Like most asset classes, gold is being affected by the unprecedented economic and financial market conditions in play around the world.

The recent volatility seen in gold prices has been driven by massive liquidations across all assets, and likely magnified by leveraged positions and rule-based trading, the World Gold Council (WGC) said on Thursday in their latest market report.

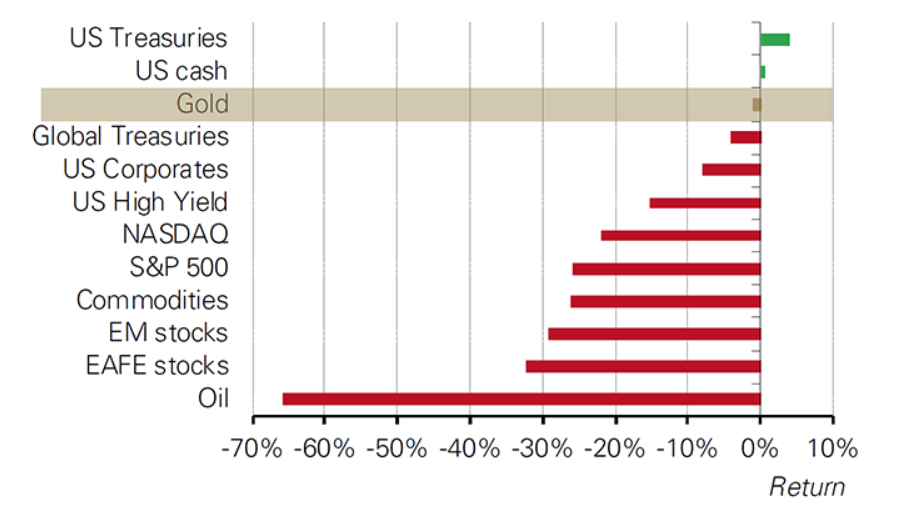

The Council points out that the precious metal has likely been used to raise cash to cover losses in other asset classes because it remains one of the best performing asset classes year-to-date, despite recent fluctuations (see graph below). It is also a high-quality and highly liquid asset, WGC says, trading over $260 billion per day in March.

The Council adds that so far, selling appears more concentrated on derivatives in exchanges and over-the-counter (OTC). While gold-backed ETFs have experienced outflows in recent days, flows remain positive for the year. Funds across all regions have seen $3.6 billion of net inflows in March, according to WGC figures, giving a collective total of $11.5 billion year-to-date.

Looking ahead, WGC believes the deceleration in economic growth will “undoubtedly impact gold consumer demand” and gold’s volatility may remain high. However, it asserts that high risk levels combined with widespread negative real rates and quantitative easing will be supportive of gold investment demand as a safe haven asset.

Times of uncertainty

Explaining the recent drop in gold prices alongside stocks, the WGC points to the massive liquidation virtually all asset classes experienced in the past week, and gold was no exception. Even longer-term US treasuries fell, WGC says, despite a second unscheduled cut by the Federal Reserve on March 15, slashing the Fed funds rate to pre-2016 levels.

Gold experienced pullbacks during the 2008-2009 financial crisis as well, but it became one of the few assets to post positive returns in the end

Moreover, given its high quality and liquidity, gold may have been used to raise cash, especially since it was – until recently – one of the few assets with positive returns this year.

Despite the volatility of gold now, the WGC believes it remains an effective portfolio hedge as a source of liquidity and collateral, as well as a safe haven in the long term.

There is historical precedent for these types of pullbacks in gold, WGC adds. Gold experienced pullbacks at the onset of the 2008-2009 global financial crisis as well, but by the end of that year, it became one of the few assets to post positive returns.

The Council also reminds that while the gold price was usually quoted in dollars, its impact on portfolio performance was measured in the local currency of an investor.

To date, as stock indices around the world have fallen sharply, gold’s performance has been positive in various currencies, including the pound sterling, euro, and Indian rupee, and it has only been flat to slightly negative in renminbi, dollar and Japanese yen.

Investors seem to agree that despite the price pullback and selling in most gold-backed ETFs listed in the US and Europe this week, global inflows remain positive.

What’s next

In an overview of what’s to come, the Council re-emphasizes that gold’s performance was intertwined with its unique nature as a consumer good and investment asset, while being linked to key drivers – economic expansion, risk and uncertainty, opportunity cost and momentum.

So far this year, more than 30 central banks have cut rates and many have implemented additional quantitative easing measures.

Additionally, governments around the world are pledging trillions of dollars in support of their citizens and economies, but ballooning budget deficits, negative real rates and debasement of currencies will present structural challenges to asset managers, pension funds and personal savings.

The WGC warns that it may “take a while” for financial markets to stabilize. Amid the current high volatility, gold price may experience additional swings, but the long-term implications of an environment combining high risk and lower opportunity cost should support investment demand for gold.

“We also expect central banks to remain net gold buyers overall, albeit likely not at the same rate as in the past two years,” WGC stated.

“On the other hand, consumer demand may soften significantly,” it continued, adding that early figures by the National Bureau of Statistics in China suggested a 40% contraction in purchases of gold, silver and gem jewellery during the first two months of the year, and the new travel and movement restrictions being implemented across the world “would undoubtedly affect other regions.”

Historically, however, investment flows in periods of uncertainty tended to offset weakness in consumer markets, the Council contends.