The value of metals used in batteries for the nascent electric vehicle industry measured for the first time

It is worth remembering that the first all-electric vehicle to use a lithium-ion battery – the Tesla roadster – only rolled off assembly lines in 2008.

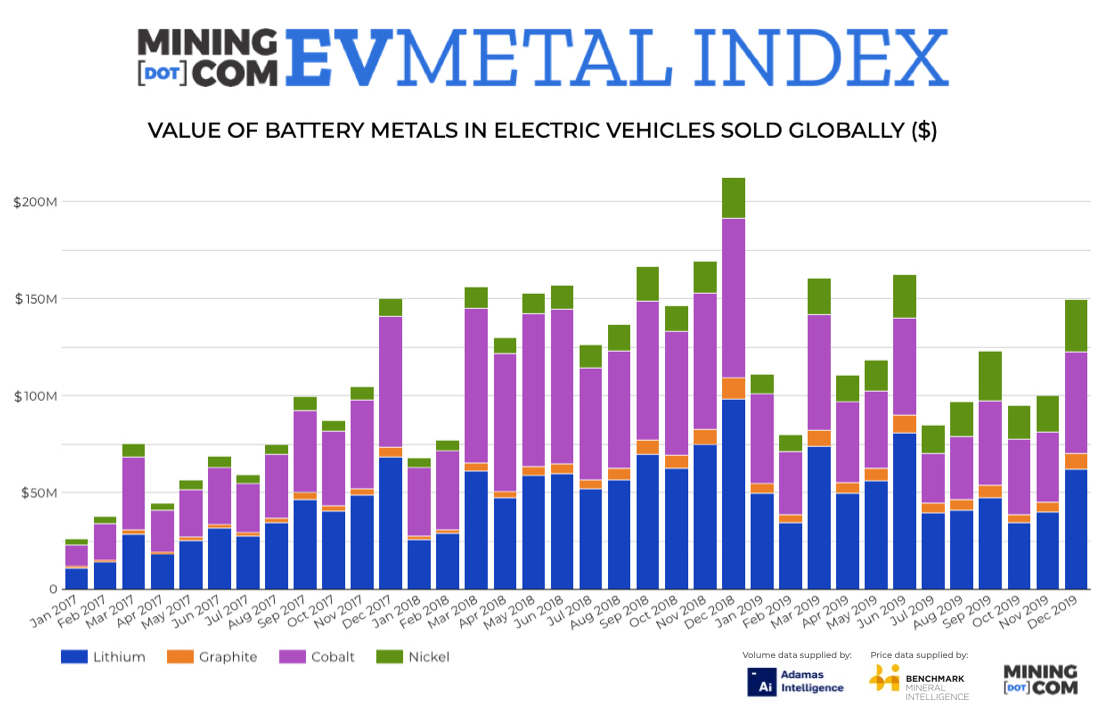

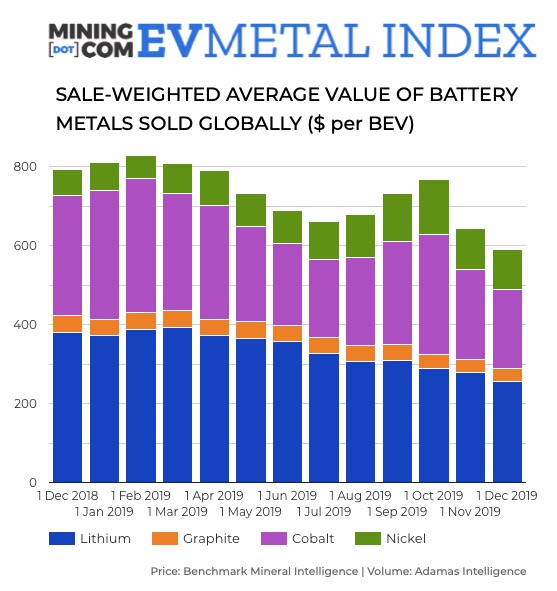

The inaugural MINING.COM EV Metals Index shows an industry in better shape than what tanking prices and dismal headlines would suggest

And the blue-sky scenarios and exuberant forecasts for electric vehicle demand and mining only really started to make headlines three or four years ago.

