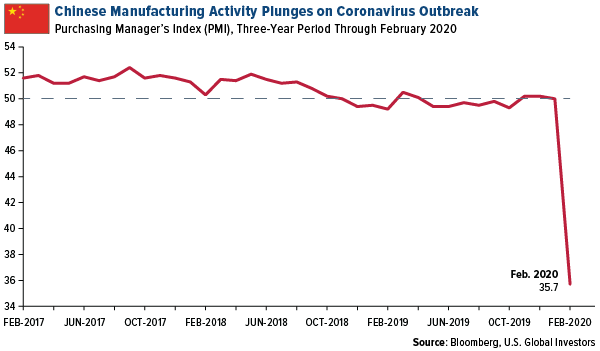

Chinese manufacturing activity slumped to a record low in February as the coronavirus outbreak temporarily shuttered plants and factories and travel restrictions impacted the supply of labor. The official government purchasing manager’s index (PMI) fell to 35.7, down from a neutral 50.0, while the private Caixin PMI posted a 40.3, also an all-time low in the manufacturing gauge’s 16-year history.

What this seems to suggest is that the epidemic has had an even bigger impact on China’s economy than any other crisis of the past decade and a half, including the global financial crisis. The services PMI fared even worse, falling to 29.6 in February from 54.1 the previous month.

U.S. factories were more resilient, with the Institute of Supply Management (ISM) PMI slipping to 50.1 in February from 50.9 a month earlier. But remember, the U.S. didn’t confirm its first case of the virus until the end of January, or about a month after China first reported it. As I write this, there are more than 160 cases of COVID-19 in the U.S., businesses are advising against corporate travel and supply chains are being disrupted. Therefore, it’s highly probable that the U.S. PMI will fall back into contraction in March, with potentially massive implications on energy and commodity demand.

Largest Commodity Demand Shock Since 2008?

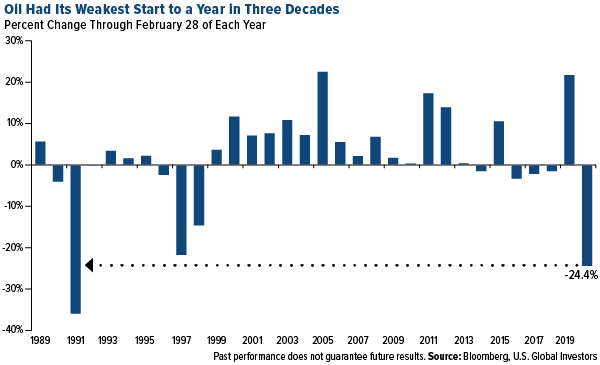

The fallout from the coronavirus has already taken a big toll on energy. Oil lost as much as a quarter of its price in the first two months of 2020, making this the worst start to a year since the first Gulf War in 1991.

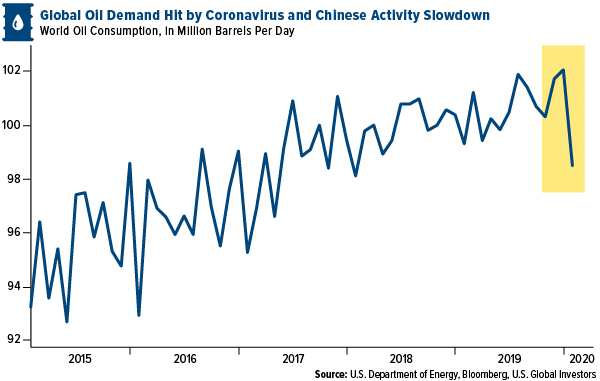

China is the world’s number one importer of crude, and according to Goldman Sachs’ head of commodities research Jeff Currie, its demand for oil has fallen some 4 million barrels a day as a result of COVID-19. This is the biggest such deficit since the global financial crisis, when demand fell 5 million barrels a day.

On a global scale, the hit to consumption could be even more historic. Economists at IHS Markit now estimate that global oil demand in the first quarter of this year will drop by the largest amount in history. Because of the rapid spread of the virus, demand is projected to be 3.8 million barrels a day lower than it was a year ago. That’s 200,000 more barrels a day that were lost in the first quarter of 2009, during the financial crisis.

The Bigger the Economy, the Bigger the Effect

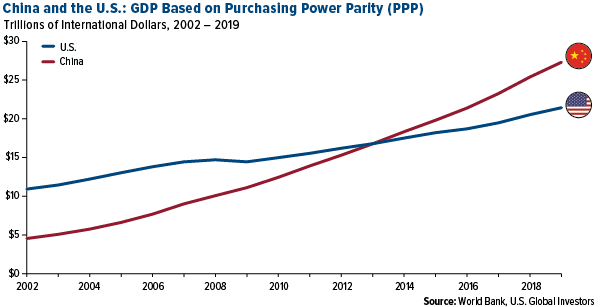

A huge factor in understanding why the coronavirus has been so impactful is China’s size today relative to its size during the financial crisis. It only makes sense—the bigger the economy, the bigger the effect.

The comparison becomes even more extreme when we go all the way back to the severe acute respiratory syndrome (SARS) outbreak in 2002-2003.

Today, China is five times larger than it was 18 years ago, having already surpassed the U.S. based on purchasing power parity (PPP). It represents close to 20 percent of the world economy versus only 4 percent in 2003. And its population has grown by some 120 million people, which is a little like adding one entire Japan.

Throw in the Chinese government’s significant travel restrictions—not to mention the impact of the U.S.-China trade war—and it should come as no surprise that the country’s manufacturing and non-manufacturing PMIs fell as much as they did.

But Manufacturer Optimism at Five-Year High

This isn’t the end of the world, though. Chinese businesses remain optimistic. According to the monthly Caixin survey, “manufacturers were confident that output would rise over the next year, with the degree of optimism reaching a five-year high” (emphasis mine). What’s more, companies “expect production to rebound once restrictions related to the virus are lifted.”

Nor does this mean that investors should flee the region. There are still attractive opportunities. In February, health care—perhaps as you might expect—was the best performing sector in the Hang Sang Composite Index (HSCI), rising 6.1 percent. Among the biggest contributors during the month were financials and real estate firms such as China Construction Bank, up 58.5 percent, Sunac China Holdings (21.2 percent) and China Resources Land (17.3 percent).

On a final note, the Chinese government’s efforts to contain the virus and prevent its spread have been incredibly effective, with the number of new cases nearly brought to a halt. In a report dated February 28, a Joint Mission consisting of 25 health experts from eight different countries and the World Health Organization (WHO) commended the response:

China’s bold approach to contain the rapid spread of this new respiratory pathogen has changed the course of a rapidly escalation and deadly epidemic… This decline in COVID-19 cases across China is real.

And now it looks as if people in China are returning to work. Satellite imagery shows that pollution over the country, which had decreased because of factory closures, is finally starting to return. Although pollution is not in itself a good thing, it’s a welcome sign that the worst of the epidemic may be behind us.

For more timely insight on global markets, be sure to subscribe to our award-winning Investor Alert by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Hang Seng Composite Index is a market-cap weighted index that covers about 95% of the total market capitalization of companies listed on the Main Board of the Hong Kong Stock Exchange.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

Purchasing power parity (PPP) is a term that measures prices in different areas using a specific good/goods to contrast the absolute purchasing power between different currencies.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/2019: Sunac China Holdings Ltd.