Source: Streetwise Reports 04/16/2020

Gold Terra’s Northwest Territories project benefits from its close proximity to Yellowknife City.

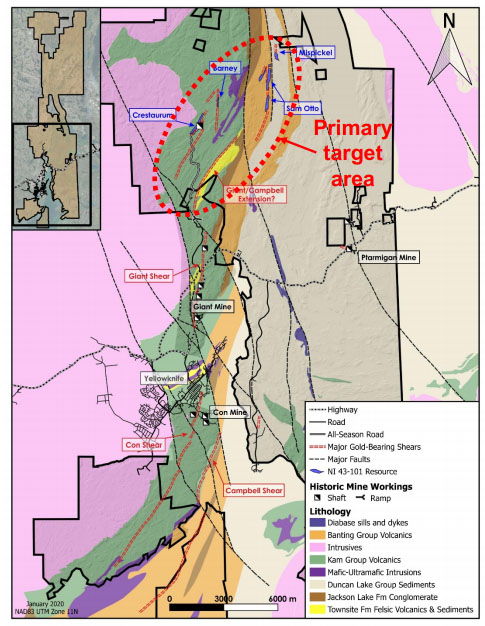

In February, Gold Terra Resource Corp. (YGT:TSX.V; TRXXF:OTC; TXO:FSE) came into being, making the transformation from TerraX Minerals Inc. The company holds a large, 790-sq-km property in Canada’s Northwest Territories, in the shadow of the historical mining city of Yellowknife.

The rebirth of the company has been accompanied by changes in management. The company’s founder, geologist Joseph Campbell, serves as chief operating officer, and he has been joined by David Suda, serving as president, CEO and director, and Gerald Panneton as executive chairman.

“We consider YGT shares to be an attractive investment for exploration success, with high-grade gold deposit potential in a low political risk jurisdiction with above-average infrastructure.” – Michael Curran, Beacon Securities

“We made some management changes and put people in positions where they are able to maximize their strengths,” David Suda told Streetwise Reports. “Joe Campbell, the founder of the company, is a geologist who has had tremendous success finding and defining mineral resources. Joe put Gold Terra’s exploration property together. He runs our technical programs and is the liaison with the community of Yellowknife as he’s been operating there now for nearly seven years,” Suda explained.

“I bring in capital markets experience, relationships, corporate strategy and the ability to raise money, all the things you would expect from someone coming from the brokerage side of the business,” Suda stated. “The next move was to bring in Gerald Panneton as executive chairman. He was the founder of Detour Gold, which was recently sold for nearly $5 billion to Kirkland Lake Gold Ltd. Gerald built that company from A to Z. He has built several mines, first at Barrick Gold and then with Detour.”

“The company started in Yellowknife in 2013 with 37 square km and grew the property mostly piece by piece over six years to now approximately 790 sq km. It required a lot of work, building relationships with local prospectors, establishing a high level of trust within the local community,” Suda said and explained that what convinced him to join Gold Terra was its Yellowknife City Gold Project checked the right boxes. “First, it’s a high-grade gold camp, 100% owned. Second, it’s in Canada, a safe jurisdiction where we have economic and political systems in place. And third, it’s right next to infrastructure and the city of Yellowknife,” Suda said.

“What’s missing out there in the exploration world is a major discovery. And there certainly hasn’t been a major discovery of a mine that’s right next to infrastructure where it can be readily built. So, for us to have all three of those ingredients is tremendous, and that’s what attracted my attention,” he added.

Additionally, Gold Terra has the usual things that people look for in an exploration company, Suda said. “Does it have a good asset? Yes. Does it have a good management team with the right skills and experience? Yes. The next phase was to be able to raise money and in what’s been a tough market, we did that. We’ve drilled over the course of this winter, roughly 10,000 meters on our Sam Otto target. And then we’re going to exit the field by drilling on a new, very exciting high-grade target very close to town. And so we’ll have that suite of results coming from that program. We’re very happy to be cashed up to cover our G&A for at least the remainder of the year.”

