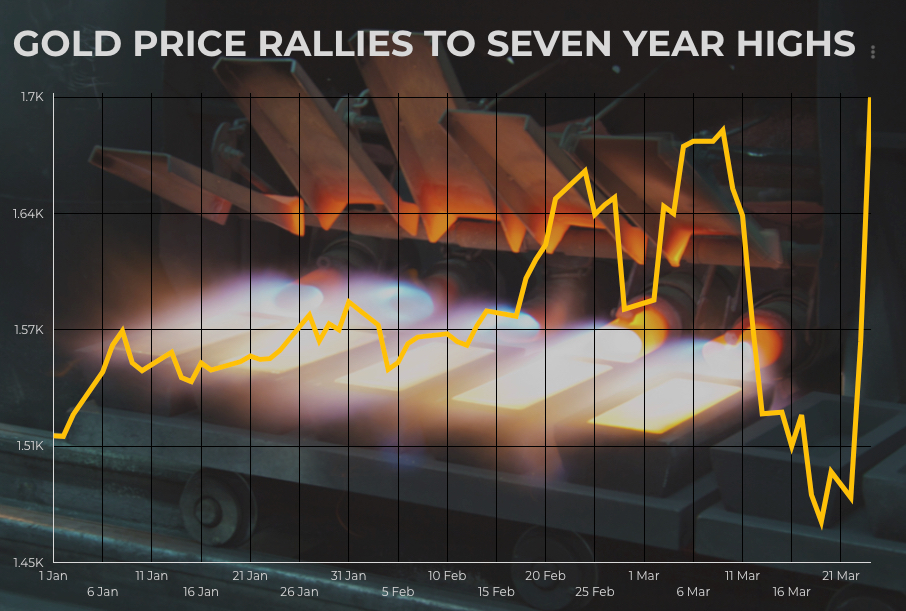

The gold price rallied again in spectacular fashion on Tuesday as panicked investors scramble for hard assets on the back covid-19 closures of mines and refineries and unprecedented monetary action by the US central bank.

On the Comex market in New York, gold for delivery in April, the most active contract, rocketed by as much as $131 an ounce or 8.4% compared to Monday’s close, to trade at $1,698 an ounce by midday before paring some of those gains in early afternoon trade.

Tuesday’s surge beat yesterday’s record-setting one-day gain by a handy margin and brings gold’s gains so far this week to $193 an ounce.

Goldman Sachs said on Tuesday inflationary concerns triggered by the central bank policy response to the coronavirus outbreak should underpin gold prices this year as the “currency of last resort.”

“Combined with the fiscal nature of the current policy response to COVID-19, we believe physical inflationary concerns with the dollar starting near an all-time high will for once dominate financial asset inflation that was a feature of the past decade.”

Gold has been on a wild ride over the past weeks, dropping as low as $1,450 an ounce a week ago after briefly hitting a seven-year high above $1,700 a week earlier.