Global copper mine production will see steady growth over the next few years, as a number of new projects and expansions come online, supported by rising copper prices and demand, Fitch Solutions forecasts in a new report.

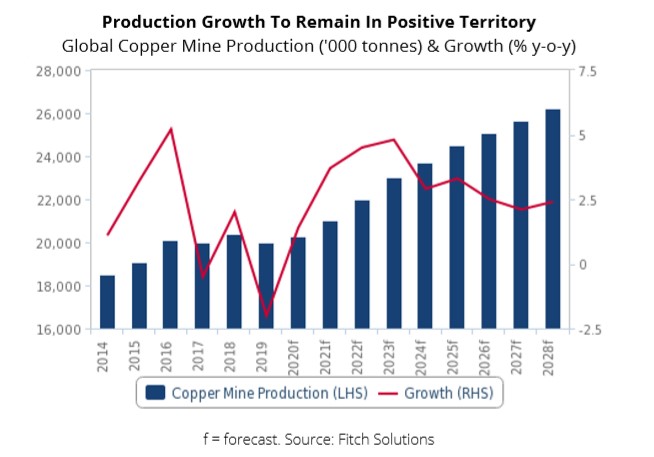

Fitch analysts predict global copper mine production to increase by an average annual rate of 3.1% over 2020-2029, with total output rising from 20.3mnt to 26.8mnt over the same period.

In 2020, Fitch forecasts Chile to increase production modestly by 0.5% to 5.89mnt. Growth will be led by the ramp-up of BHP’s Spence Growth Option over H220, increasing production at Lundin Mining’s Candelaria mine and a rebound in production from mines hampered by heavy rains in the beginning of 2019. Fitch says these developments will outweigh the decline in production from Antofagasta’s Centinela operation due to a decline in ore-grades and a loss of production from Teck Resources’ Quebrada Blanca.

Downside

risks to production will stem from declining ore-grades across the country,

unfavourable climate, protests that hamper supply chain operations and union

strikes, analysts predict.

Fitch forecasts Chinese copper mine production to increase at an average clip of 1.8% per year over 2019-2028, compared with an average growth rate of 6.9% over the past 10-year period. This slowdown in production growth will be driven by closures of low-grade copper mines in China and delayed planned capacity expansions.

Growth in domestic production will still be positive as new projects come online. A weaker Chinese yuan against the US dollar will help reduce costs for domestic Chinese mines, say Fitch analysts. China being the world’s largest consumer of refined copper and third-largest producer of mined copper will look to develop foreign assets to improve its resource security.

Chinese copper miners will remain committed to investing in copper deposits abroad to secure access to high-grade, low-cost material. For instance, in October 2019 Zijin Mining, announced that it would spend USD146mn to increase its interest in Ivanhoe Mining. The purchase will make Zijin the second largest shareholder in the company developing

the Kamoa-Kakula copper mine in the Democratic Republic of Congo (DRC), Fitch asserts.

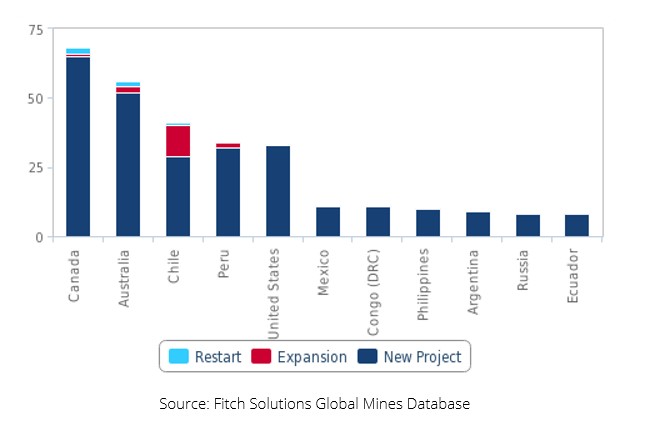

Australia and Canada to dominate new projects

Canada has the largest new copper project by capex, as Seabridge Gold announced in March 2019 an updated indicated resources of 423mnt at Iron Cap deposit at the KSM project in Britsh Columbia. Proven reserves: 460mnt; expected production: 129.8kt/yr; mine life: 51 years; The project includes Kerr, Sulphurets, Mitchell and Iron Cap deposits.

Fitch analysts are revising down slightly their forecast for Peru’s copper production growth from 1.0% y-o-y in 2020 to 0.0% growth. The revision came on the back of lower production guidance for MMG’s Las Bambas operation, with copper production expected to range between 350-370kt over 2020 from the 382kt produced in 2019.

Adding to the headwinds is an expectation for lower copper output at the jointly owned Antamina mine. However, Minsur SA is expecting copper production at Mina Justa to begin in Q420, which will help to prevent a contraction in Peru’s mine copper output.

Over 2020, Fitch maintains its modest growth forecast of 2% on US copper production as the Pumpkin Hollow mine ramps up. Despite pressure on profit margins as spot copper prices remain lower than expected, US miners are positioning themselves for long-term recovery in global copper demand.

US copper miners are better positioned financially than operators in other markets, having worked to cut operating costs and increase profitability over recent years. In the longer term, Fitch believes copper outlook in the country will recover, driven by a rise in copper prices and continued foreign investment which will be lured by the country’s high-grade reserves.

Read the full report here.