US domestic demand for

thermal coal will fall in the near term as individual states shut down much of

the industrial economy to try and stem the

coronavirus pandemic, and as slowing economic activity cuts US

electricity demand in the second quarter of 2020, Moody’s Investor Service said

Thursday in a research note, adding that it expects an unprecedented shock to

the global economy in the first half of 2020.

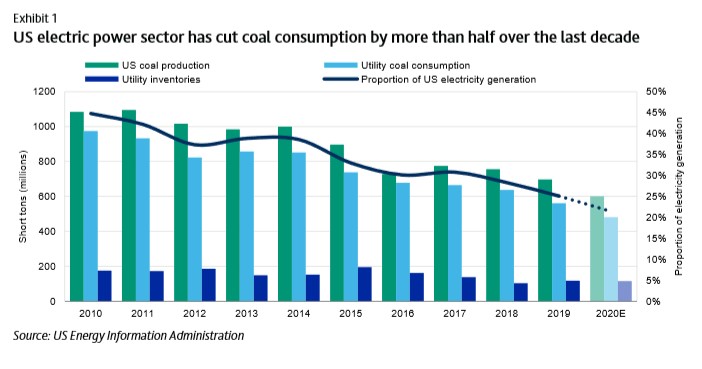

The outlook for coal-fired power plants in the US has darkened over the past few months, Moody’s said, particularly for coal plants in the Mid- Atlantic and the industrial Midwest. These coal plants have been economically challenged for the past few years, generating minimal to negative cash flows. The developments in the past few months have conspired to push them into an even more perilous position, Moody’s asserted.

Meanwhile, environmental, social and governance-related (ESG) issues with respect to the coal industry have eroded access to capital for US coal companies, Moody’s noted. Equity and debt trading levels for coal companies have worsened substantially from a trifecta of factors. Moody’s highlighted a weakening export market in the second half of 2019, multiple announcements that major investors would divest coal- related holdings, and the broader weakening that occurred with the global spread of the coronavirus in March 2020.

A few of the stronger coal

companies have obtained new financing in 2020, including equipment financing for Arch Coal, which Moody’s believes

remains widely available, and a new revolving

credit facility for Alliance. But in general the industry’s access to

capital remains tight, and the coronavirus outbreak adds to the uncertainty.

Prospective government assistance for the coal industry remains highly uncertain, though the National Mining Association has reportedly requested relief for the coal industry.

Coal companies have also struggled with recent adverse political developments, including a revised approach to black-lung liabilities that would require them to post more collateral during a weakening market environment, and a recent US Federal Trade Commission ruling against Arch and Peabody’s joint venture in the Powder River Basin that would have helped these compete against alternative fuels.

Export thermal markets will

continue to fall in 2020, Moody’s said, rather than helping rescue domestic

thermal coal producers from weakening domestic demand like in 2017 and 2018.

While some producers still have contracts established during stronger market conditions, and cash costs vary significantly for each mining operation, coal pricing in Europe will not support a continuation of US exports at 2019 levels, which were themselves down 20% from 2018 levels.

Falling export volumes contributed to Foresight Energy’s recent bankruptcy filing and will limit export opportunities for other rated producers over the next few quarters, Moody’s noted. Some domestic producers guided toward lower export volumes during their fourth-quarter 2019 earnings calls. Some producers have partial offsets, such as Peabody Energy’s (Ba3 negative) seaborne operations in Australia, and CONSOL’s efforts to develop export markets in India.

While some producers still have contracts established during stronger market conditions, and cash costs vary significantly for each mining operation, coal pricing in Europe will not support a continuation of US exports at 2019 levels

While thermal coal prices continue to decline, demand for metallurgical (met) coal used in steelmaking remains uncertain – with clear downside risk.

The US exports most of the met coal it produces, especially to European steelmakers. Met coal prices have held up better than most commodities in 2020, which Moody’s believes reflects a combination of weather-related issues in Australia and anticipation of a major stimulus program in China.

Moody’s said demand in

Europe has softened (particularly with the auto-related shutdowns) and, to the

extent that US steel producers idle capacity at blast furnaces on declining end

market demand, met coal producers serving the US market would be hurt. US met

coal producers have very different costs and levels of business

diversification.

Warrior Met Coal (B2 positive), which produces benchmark-quality met coal from two longwall mines in Alabama, will remain durable amid unfavorable pricing, Moody’s predicted, while Contura Energy (B3 negative), which operates smaller mines with higher cash costs, is the most exposed to met coal pricing, and will burn through its cash in 2020, Moody’s asserted.

Arch Coal (Ba3 stable) will also spend much of its cash to help fund the development of the Leer South high-vol A mine in 2020, but Arch also has significant cash reserves and very little net debt. Some unrated producers have idled met coal mines within the past few weeks.

About three-quarters of rated US coal companies have negative outlooks today – indicating weakly-positioned ratings. Moody’s took negative actions on more than three-quarters of the sector between mid-February and mid-March 2020, based on expectations for weak industry conditions in 2020 and a decline in industry-level EBITDA by at least one-third in 2020.

While the coal industry

generated significant free cash flow in 2017 and 2018, credit quality did not

improve meaningfully because producers returned much of that cash to

shareholders through dividends, special dividends, and share repurchases.

Moody’s will monitor

closely the anticipated supply/demand balances for the various grades of coal

and within key coal-producing regions to determine our view of prospective cash

flow generation, which will be overlaid against the sufficiency of rated

producers’ liquidity arrangements.

It will also consider any prospective government aid, though Moody’s sees that scenario as less likely today.