The project lies in the shadow of the Con and Giant mines, which produced 14 million ounces of gold, at an average grade of around 16 grams per tonne.

Yellowknife City Gold Project

“Five of the six million ounces that were produced at the Con Mine were produced out of the Campbell Shear. We believe there is another one or maybe more of these on the property,” Suda said. “So in sync with our drilling this winter, we’ve also run a large geophysics program, which has identified some anomalies that have spurred us to go and drill what we believe could be just that.”

“The really blue sky for Gold Terra is that we’ve got this huge district, 790 square km and roughly 70 km of strike,” Suda stated. “This is a large property but it needs to be tackled in a methodical and focused way. With the team we now have and the funding that we now have, we put out our first resource, we’re showing that we’re going to find the next one, and we’ll go on from there, instead of trying to run around the entire property.”

“Our job is to put it all together and to prove that there is another Con Mine on our property. We strongly believe it’s there. Our mission is to go out there and find it and prove it,” Suda added.

“The project has some very high-grade targets, with intercepts like 60 grams per tonne over 5 meters. We also have Sam Otto, which we just drilled. It is a wide bulk tonnage disseminated sulfide target right at surface,” Suda explained. “When major gold producing companies come to our site to look at our assets, Sam Otto is one of the first places they look and they see a cornerstone of a mine because of its large, long and predictable structure. The kicker is that it’s surrounded by a halo of high grade targets, which make up the rest of our resource. So you could have this large bulk tonnage area and a mill, and the high-grade targets could be used to blend the ores, using the high grade to supplement the lower grade stuff. And, of course, it’s right next to town, near a road, with power lines. It’s just a tremendous situation to be in.”

Gold Terra is on the radar screens of numerous industry observers including Beacon Securities analyst Michael Curran. “I’ve been covering Gold Terra for about a year and a half, and have been following it for several years prior to that,” he told Streetwise Reports. We are always interested in high-grade districts, and clearly that’s what Gold Terra is involved in. We’ve seen Gold Terra assemble and expand its land package north of the city. It is an area that we think has been underexplored and certainly has potential geologically to see some of the same mineralization that was found in the city with the Con and Giant mines.”

“We’ve been very impressed with the revised strategy that the new management team has brought in,” Curran added. “One of the issues with the old ways was that we’d see press releases with some good drill results, but they would be on three, four or five different zones, so it was a difficult story to follow, because it seemed like there were upwards of 10 different zones that had shown good drill results but they weren’t really describing the story well enough for investors to grasp the full potential. Certainly they hadn’t done enough targeted drilling to put out resources on the project, to show at least a starting point, and then build upside from there. So certainly that’s been the change in the last year and a half with new management that has a more focused exploration program.”

On the Yellowknife project itself, Curran said, “Gold Terra seems to be outlining a larger area in Sam Otto, potentially lower grade, but I think the combination of having lower grade zones plus higher grade zones is a good one. I covered Kaminak in the Yukon that was taken out by Goldcorp. One of the attributes of its Coffee deposit was a combination of mineralized zones where you had large areas of 1-2 gram open-pittable resources, as well as zones of higher grade 5 g/t or higher material, so that when you put it all together, there was compelling economic potential. So I think we are starting to see some sprouting of early stages of that, with Sam Otto potentially being a larger resource of lower grade, but I’m very excited when the company gets back to the summer drilling in Crestaurum, poking some holes there that may show that to be developing into a higher grade zone. As you build resources in both camps, the economic viability starts to improve.”

“We consider YGT shares to be an attractive investment for exploration success, with high-grade gold deposit potential in a low political risk jurisdiction with above-average infrastructure,” Curran concluded.

Jay Taylor wrote in Gold, Energy and Tech Stocks newsletter on February 28, “I have viewed Joseph Campbell, who is the company’s COO, very positively. But the addition of David Suda as CEO and Gerald Panneton, Executive Chairman, over the past year or so, has provided the company with additional talent that I believe can help to help make Campbell’s visionary dreams for this company’s Yellowknife City 790-sq.-km gold project come true. . .The excitement here is the potential for this deposit [Crestaurum] to evolve into a high-grade underground mine akin to the prolific Con Mine where ~1 million ounces of gold from material grading 19.54 g/t were mined. “

“I can tell you that if there starts to be evidence of continuity between Sam Otto Main and Sam Otto South, visions of a Detour Lake encore may start to generate some significant buying in these shares. And then at some point, there will also be some very interesting exploration of Crestaurum. There’s lots to look forward to with Gold Terra, as exploration progresses this year,” Taylor wrote.

