The mining industry is fraught with capital cost overruns. A quick internet search will turn up many examples. The results quickly high-light that as many as two-thirds of mining projects see cost overruns. Moreover, the researcher can see that it is a decades-long problem. That is, the industry doesn’t seem to be getting better at their cost estimating. We aren’t learning from our mistakes.

Where does the problem lie? Our industry’s cost overrun problem is multi-faceted. There isn’t a single reason or error that we can definitively say is the key to the solution. Poor engineering assumptions, a lack of understanding of key risks (either actively choosing to “kick the can” or a simple failure to recognize risks), bias (both intentional and unintentional), aggressive timelines, and other reasons may play a role. These issues can contribute to cost overruns individually, although they more commonly occur in tandem.

Our industry’s cost overrun problem is multi-faceted. There isn’t a single reason or error that we can definitively say is the key to the solution

To highlight a single, yet profound example, consider Teck and Newmont’s Galore Creek project in northwest British Columbia. All of the information presented below is publicly available via company or securities websites. It is representative of the company and project information that would be available to investors.

Project example

The Galore Creek project is an alkalic porphyry copper-gold-silver system with at least three mineralizing events that deposited bornite, chalcopyrite, gold, silver, and other base metals, primarily in association with potassic alteration. Exploration and development are difficult due to its remote location and helicopter-only access. The project was originally discovered by Hudbay Mining in 1955 and has since been explored and partially developed by several companies.

NovaGold was the 100% owner immediately prior to June 2007, however it has since divested itself in full, via an initial partnership with Teck Resources in 2007, followed by a more recent agreement with Newmont. The project is currently being worked by a partnership of Teck and Newmont under the name Galore Creek Mining Corp. The first assessment of the development potential for the project was completed by Kennecott in 1992, but this example focuses on information from the last three publicly available studies of the project: a 2004 preliminary economic assessment, 2006 feasibility study and a 2011 pre-feasibility study.

The 2006 study resulted in the first declaration of reserves on the property. Permits were obtained and initial development (preconstruction) activities began based on this study. Then a third-party review of costs and work completed in 2007 (after a new partnership with Teck) showed that the economies of the project were ultimately not favourable.

Development activities were halted at that time, with the stated reasoning for the stoppage focused primarily on the complex sequencing related to the construction of the tailings dam and water management features. As we will see shortly, there was a much larger concern that likely played into halting development.

The increases in tunnel and infrastructure costs between 2006 and 2011 are substantial and not easily explained

