Nickel-cobalt-manganese cathode chemistries dominate global lithium ion electric vehicle battery production — though Tesla is doing its best to change that.

The fact that the Democratic Republic of Congo is the source of more than two-thirds of global production and China’s control of refining is north of 80%, makes cobalt a particular headache for automakers.

That two years ago the price topped $100k a tonne and you’re bidding against the likes of Apple and Huawei to get hold of the pink powder only add to the anxiety.

Manganese is almost an afterthought in the EV raw material debate

While not unfamiliar with volatility (thanks to Jakarta’s on-again off-again ore bans), the nickel industry is well-understood and mining fairly evenly spread around the world.

EVs still only account for around 7% of overall nickel consumption and with 35% of chemical processing outside China, it’s less lopsided than other parts of the supply chain.

Manganese is almost an afterthought in the EV raw material debate – more manganese probably goes into prison bars and fungicide at the moment than goes into EV batteries.

Mine supply is concentrated with South Africa, followed by Australia and Gabon, the most well-endowed, but ore volumes are orders of magnitude larger than cobalt and nickel.

At around $2,000 a tonne, high-purity manganese sulphate also sells at a healthy premium to the material going into alloys, but as a component of NCM batteries, no auto exec is losing sleep over manganese costs or supply.

Perhaps they should.

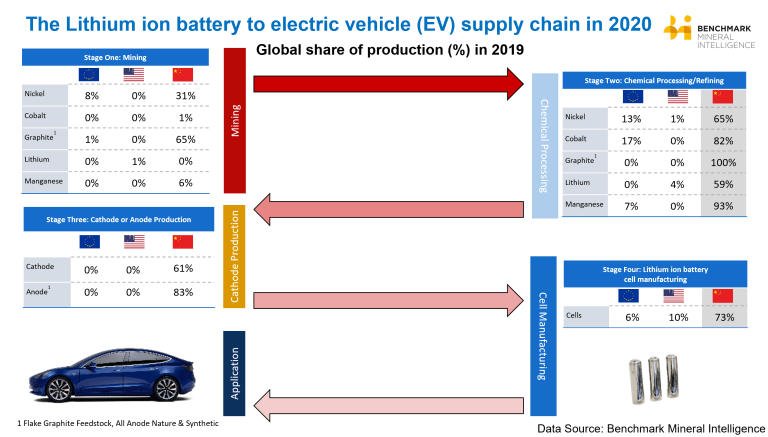

A new report by Benchmark Mineral Intelligence shows just what a stranglehold China has developed on the EV battery supply chain.

The London-based battery supply chain, megafactory tracker and market forecaster first developed the chart for testimony to the US Senate in 2019, with MD Simon Moores warning that the US is a bystander in the battery arms race.

You do not need to own the raw material sources to control the global flow of trade

New data from Benchmark shows imbalances in the manganese supply chain are even more pronounced than that of cobalt.

North America produced zero manganese and Ukraine is home to a small operation, but it’s not capable of producing feedstock for the battery supply chain.

Benchmark says while China only mines 6% of the globe’s manganese, it is this chemical refining step in the supply chain where China has the significant advantage, with 93% of production in 2019:

As Benchmark has always advised, you do not need to own the raw material sources to control the global flow of trade in the lithium ion battery supply chain.

It is these chemical links in the supply chain that both Europe and North America are sorely missing and could yet act as another roadblock to creating a 21st century EV ecosystem on their respective continents should the situation continue unchecked.