Source: Clive Maund for Streetwise Reports 03/30/2020

Technical analyst Clive Maund charts silver and explains why he is bearish in the short to medium term.

Whichever way you cut it, silver’s chart looks bearish for the short to medium term, but against this we must set its rapidly improving COT structure and the mega-bullish silver to gold ratio (by all past standards).

Silver’s 7-month chart is a rather grim picture. On it we see that key support failed this month, leading to a dramatic plunge to new lows, and this support has now become resistance. In addition we see that moving averages have swung into bearish alignment, with a bearish “death cross” having occurred about a week ago. The relief rally of the past week or so in sympathy with the relief rally in the broad stock market fueled by Fed intervention, that we predicted and played via leveraged silver ETFs and Calls, is therefore thought to be petering out and set to be followed by another probably steep selloff, congruent with another decline in the broad stock market, and a potentially heavy decline in the precious metals sector.

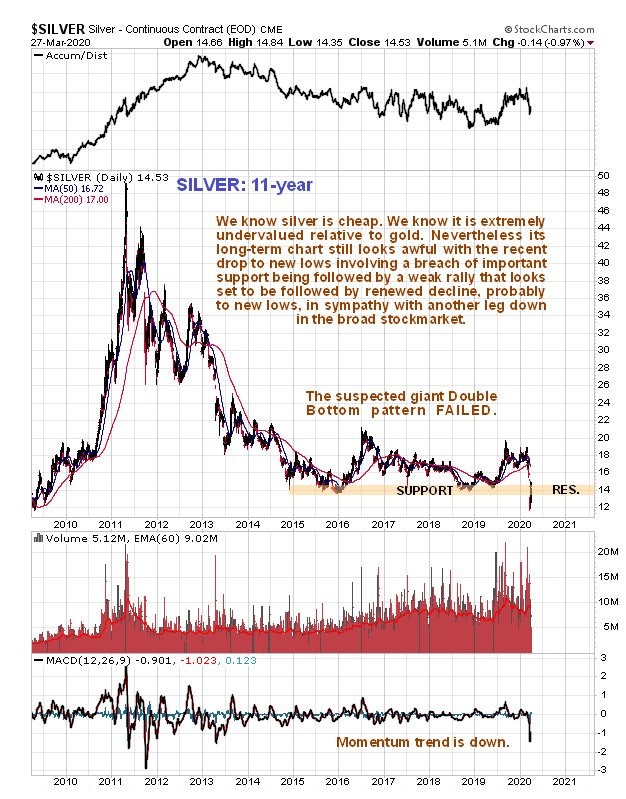

This month’s dramatic failure of key support at the lows was a hammer blow to investors in the sector and it’s easy to see why on the latest 11-year chart for silver. This support failure crashed multi-year lows dating back to early 2016, and aborted the potential giant Double Bottom pattern – it is precisely the sort of development that would lead silver bugs to give up in disgust and disgorge their holdings in despair to Smart Money waiting patiently to scoop them up at rock bottom prices.

