In its latest report, UK-based data analytics firm GlobalData says iron ore exports from India are expected to decline by around 25% to 23.3 Mt in 2020 due to the coronavirus outbreak and the subsequent closure of ports, shortage of workers and transport restrictions, which are severely disrupting the exports as well as the domestic supply.

In addition, the auctioning process of several iron ore mines were completed in February as their leases were about to expire in March. According to GlobalData estimates, out of around 25 non-captive iron ore mines, 22 were successfully auctioned, while three were put on hold over a pending legal suit from the Supreme Court of India.

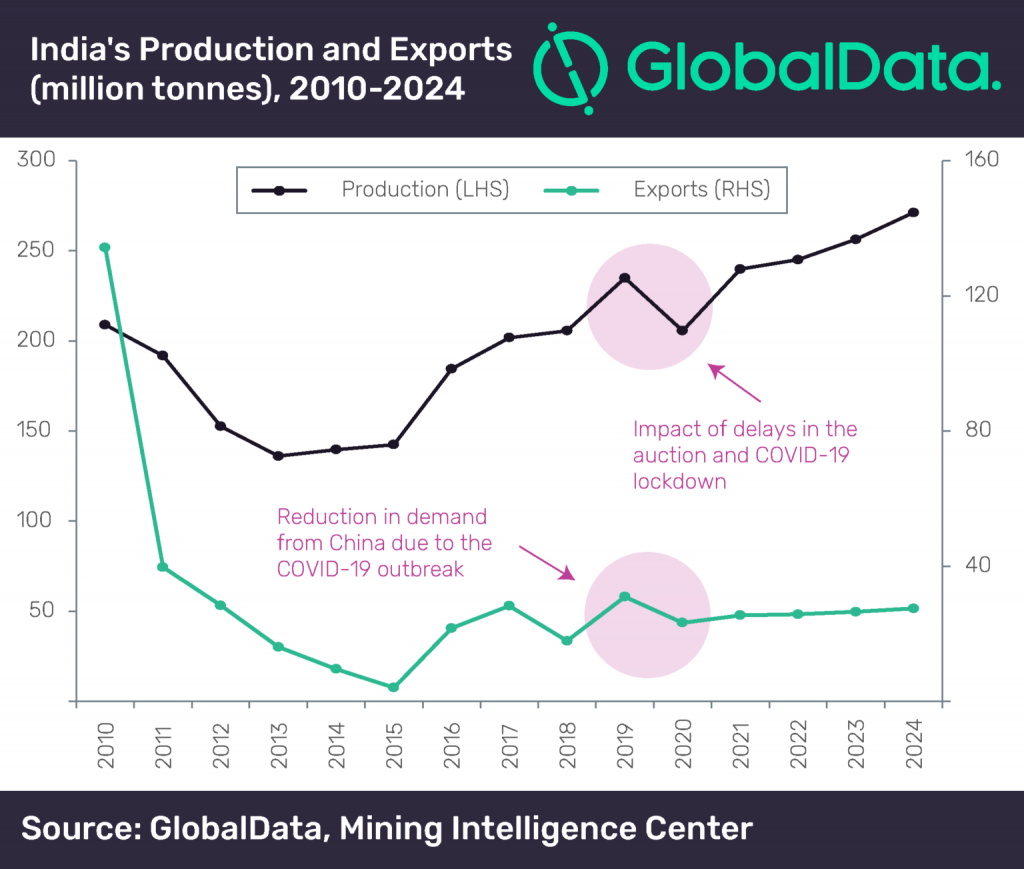

GlobalData senior mining analyst Vinneth Bajaj says the delays in mine auctions in Odisha, which were to be held in March of last year, due to the lack of clarity on the maximum lease area, will “severely damage” India’s iron ore output this year, which is expected to fall to 205.7 Mt, a 12.5% decline compared with 2019 (234.9 Mt).

The decline could have been over 40 Mt, Bajaj elaborates, had the Indian government not allowed new owners to start and continue operations until they had acquired fresh forest and environmental clearances, which could have taken up to three years.

Moreover, some idle time is inevitable as operations are reestablished by the new owners, GlobalData says. The firm expects production to pick up once the lockdown ends and operating activities resume.

Despite the decline in 2020, iron ore production in India is expected to grow over the forecast period (2020–2024) at a compound annual growth rate (CAGR) of 7.2% to reach 271.2 Mt in 2024. The resumption of operations at the auctioned mines will be a key factor behind this growth, GlobalData explains.

“Simultaneously, iron ore exports from India are expected to recover from the 2020 decline and post a forecast-period CAGR of 4.2% to reach 27.5 Mt in 2024, supported by improving demand from China,” Bajaj concludes.