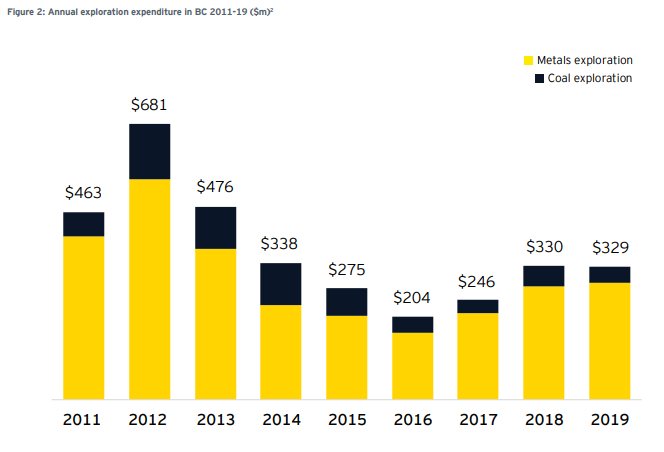

The positive momentum gained in British Columbia from mineral and coal exploration expenditure between 2016 and 2018 flattened out in 2019, according to the British Columbia Mineral and Coal Exploration Survey.

The report is a joint initiative between the Government of British Columbia EY and the Association for Mineral Exploration (AME), and includes insight collected from 326 exploration projects across the Canadian province.

The 2019 survey shows companies’ exploration expenditure remained relatively unchanged from a 2018 peak of C$330 million, with a slight decline in expenditure to C$329 million.

“Global demand for base metals has seen a significant increase, likely driven by an uptick in demand for electric vehicles and green energy, pushing investor focus from gold to copper,” said Iain Thompson, EY Canada Mining & Metals Advisory Leader.

“Meanwhile, coal saw a decline in investment despite optimism in the previous year surrounding future growth.”

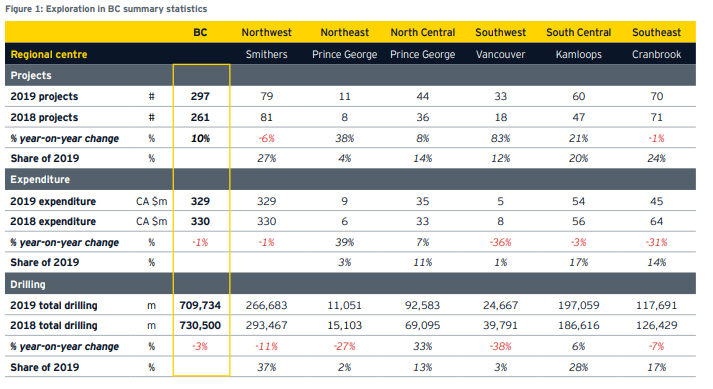

The Golden Triangle in northwestern BC continues to attract exploration activity, as investors capitalize on high-grade discoveries supported by investment from major firms, partnerships with Indigenous groups and continued infrastructure development.

Overall, gross revenues are estimated to approach C$9 billion per annum for the province, and of the 200 companies that reported on the distribution of spending, 138 spent 50% or more in local communities, EY says.

Grassroots and early-stage exploration accounted for 40% of total exploration in 2019, down from 44% in 2018

The Northwest region accounted for 55% of total expenditure for the province, seeing a 10% increase in spending.

Grassroots and early-stage exploration accounted for 40% of total exploration in 2019, down from 44% in 2018, as exploration spending moved to advanced and mine evaluation stages.

“We’ve seen a further shift in spending along the exploration lifecycle with increases in late-stage exploration, bringing forward the possibility of new mines in the province in the near future,” said Thompson.

The 2018 “gold rush” saw a shift to copper

The decline in gold exploration investment continued in 2019, with its share down by 11% as investors increased their focus on base metals and other commodities.

Decreases in gold were offset by increases in copper, whereas declines in coal were balanced by increases in nickel.

Copper was the leading base metal, contributing 72% of total metal spend, up 31% to $103 million.