project, even owning just underground rights. This made it very difficult for a project-wide exploration focus. Copper and gold prices were way lower in the past as well, and what was not economic gold in the 1970s is now, especially in Nevada. There is a good chance this could be an economic gold mine, without the copper. There is also rich silver and lead.

Back in the early 1900s, [miners] just mined out the high grade. This would be multi-ounce gold per ton, and copper that was probably over 10% grade. Noted above is historical production at 12% copper, with 2 to 3 ounces for silver. I have no doubt there is a lot of good grade material left behind. Note the gold at 0.15 opt. This equates to 4 to 5 grams per ton. They are now mining gold in Nevada at 0.5 g/t and even less. The Pipeline is one of the higher-grade mines at 1.4 g/t.

The past couple of juniors who optioned the project loved it, but with the difficult market conditions were unable to keep raising financings and had to let their options go, reverting back to Buster Hunsacker. Their work did provide very positive results and more valuable information.

On April 14, Daniel-Carl Eigenmann joined Bam Bam’s board of advisers. From the press release: “Mr. Eigenmann is a founder and the president of the board of directors for Iko Capital AG, a leading Wealth Management firm based in Zug, Switzerland. Prior to founding Iko Capital AG, Mr. Eigenmann was the executive director of DE Investment and Consulting AG until its acquisition. As part of Mr. Eigenmann’s 36-year career in the financial markets, [he] held the position of vice-president of investment banking at UBS Zurich and St. Moritz for 15 years as well as vice-president of wealth management at Liechtensteinishce Ladesbank Vaduz. Mr. Eigenmann has a degree from the University of Cambridge and a business economist diploma from the Graduate School of Business Administration, Zurich.

“‘It’s with great pleasure that I have decided to join Bam Bam’s board of advisers,’ stated Mr. Eigenmann. ‘With the forecast for copper and gold being so bullish I couldn’t think of a better time to become involved with what I believe is a future contender. I believe that copper- and gold-focused explorers and developers are the future! Since my involvement with the company, I see a truly great asset with unbelievable potential. I believe that Majuba Hill will prove to be a copper-gold asset that people talk about for years to come.'”

Somebody like this does not join just any junior. Mr. Eigernmann sees the same huge potential I do.

BBR put out news this morning [April 28] that relates to gold on the property, so I mention that here in the summary. Review of historical [information] found significant gold assays in 14 of 37 drill holes and in 994 surface samples. Before heap leaching around the 1970s, gold was often ignored in copper deposits, but we know now it can be recovered and offer significant value and sometimes more value than the copper. The best historic drill intercept was hole MH-11 with 5 feet at 6.44 g/t Au and 15 feet of 3.173 g/t.

Three gold zones are outlined based on the historical data. The gold zone in the main target area overlaps with the oxide copper target zone that will be drilled in the upcoming program.

On the chart, trading has been sparse as this is a new story under the radar. Around $0.06/share seems to be a base and a close over $0.10 would probably be a signal of a new up move.

Ron Struthers founded Struthers’ Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 – $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Bam Bam Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Bam Bam Resources is a paid advertiser at playstocks.net. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and images provided by the author.

Struthers Disclosure: All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

( Companies Mentioned: BBR:CSE; NPEZF:OTC,

)