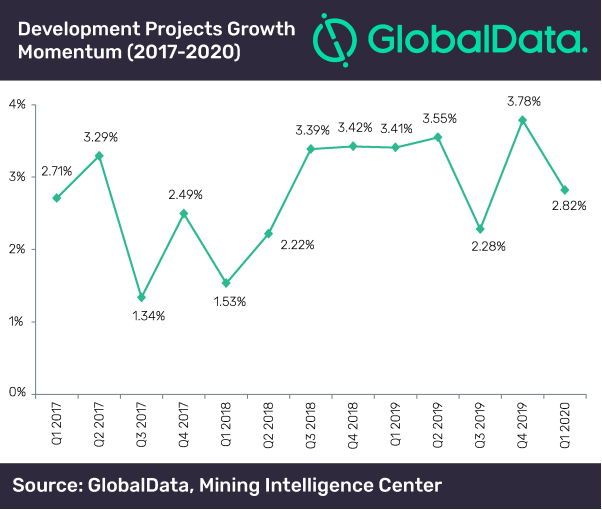

The share of global mining projects that advanced to the next stage of development has decreased from 3.8% in Q4 2019 to 2.8% in Q1 2020, and is expected to slow further in Q2 2020 due to the coronavirus outbreak, according to a new report by energy research company GlobalData.

The industry report indicates that, with several countries entering complete lockdown, mining companies have minimized their workforce to temporarily suspend operations and development activities.

“As of April 13, the progress of 35 mines currently under construction globally was disrupted due to such lockdowns. These projects account for around 9% of total mines under construction and around 10.5% of total capacity as measured by run-of-mine (ROM),” said Vinneth Bajaj, mining analyst at GlobalData.

Anglo American slowed the development of its $5.3 billion Quellaveco copper mine in Peru, withdrawing employees and contractors amid the country’s lockdown.

The company also temporarily put Woodsmith, its newly acquired potash project in the UK, on hold from March 27.

Around 76 mineral projects advanced in Q1 2020, down from the 101 projects in Q4 2019

In Canada, Vale initially placed its Voisey’s Bay mine on care and maintenance for four weeks, but has since extended this for up to three months – delaying the development of its mine expansion project and transition from open pit to underground mining.

Similarly, in Chile, Teck Resources has suspended construction works at its Quebrada Blanca Phase 2 in the wake of the country’s lockdown measures. The updated feasibility study work of the Prieska copper-zinc project in South Africa is undergoing remotely, with the site being shut-down temporarily.

“Around 76 mineral projects advanced in Q1 2020, down from the 101 projects in Q4 2019. Assets moving forward into construction include the El Pilar copper project in Mexico, the Zaldivar copper-molybdenum in Chile, and North star iron ore in Australia,” Bajaj said.