By James Kennedy, ThREEConsulting.com

The Department of Energy and Department of Defense have taken their first steps toward establishing a domestic rare earth value chain. Last year the U.S. Army announced a program to fund the development of rare earth value chain processing and technologies. Early this year the Department of Energy announced a similar program that focuses on extracting rare earths from coal waste.

Award announcements were expected sometime late last month. Funding is anticipated to be tied to green field mining projects, reconstituted mining projects like MP Minerals or extracting little bits of rare earth from coal ash.

Unfortunately, most of the applications are directly tied to the same speculative mining ventures that have failed in the past or projects that could never convince investors to move their projects forward.

While the U.S. continues to place its salvation in speculative mining projects or challenging and costly chemical extraction processes, China’s monopoly has morphed into something much more robust and omnipresent.

China’s monopoly strategy over the last few decades can be broken down as follows:

- Mining: Basic Resource Production Monopoly

- Control Entire Value Chain: Integration / Domination Over Refining, Metals, Alloys & Magnets

- Manufacturing & IP Capture: Leverage, Control & Relocation of All REE End-User Tech

- Resource Exploitation: Supplication & Resource Redirection

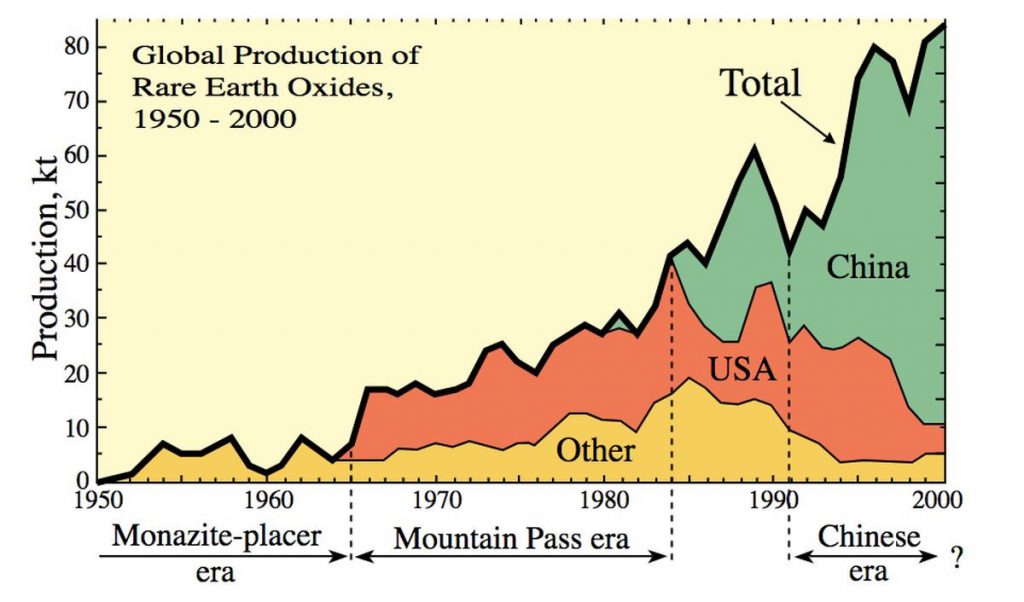

The USGS graphic below tells much of the story

Mining: Basic Resource Production Monopoly

As illustrated in the graph above, China fully exploited its global monopoly over rare earth resources by 2000, or 20 years ago.

Control Entire Value Chain: Integration / Domination Over Refining, Metals, Alloys & Magnets

China moved beyond resource production as it expanded its monopoly over the value chain. China systematically gained global monopoly control over the production of oxides, metals, alloys, magnets and all other high value materials.

This process actually began as far back as 1985, or 35 years ago, when China made its ambitions clear when it announced the establishment of the Baotou Research Institute of Rare Earths. The institute, at inception, was the largest rare earth research organization in the world. China’s public commitment to rare earth research and development dwarfs the U.S. and the rest of the world combined. Today China has the equivalent of five National Laboratories dedicated exclusively to rare earth research[i]. The U.S. failed to take notice. The rest is history.

Manufacturing & IP Capture: Leverage, Control & Relocation of All REE End-User Tech

China began leveraging its control over access to these finished rare earth metals, alloys and magnets over 15 years ago. It began with technology companies like Apple, who’s products could not be built without these materials.

Apple moved much of its manufacturing to China as early as 2004. When Apple introduced its iPhone in January of 2007 it must have been surprised to learn that a company named Huawei had successfully knocked-off its new phone before the end of summer of that same year. By 2016 the top 2 Chinese iPhone knockoff makers, Huawei and Oppo, outsell Apple worldwide. By 2017 Huawei alone outsells Apple worldwide. By 2018 Chinese iPhone knockoff companies begin suing Apple for technology infringement

Because China controls access to rare earths Apple and so many other companies had no alternative but to move their manufacturing to China. This is a common story for all rare earth dependent technologies. The outcome is always the same, Chinese assimilation of foreign technology and a rapid expansion of Chinese knock-offs into global markets – eventually displacing the original technology leader.