And those headlines came just at the right time for an industry at the bottom of a brutal business cycle and in desperate need of a feelgood news story.

Not that the feeling lasted all that long.

All of mining is mercifully free of the ravages of price stability, but even tulips bulbs took longer from boom to bust than EV metals.

But how does falling prices for lithium, cobalt, graphite and nickel square with demand forecasts that all start in the bottom left corner and end in the top right?

Pedal to the metal

To get a better grip on the nascent sector MINING.COM combined two sets of data:

- First, prices paid for the mined minerals at the point of entry into the global battery supply chain.

London-based Benchmark Mineral Intelligence, a global battery supply chain, megafactory tracker and market forecaster, provides MINING.COM with monthly sales-weighted price data.

- Second, the sales weighted volume of the raw materials in electric and hybrid passenger car batteries sold around the world.

Toronto-based Adamas Intelligence, which tracks demand for EV batteries by chemistry, cell supplier and capacity in over 90 countries provides the data for the raw materials deployed.

Benchmark has been tracking megafactory construction since Tesla broke ground on the first of its kind in June 2014. Adamas completes the chain, recording all that battery power hitting the road.

That makes the MINING.COM EV Metals index more than a mine to market measure. More like mine to, er, garage.

The inaugural MINING.COM EV Metals Index shows an industry in better shape than what tanking prices and dismal headlines would suggest.

In fact, the nickel sub-index is at a record high and cobalt bulls would be happy to know that the metal feeding the battery supply chain had its biggest month in nine.

Where the rubber, only the rubber, meets the road

If you take Tesla’s stock price as a guide (and I know a bunch of short sellers who would rather pluck their own eyes out than do that) the essential ingredients of muskmobiles should not be languishing at multi-year lows.

Last year, Elon Musk said getting more Teslas on the road is dependent on scaling battery production and to scale at the fastest rate possible it may be necessary to get into mining, “at least a little bit.”

The last auto exec to venture into mining was Henry Ford

The last auto exec to venture into mining was Henry Ford. When the equivalent of an over the air update was a hand crank and cars could only be had in black and not four (wow!) other colours like the Model S.

But crucially then, the cost of raw materials had a much bigger bearing on the final price of a car. In EV production the battery can be up to 50% of the cost of production and raw materials the bulk of that.

A seminal study on EVs by UBS showed the only commodity your average EV (Chevy Bolt) and ICE car (VW Golf) have in equal amounts, is rubber. (Ford, btw, also owned a rubber plantation in Brazil.)

That’s how much of a change the switch to electric vehicles represents in the auto industry’s raw material supply chain.

Rocks down to electric avenue

Yet here we are.

Newbie investors are taking a crash course in surviving a sector that can turn on a dime.

Juniors are being scared off. Bodies are piling up among developers. Producers’ grand ambitions have been thwarted. Contracts have been reneged on.

It’s difficult to see the disconnect on fundamentals lasting that much longer – governments’ green demands and emissions strictures are only intensifying and carmakers’ programs are only becoming more lavish.

Volkswagen promises 80 all electric models across its brands by 2025. Three hundred by the end of the decade.

While miners are encountering the pitfalls of vertical integration, the global auto industry is getting a crash course in mining lead times

A year ago already, Wolfsburg said it’s allocating $48 billion for EV development.

And then you also read that Audi (a VW brand) and Mercedes Benz had to suspend production due to a battery shortage (long before coronavirus).

While miners are encountering the pitfalls of vertical integration, the global auto industry is getting a crash course in mining lead times and how tiny markets (annual global cobalt mining revenues is less than what VW collects in a week) can impact giant industries.

In total the world’s automakers have committed $300 billion for making rides you have to plug into a wall Benchmark estimates. Or to use the car industry term, $300 billion for ushering in a new epoch of sustainable mobility.

Neither is there a shortage of government support for the transition. Unlike AOC’s, the EU’s $1 trillion green new deal may actually get off the starting grid, and Beijing has ordered 25% of cars sold must be EVs within five short years.