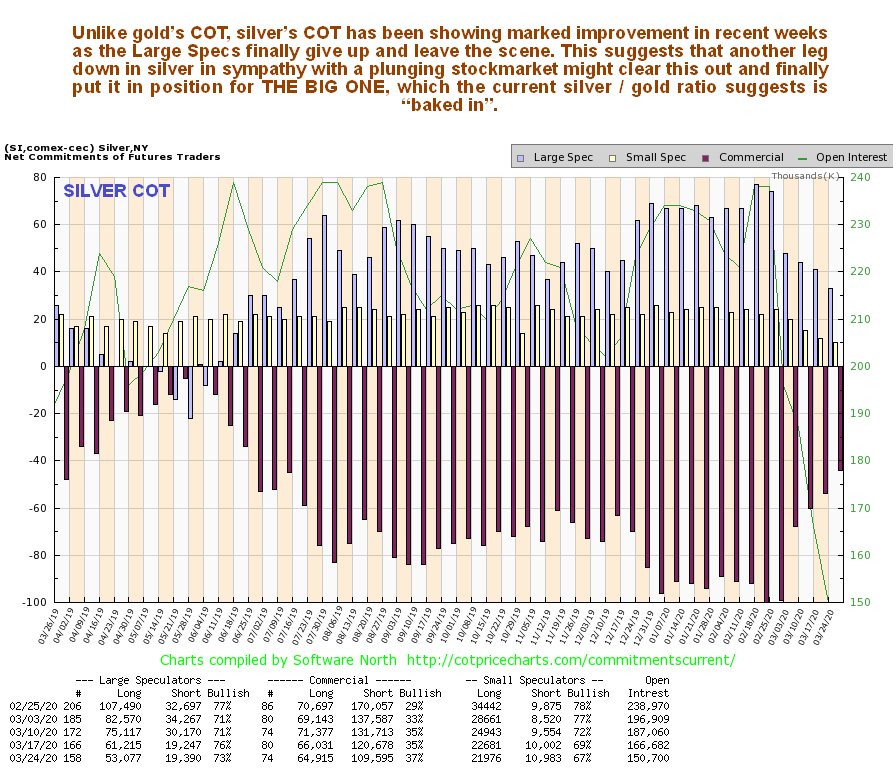

For as we can see on the latest silver COT chart, the faithful are giving up in droves and heading for the hills – with the Large Specs’ holdings ebbing away steadily. With the shorter-term charts for silver pointing to further losses dead ahead, we can expect to see considerable further improvement in this COT structure which will finally set the stage for the expected humongous silver bull market.

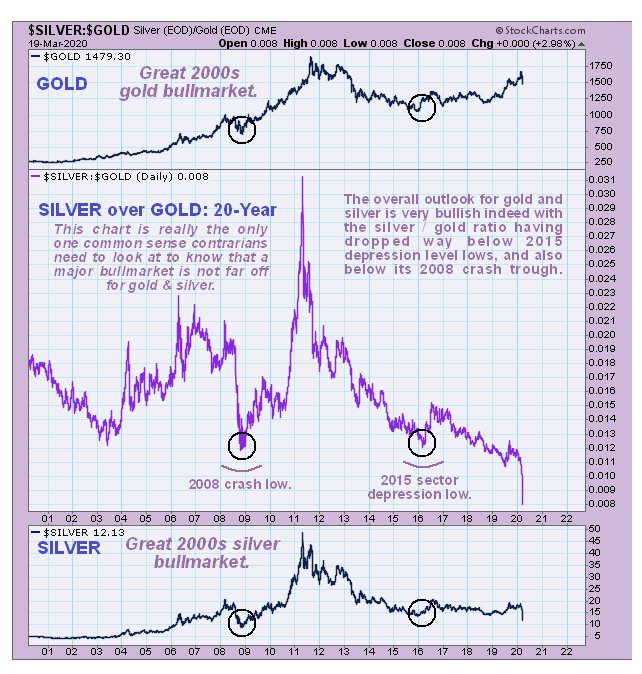

Why humongous? – here’s why: the silver to gold ratio has dropped to a record low by a wide margin this month, and is way below lows that in the past have been the precursor to major sector bull markets. This is why, after the stock market crash phase is done, and maybe even a little before, silver is expected to reverse to the upside in a spectacular manner and take off like a rocket, and there is a precedent for this behavior, for this is what happened near to the bottom of the 2008 market crash. The difference this time is that the situation is much more extreme and the upside potential much greater than it was back then. So we will be keeping a very close eye on silver going forward.

The conclusion is that silver looks set to drop hard over a short to medium-term time horizon with the broad stock market but in the larger scheme of things it is setting up for a massive and probably spectacular bull market that is likely to commence with a screaming rally when the time is right that will probably blow straight through the failed support, now resistance, shown on our 7-month chart . This should not come as a surprise when you consider what is set to be done – and is already being done – to fiat currencies going forward.

Originally posted on clivemaund.com on March 29, 2020.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.