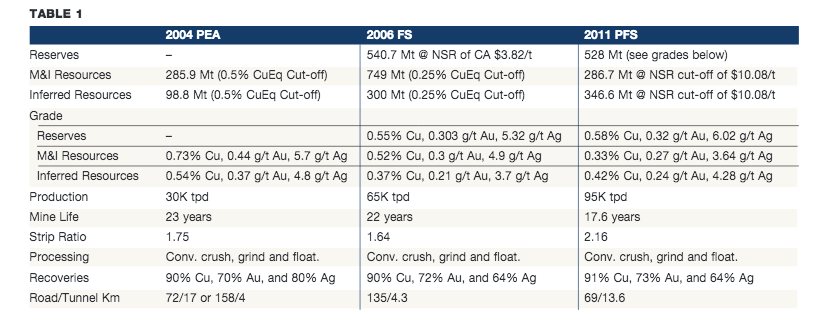

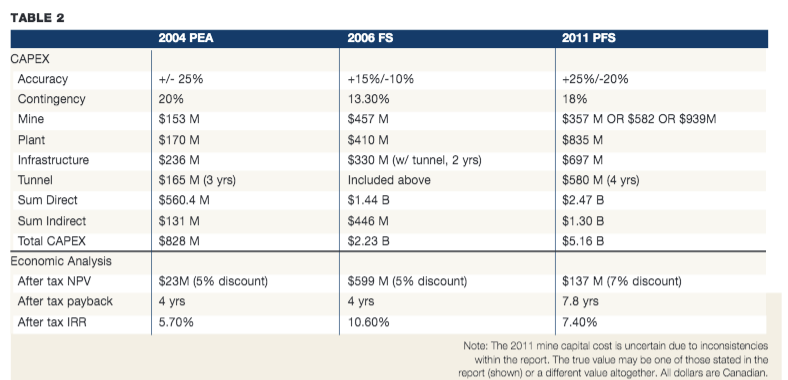

In 2008, the mineral reserves were reclassified back to mineral resources and an optimization study was implemented. Then, in 2010-2011, Galore Creek Mining Corp. commissioned several consultants to help it with a new prefeasibility study, which is the last publicly available report on the project. The following tables highlight the cost inflation at Galore Creek over the seven-year span covered by the latest publicly available reports. Table 1 shows the key project characteristics over time and Table 2 outlines the costs associated with each scenario.

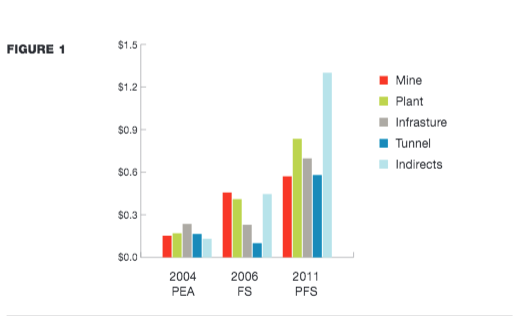

If the costs shown in Table 2 are charted (Figure 1) and we consider the underlying project parameters in Table 1, we can begin to understand the capital cost progression at Galore Creek. The increases in mine development and plant posts are expected due to the higher production levels assumed for each subsequent study. (The actual increase in mine costs is uncertain due to reporting inconsistencies.) However, the increases in tunnel and infrastructure costs between 2006 and 2011 are substantial and not as easily explained.

These costs were dramatically understated in the earlier reports due to risks and scheduling not being well understood, as they pertain to the tunnel and other infrastructure aspects. With specific regard to the tunnel, the construction period was re-evaluated and time for completion moved from two years to four years. That is a huge oversight. Timelines for the water management features changed as well due to elaborate build sequencing.

These types of oversights, or lack of investigation into the risks of a project earlier in its development, can have significant impacts on the total estimated capital costs associated with project development.

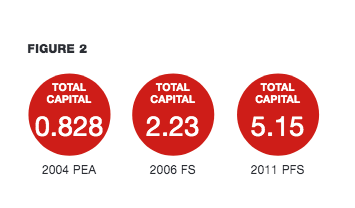

In the Galore Creek example, the total estimated capital cost increased a whopping 131% between 2006 and 2011. (Figure 2).

The Galore Creek example highlights that companies should be making efforts to better understand their project risks (technical, market, government, etc.) and the potential effects they may have on costs

What needs to happen?

The Galore Creek example highlights that companies should be making efforts to better understand their project risks (technical, market, government, etc.) and the potential effects they may have on costs.

Similarly, investors and financing houses should require and/or carry out more intensive due diligence work and conduct more thorough cost estimates earlier in a project’s life.

The end game for this additional work is a better project, from both technical and cost perspectives. What would happen if the industry suddenly shifted to better projects? Industry credibility would improve, projects would advance, and the currently narrowed financing options would potentially be reinvigorated.

Unfortunately, closing the gap between estimated costs at the study level and the actual costs of development is not an easy task. Individuals and companies would need to commit to understanding their project risks with real-time and real dollars, while also braving the prospect of having to condemn their own projects.

For the Galore Creek example, the publicly available information paints a bleak picture of its economic feasibility. However, it is clear that NovaGold was able to drum up interest in the project from two very significant multinational mining companies.

Perhaps there is more privately available information that would help us understand their interest in such a property, but this leads to my final point. What is your typical investor to do if all of the information isn’t at their disposal or if the public reports are of poor quality? If we want to see funds come back to the industry from the marijuana industry, and others, the onus is on us to improve reporting and to regain the confidence of the investor.

(This article first appeared in the Canadian Mining Journal)