Lithium nirvana

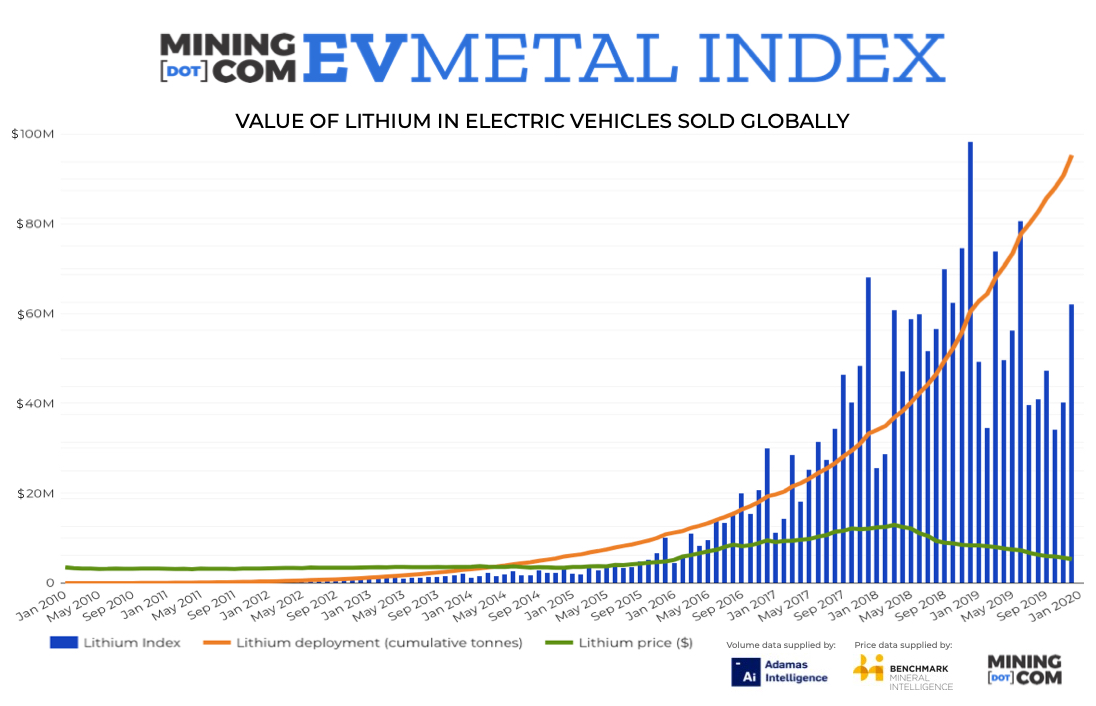

MINING.COM compiled the data for lithium prices from Benchmark and lithium deployment from Adamas going back eleven years.

It just shows again that the EV raw materials industry is in its infancy.

For calendar year 2009, the electric and hybrid cars sold around the world contained a paltry 31 tonnes of lithium in their batteries worth a combined $182K (that’s a K not an m).

Ten years later, the industry had grown 3,330-fold for a value of $609m. Ok, that’s just having fun with the base effect, but measured just over the last five years the value of lithium in EVs are up more than 1,000%.

And that’s despite a contraction in 2019. Lithium price tripled between April 2015 and peaked three years later, only to tumble by 60% in value since then.

Graphite was the first to peak in early 2012, but has since halved.

As the graphs show, the bigger picture is one of an industry that is still expanding.

The value of graphite deployed in EVs is up 370% in three years. And as a percentage of the index, graphite has in fact steadily increased its share.

Cobalts from the blue

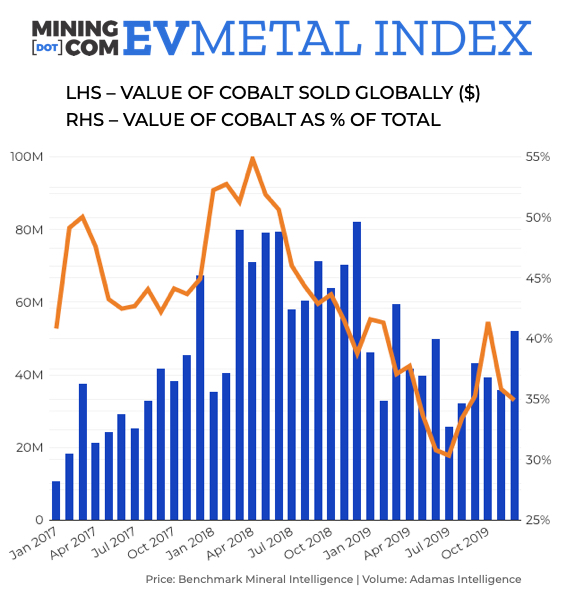

Given its tricky fundamentals, cobalt is always going to be a conundrum for investors and a headache for carmakers.

