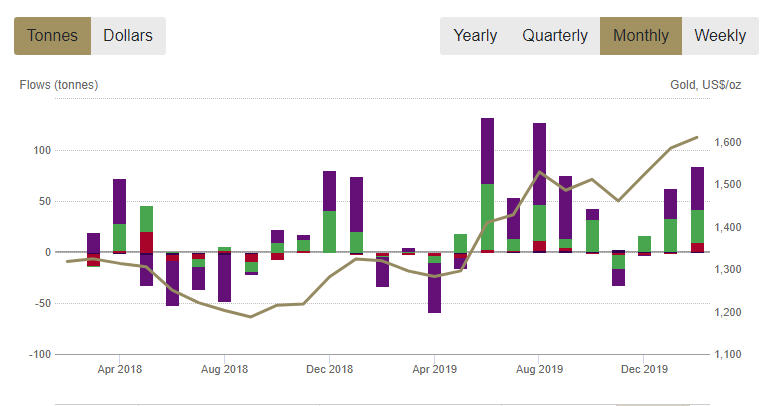

Global gold-backed exchange-traded funds (ETFs) had $4.9 billion or 84.5 tonnes of net inflows in February, boosting holdings to new all-time highs of 3,033 tonnes, the World Gold Council (WGC) reported Thursday.

Combined with a gold price increase of nearly 2%, assets under management (AUM) grew by 4.4% in dollar terms during the month, breaching the previous September 2012 record high, according to the WGC.

At that time, the gold price was 10% higher than current levels, highlighting two trends: The global growth in gold ETFs outside of the US; and that US investors have not yet increased their gold allocations as much as they did in 2012.

Market uncertainty surrounding the impact of the coronavirus outbreak on the global economy drove strong inflows to all regions.

North American funds led the way with inflows of 42 tonnes ($2.3 biliion, 2.9% AUM), while European funds added 33 tonnes ($2 bilion, 2.8% AUM). Asian funds, primarily in China, also finished the month with strong inflows, adding 8.7 tonnes.

Looking ahead, WGC analysts said that multiple drivers continue to support the demand for gold moving forward.

“We expect market risk and slowing economic growth interaction to impact gold prices, particularly as the financial effects of the coronavirus are realised. Additionally, lower interest rates, increased gold price volatility and central bank intervention could continue,” a WGC analyst said.