Resource Exploitation: Supplication & Resource Redirection

China has learned that mining is a dirty, low margin and thankless business. China’s current monopolistic strategy is to retain control over all aspects of value adding and ‘outsource’ resource production to other countries, including the U.S.

Today China’s rare earth monopoly is centered on access to rare earth metals, alloys and magnets. This is accomplished through generous subsidies to cover the production cost of all new rare earth metals, the precursor to alloys and magnets. The resulting price distortions are so significant that Japan informed the U.S. government that it was suspending all new rare earth metal production in 2019. No non-Chinese company in the world can match their prices for new rare earth metal.

Off queue, out of step and 20 years too late, U.S. policy still remains narrowly focused on ramping up resource production. Of course, this will play into China’s larger plan. China will be in a position to manage price wars between these new U.S. rare earth mines, its domestic production and new low-cost producers in the region[ii]

Establishing new stand-alone rare earth mines in the U.S. will only make things worse. China has demonstrated that it can easily manipulate its internal production upward, thus driving prices down. Its best tool for this is its notorious ‘black market’ producers; an army of artisanal rare earth producers that can match or exceed China’s official production numbers[iii].

New U.S. rare earth mines would also need to compete against the many new Asian rare earth producers desperately queuing up to do business with China. It is unlikely that any of the proposed U.S. mining projects would be competitive against China or the new Asian producers.

Worse yet, all of these new producers would find themselves fiercely battling amongst themselves over market share. The end result will be a string of bankruptcies and the gift of low-cost resources being exported to China. This is exactly what happened when Molycorp and Lynas both ramped up their production leading up to Molycorp’s bankruptcy in 2015.

None of these companies will be able to directly compete against China’s subsidies in the production of new rare earth metals, so for all practical purposes China’s monopoly over metals, alloys and magnets will remain intact and no domestic value chain will emerge.

Finding a sustainable solution:

To establish an uninterruptable value chain, you first need to establish an uninterruptable supply of resources. As challenging as that may sound, the solution is right in front of you.

A glance back at the graphic above under the data series labeled “Other” is something referred to as the “Monazite-placer era”. What is largely unknown is that these resources made up as much as half of all global rare earth production – and 100 percent of heavy rare earth production before the “Chinese era”. More importantly, these REE resources were not directly mined. They were the byproduct of some other commodity. They were a freebie.

Unfortunately, the production of REEs from these sources ended due to a 1980 NRC / IAEA regulation that pushed rare earth production into China (not an IAEA member). The regulations resulted in these resources being classified as “source material”, or nuclear fuel. Why? Because these resources commonly carried the companion element thorium and sometimes uranium.

Today these REE resources continue to be mined but are then discharged as waste to avoid the regulatory costs and liabilities associated with “source material”. Most of these potential producers consider this material to be a liability. If the “source material” issue can be resolved in favor of the potential producers the resources can be had at a significant discount to Chinese pricing. If these savings were passed along to the end-users through a cooperative business model the U.S. could compensate for China’s subsidies in metal production.

Today the U.S. alone disposes of enough economically recoverable REEs as the byproduct of some other commodity to exceed U.S., EU, Japanese, Korean, Canadian, South American and Russian demand.

The only obstacle to utilizing these resources is establishing a mechanism to manage the thorium and uranium and developing an integrated value chain that can supply finished rare earth metals, alloys and magnets at prices equal to or even cheaper than China. The proposed solution has been around for over a decade and can be found in its current form in Senate and House rare earth bills S. 2093 and H.R. 4410. The proposal is also under consideration with the current Administration.

[i] The U.S. has a single National Lab, Ames, ‘focused’ on rare earths along with several other unrelated priorities.

[ii] Remember, China is the market and sets price.

China does not need outside producers. China’s official REE capacity is approximately 200 percent of global demand.

By allowing other countries to become its resource supplier, China can preserve its resources and begin the process of cleaning up the ugly environmental legacy of its recent past.

[iii] According to a China Chamber of Commerce of Metals, Minerals & Chemicals Importers & Exporters report Chinas official production quota for 2016 was 105,000 tons per year but total rare earth production exceeded 250,000 tons per year, putting so-called black-market production at over 150,000 tons per year or at least 150% above official production.

________________________________

[1] The U.S. has a single National Lab, Ames, ‘focused’ on rare earths along with several other unrelated priorities.

[1] Remember, China is the market and sets price.

China does not need outside producers. China’s official REE capacity is approximately 200 percent of global demand.

By allowing other countries to become its resource supplier, China can preserve its resources and begin the process of cleaning up the ugly environmental legacy of its recent past.

[1] According to a China Chamber of Commerce of Metals, Minerals & Chemicals Importers & Exporters report Chinas official production quota for 2016 was 105,000 tons per year but total rare earth production exceeded 250,000 tons per year, putting so-called black-market production at over 150,000 tons per year or at least 150% above official production.