Despite the challenges presented by the covid-19 pandemic in forecasting silver market conditions over the rest of the year, extended physical demand could drive the metal’s price higher in 2020, the Silver Institute suggested in their annual World Silver Survey.

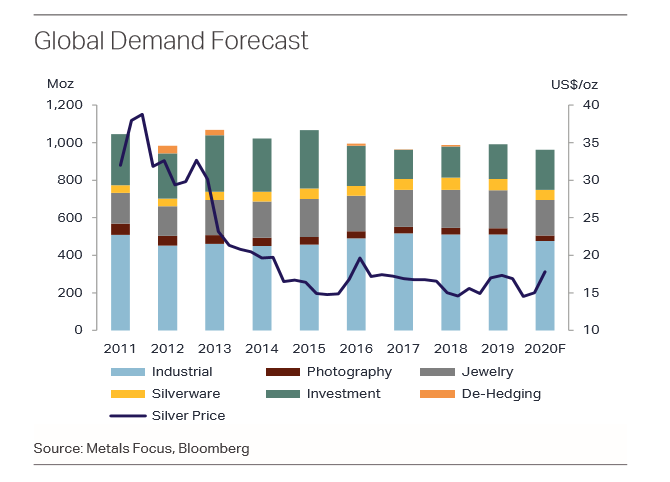

Last year, global silver demand edged 0.4% higher despite an ongoing global trade war affecting many industries, while silver mine supply declined for the fourth consecutive year, falling by 1.3%. Favorable structural changes such as vehicle electrification and a rebound in the key field of photovoltaics fueled solid industrial demand, the Institute wrote.

Silver investment demand jumped to a 12% increase — the highest annual growht since 2015 — as retail and institutional investors focused their attention on the long-term investment appeal of the white metal. Exchange-traded product (ETP) holdings stood at 728.9 Moz at year-end, up by 13%, achieving the largest annual rise since 2010.

Also, money-managers’ net positions in Comex futures went from being short over much of 2018 to consistently positive in the second half of 2019. Coins and medals saw a 13% increase in demand over 2018, rising to 97.9 Moz, while bar demand remained solid at 88.2 Moz, the report showed.

The Institute said these were key drivers for the 15% intra-year rise in silver price to a three-year high of $19.65 last September. The 2019 yearly average silver price was $16.21, about 3% higher than the 2018 average price.

Although many key areas of silver demand — including industrial fabrication and jewelry and silverware offtake — are anticipated to fall solely as a result of the global pandemic, the Institute still expects silver physical investment to extend its gains this year, with a projected 16% rise to a five-year high as investors rotate out of equities in search of safe haven vehicles.

Additionally, mine supply is expected to continue its decline given the temporary shutdown of mining operations in several significant silver mining countries in early 2020.

As a result, silver price will likely rise this year and test the $19/oz threshold again before year-end, said Metals Focus, the research firm behind the Silver Institute report.

The firm also expects silver to benefit from bargain hunting and outperform gold later this year on the back of its historically low relative value.