Source: Michael Ballanger for Streetwise Reports 03/23/2020

Sector expert Michael Ballanger describes what he believes is really behind the market crash.

“Never let a good crisis go to waste.” —Sir Winston Churchill

My late older brother Donnie was a quasi-anarchist tax collector for the Canadian government who self-educated himself and then morphed from a grumbling, cynical security guard/starving artist to a very successful 20-year career auditor with the Canada Revenue Agency (CRA) before his untimely passing in 2014. Within weeks of the 9/11 terrorist acts that brought down the Twin Towers in New York City in 2001, he summoned me for a beer conference at the local suds parlor in the West End of Toronto. Holding court for around an hour and a half and three pitchers of local stout, he set about to convince me that all those aircraft slamming into major American landmarks of symbolic importance could only have been a “false flag” operation that was the design and execution of the American government.

His cynicism could be aggravating at times, but it was never, ever without argumentative substance. It was only until after the second Gulf War and subsequent confiscation of Iraqi oil fields, and the almost twenty-year “War Against Terror,” that evidence has come to light that in retrospect makes Donnie look somewhat clairvoyant.

Saudi terrorists carrying out multiple terrorist missions invoking massive retaliation against Iraq and Afghanistan might appear somewhat “misdirected,” but that is a discussion for the beer tent and not today’s microphobic maelstrom. The point is that all one sees may not be what it appears to be, and with markets melting down in a conflagration of fund redemption and debt liquidation, it is important to ask whether or not the arrival of a viral pandemic was the actual source of the financial implosion.

Could it not have been something else?

If one turns the pages in the Book of Bond Insolvency back to last September, every single release from the U.S. Department of Commerce was upbeat; everything coming from the Fed was positive; and stocks around the world were shrugging off the Trump Trade War, the woes of Deutsch Bank, the ever-ballooning U.S. deficit, and the extreme overvaluation (by all measures) of the global markets. In what I penned as “the greatest fiscal policy about-face in history,” I asked in October 2019 “what exactly it was that Jerome Powell saw that spooked him into a sudden series of multibillion- (then trillion) dollar liquidity injections?”

We now know that these “liquidity problems” originated, once again, in the C-Suites of the Wall Street banks, because we know now from statements from JPMorgan CEO Jamie Dimon that banks were having a few “issues” lending to one another. A booming economy with stocks at record levels and a president firing off numerous self-congratulatory tweets with deal flow booming and the banks are having “issues” lending to one another?

As followers of this missive know all too well, I am a full-on cynic of the highest order and not without justification. My lifelong hero of history, Sir Winston Churchill, underscored peak cynicism by offering the quote “Never let a good crisis go to waste,” in reference to taking of advantage of voter anxiety in order to advance a silent agenda or “false flag.” The actions of the Fed last fall were baffling to me, and as REPO ops began to balloon in the final days of January, it was the bond market’s crashing yields that I addressed in my February e-mail alert, not some Asian flu, that accelerated my shorting campaign that was looking really quite foolish until late February.

So, when I look at the slag heap of failed dreams and faulty assumption lying in ruin and despair on the floor of the New York Stock Exchange, I am today asking whether it was really the COVID-19 outbreak that caused the meltdown or is it the cover story that now allows the banco-political alliance to plead in the bended-knee style of Hank Paulson back in 2008 for a legislated bailout of the global banking system, not to combat the global pandemic of viral infection but the more insidious global pandemic of debt, as in “way too much of it.”

Now, with people dying and people close to my place of residence infected, I am not suggesting that this tragic outbreak is to be understated or dismissed. What I am raising is the manner in which the media and the governments around the globe have handled this crisis. Secretary Mnuchin’s first statement pledging action by the Trump Administration was “to support the U.S. economy,” with nary a mention of the health of its citizens. It would seem to me that you help the ill first, the unemployed second and the profit and loss statements of your Wall Street pals last.

Further, just as the banker-politico alliance opted to bail out the banks rather than the citizens losing their homes in 2008, it seems that history is once again rhyming, but not pleasantly nor with the numbing calm of a Robert Frost soliloquy.

After a week of total and complete market mayhem and monetary madness from the banco-politico alliance, I feel the same today as I did in 1987, 2001, 2009 and December 2018. Most importantly, I feel the same way I did in April 2011, when the central banking interventionists took down the gold and silver market in what is still, to date, the singular most blatant example of “free market” abuse ever.

That feeling is one of violation, but the odd part about it this time is that we, in the precious metals fraternity/sorority, have had to live through financial armageddons before, such that our emotional coping mechanisms are more conditioned to external violation than the current generation of stock junkies that have been day-trading the “Spoos” with “the Fed at their back” for over twelve years. Only now are they discovering the horror of financial loss at the hands of an external perpetrator. Only, for them, it is a microbe, while for us it was, and is, an entity. Nemesis arrives in different disguises.

Navigating the current investment landscape is not unlike “shooting the rapids” in a kayak, and the important tip in doing so is to keep the paddle perfectly balanced in order to keep the upper body out of the water. In terms of trading, I take position sizes down and try to avoid leverage where possible, but I go into a trade or a theme knowing full well that these are not normal times.

The performance of the gold miner exchange-traded funds (ETFs) run by Van Eck has been a disgrace, with massive swings in discount-to-net-asset-value (NAV) settlement prices and shoddy rebalancing. I must assume that I could lose everything if my judgment is off by as much as a blink, so while prudence is of the utmost importance, paralysis is not.