Brien Lundin wrote in Gold Newsletter on February 27, “The winter drilling program on Gold Terra’s YCG [Yellowknife City Gold] project in Northwest Territories continues to bear fruit. The latest assays came from three holes drilled on the Sam Otto South target, with Hole 58 (25 meters of 1.39 g/t, including 10.59 meters of 2.48 g/t) and Hole 53 (2.0 meters of 6.24 g/t) providing the highlights. With assays pending from another 14 holes drilled on Sam Otto Main, Sam Otto South and the Connector zone between them, Gold Terra’s news will continue to flow.

“YCG is truly a district-scale project. As such, it takes a while to wrap your mind around its scope. That said, the overall project has multi-million-ounce potential and, with gold soaring, Gold Terra is an inexpensive bet on discovery, resource growth and higher gold prices. It’s still a buy,” Lundin concluded.

Gold Terra has stopped exploration during the Covid-19 pandemic. “We will use the down time to analyze the data that we do have. We have battened down the financial hatches, decreased our burn rate as much as possible, and plan to raise money for the next major drill program on the back of solid results from this program,” Suda explained.

The company has 160 million shares outstanding, 178 million fully diluted.

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following company mentioned in this article is a billboard sponsor of Streetwise Reports: Gold Terra. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Gold Terra and Newmont Goldcorp, companies mentioned in this article.

Additional Disclosures

Disclosures for Beacon Securities, Gold Terra Resource Corp., February 21, 2020

Does Beacon, or its affiliates or analysts collectively, beneficially own 1% or more of any class of the issuer’s equity securities? No

Does the analyst who prepared this research report have a position, either long or short, in any of the issuer’s securities? Yes

Has any director, partner, or officer of Beacon Securities, or the analyst involved in the preparation of the research report, received remuneration for any services provided to the securities issuer during the preceding 12 months? No

Has Beacon Securities performed investment banking services in the past 12 months and received compensation for investment banking services for this issuer in the past 12 months? Yes

Was the analyst who prepared this research report compensated from revenues generated solely by the Beacon Securities Investment Banking Department? No

Does any director, officer, or employee of Beacon Securities serve as a director, officer, or in any advisory capacity to the issuer? No

Are there any material conflicts of interest with Beacon Securities or the analyst who prepared the report and the issuer? No

Is Beacon Securities a market maker in the equity of the issuer? No

This report makes reference to a recent analyst visit to the head office of the issuer or a site visit to an issuer’s operation(s)? No

Did the issuer pay for or reimburse the analyst for the travel expenses? No

Analyst Certification

The Beacon Securities Analyst named on the report hereby certifies that the recommendations and/or opinions expressed herein accurately reflect such research analyst’s personal views about the company and securities that are the subject of the report; or any other companies mentioned in the report that are also covered by the named analyst. In addition, no part of the research analyst’s compensation is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.

J. Taylor’s Gold, Energy and Tech Stocks: Securities are selected for presentation in this publication based strictly on their investment merits in the judgment of the editor and no fees are charged for inclusion in this letter. The currency used in this publication is the U.S. dollar unless otherwise noted. The material contained herein is solely for information purposes. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice before investing in any of the ideas expressed in this letter. Jay Taylor owns Gold Terra securities.

Gold Newsletter: The publisher and its affiliates, officers, directors and owner actively trade in investments discussed in this newsletter. They may have positions in the securities recommended and may increase or decrease such positions without notice. The publisher is not a registered investment advisor. Authors of articles or special reports are sometimes compensated for their services.

( Companies Mentioned: YGT:TSX.V; TRXXF:OTC; TXO:FSE,

)