Ivanhoe Mines (TSX:IVN) said that progress at its Kakula project, the first of multiple planned mining areas at Kamoa-Kakula, in the Democratic Republic of the Congo (DRC), continues to move forward, with production slated for the third quarter of 2021.

Delivering full year results and activities updates, the Canadian miner said once the ongoing definitive feasibility study (DFS) for its Kakula copper mine is finished, the company would have “an increased level of accuracy” for the design, production schedule and expenditure for the initial phase of mine development.

Cost of Ivanhoe’s giant Kamoa-Kakula project in Congo now pegged at $1.3 billion.

Following the completion of basic engineering and

procurement, as part of the imminent Kakula DFS, the mine’s initial processing

plant capacity has increased from 3 million tonnes a year to 3.8 million tonnes

a year.

The expansion in initial plant capacity will require boosting underground mining crews from 11 to 14 members this year to ensure enouigh output to feed the expanded plant. More workers will also be needed to create pre-production stockpiles of about 1.5 million tonnes of high-grade ore and an additional 700,000 tonnes of material grading of between 1% and 3% copper, Ivanhoe said.

The Kamoa-Kakula team completed in November basic design and costing for Kakula’s initial mine and infrastructure, the first concentrator module and associated infrastructure.

The report pushed initial capital costs up to about $1.3 billion — an 18% increase over planned costs.

Billionaire Robert Friedland, who made his fortune from the

Voisey’s Bay nickel project in Canada in the 1990s, has been working on

Kamoa-Kakula for ten years.

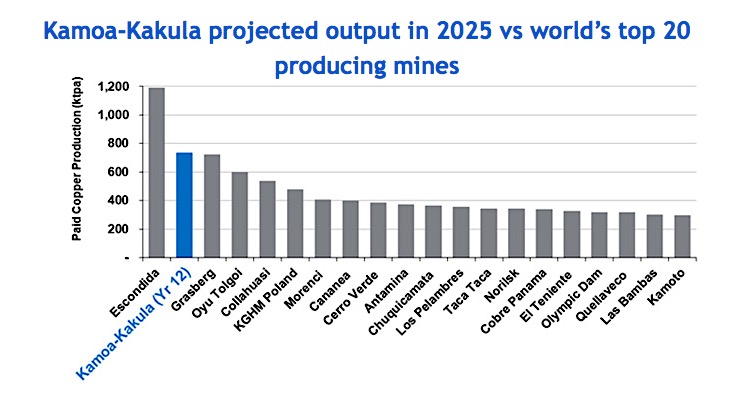

The mining legend believes the project, being developed in partnership with China’s Zijin Mining Group, will become the world’s second-largest copper mine.

According to an independent pre-feasibility study (PFS) released last year, if all phases are completed the operation is expected to reach peak annual production of more than 700,000 tonnes of copper.

The updated resource estimate for the massive project, delivered last month, shows it holds 1.4 billion indicated tonnes grading 2.74% copper for 83.7 billion pounds of copper and another 339 million inferred tonnes grading 1.68% copper for 12.5 billion pounds of copper at a 1% cut-off grade.

Palladium’s fading stockpiles a boon for Platreef

Ivanhoe Mines also highlighted that is stepping up efforts

to take advantage of soaring prices of platinum-group metals, particularly palladium

and rhodium. The two metals, broadly available at its 64%-owned

Platreef project in South Africa, have been benefitted by a global shortage triggered by their increasing use in catalytic converters that reduce harmful engine emissions. This has propelled the asset’s “metals-price basket” to a new, all-time high, Ivanhoe said.

The Vancouver-based company is now is fast-tracking a feasibility

study on a smaller-scale, early-stage development plan using Shaft 1 as a production

shaft at Platreef.