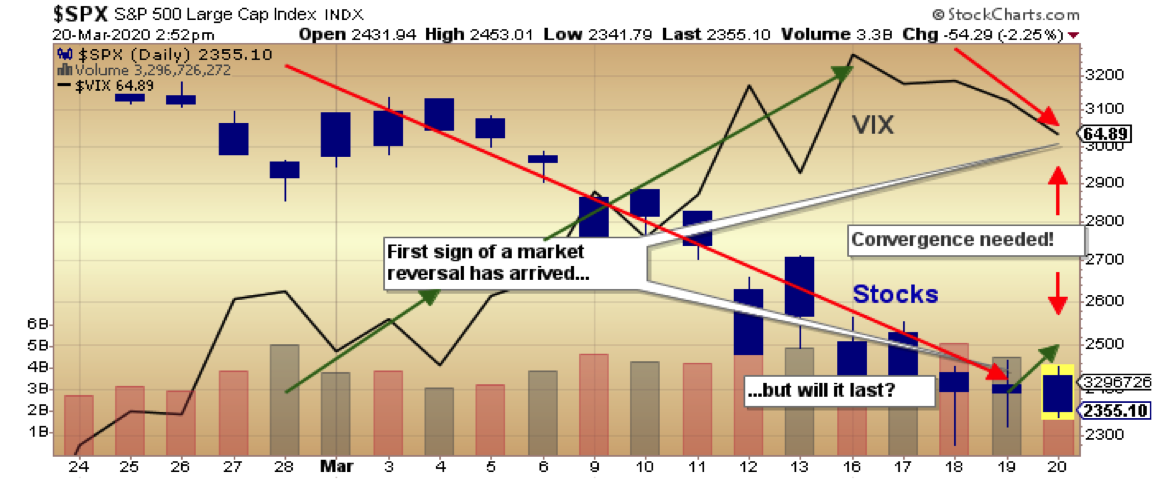

At the top of most advances there usually occurs a divergence, whereby stocks advance and volatility advances—a most unusual condition. At bottoms, there occurs an opposite divergence, and we are getting just that. Much as I detest the term “green shoots,” the first of them are beginning to poke their heads above the receding snow cap with the action in the SPX/VIX relationship. The chart below shows a definite divergence between stocks and volatility, and that has always been the first signal that a turn is possible.

Similarly, silver outperformed gold on Friday (gold up 0.26% versus silver up 2.07%), in what may yet another positive divergence in our favor.

Over the weekend, we will all be reading dozens of apocalyptic prophesies by various market gurus, complete with pointed fingers, raised hands, bulging eyes and crocodile tears everywhere. While I like to pore through their rationales for whatever investment thesis they currently hold, in the end, the question I ask is, “Did they see the crash coming?” I did, and I gave the reasons why in the Jan. 12 missive. But that, my friends, is “old news.” I am now flat; covered way too early; own no shorts or puts; and am looking for a trade-able rally in the senior and junior gold miners (GDX/GDXJ) to new highs by the end of the summer.

Further, unlike the past two months, those miners are now undervalued relative to the metals they produce. The big gains will in the shares.

Lastly, the weekly gold-silver comparison chart shown below starts in December 2015, at the onset of the current (yes, I said current) bull market in gold. In the singular largest deflationary crash in financial market history, gold is down 2.53% year to date, versus declines of 28.66% and 23.33% in the S&P and NASDAQ, respectively. Gold has done its job of protecting one’s assets from those lifestyle-ending drawdowns from which it is so difficult to recover. The important points to observe in this chart are as follows:

- Gold remains in an uptrend;

- The gold-to-silver performance differential is an astonishing 51.58%;

- Being a weekly, note the negative crossover in the gold MACD lines circled in red;

- Note the weekly relative strength index (RSI) at 45.67; oversold (bottoming area) is under 30;

- The uptrend line for gold remains around US$1,425. Gold must hold that long-term support line;

- The silver market remains an enigma to all metals analysts that I know. It is either supernaturally cheap right now or something fundamental to its long-term pricing mechanism has changed. Whether or not to buy it here remains the biggest singular investment decision of my 43-year career, and I must tell you in all candor, this is a really tough one. My heart is saying “Buy it!” but something ain’t quite right.

To sum up this past meteor storm of a week, I remain a staunch bull and grateful to have been overweight gold rather than the miners (or anything else) during the crash. I am now moving aggressively to replace all of the positions sold at or near the peak in February and last August. There are numerous names that have moved down to multiyear lows due to this forced liquidation from the EFTs and other funds, and surprisingly, there are juniors (that I own) that are actually up year to date

If there is one dominant investment theme to which I am adhering, right now, it is to focus on those microcap juniors with defined ounces. If I am right, we have now entered a new paradigm where preservation of value will be paramount. Since counterparty risk fears were what triggered the REPO explosion last fall, those same fears place gold (and ounces in the ground) front-and-center in this value proposition. Accordingly, a basket of companies producing or developing gold resources are going to be reconsidered, reranked and revalued.

It was a difficult week for all, and it is my sincere wish that everyone stays safe and rides out the current storm in the company of healthy family and friends.

Article written on March 20.

Follow Michael Ballanger on Twitter @MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.