It’s the priciest component and the most volatile. At its peak, Co made up as much as 55% of the cost of raw materials for batteries. Despite a plummeting price and ongoing thrifting, it still makes up a third of the input cost.

Given that almost two-thirds primary supply is from the Congo and more than 80% of processing capacity is located in China, cobalt’s spike to just shy of $110,000 a tonne in April 2018 was understandable.

That 15 months later it was below $26,000, less so.

At the stroke of a pen, Beijing can change market dynamics completely. Its subsidy cuts last year crumpled a market growing at more than 60% the year before.

In February, Tesla – which in good months sells more battery capacity than its three nearest rivals combined – surprised cobalt and nickel bulls by opting for batteries at its Shanghai plant that forego both.

At the time of writing, the impact of the four Cs – cobalt-Congo-China-coronavirus – is far from clear. But as the graph shows, cobalt bulls had something to celebrate in the second half of last year.

Better than the devil’s copper you know

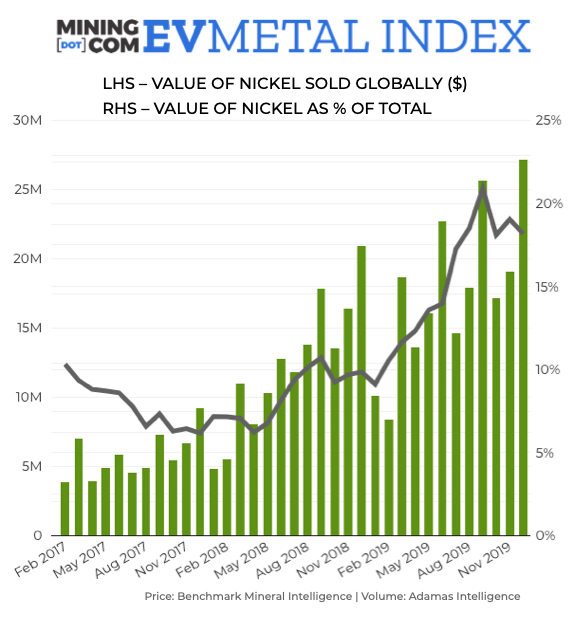

Batteries account for only 6% of global nickel demand today, meaning investors buying into the sulphates story also take a hit when Jakarta convulses the nickel pig iron trade.

MINING.COM’s inaugural index shows nickel setting a new monthly record at the end of last year, despite the sharp retreat in prices since September.

The increasing use of nickel rich cathodes also means its contribution to the value mix has almost doubled in a year to more than 18%.

As nickel-rich chemistries increasingly dominate the EV market, the average sales weighted value of nickel on a per vehicle basis is rising sharply – to over $100 in December from $67 a year earlier or from less than a quarter of the cost of the cathode’s cobalt to half that.

The combined value of lithium, graphite, cobalt and nickel based on sales weighted average deployed per vehicle was under $600.

When prices were peaking early 2018 those raw materials cost more than $1,500 per vehicle. Not the battery, just the raw materials.

In the longer run, nickel for batteries could be as big a market as for stainless steel, which would be equivalent to gold’s use in electronics, becoming a $100 billion industry, from an afterthought today.

Kalahari thirst

Adamas data shows that NCM and NCA cathodes had a 94% market share in December, based on total battery capacity deployed globally.

MINING.COM is not tracking manganese as EV dynamics have almost no bearing on its price.

High-purity manganese sulphate sells at a premium, but as a component of NCM batteries, no auto exec is losing sleep over manganese costs or supply. Likewise aluminum, despite significantly higher aluminum use in EVs.

That said, in an all-EV world battery-grade manganese demand could make the Kalahari desert, home to the oldest population of humans on earth and 70% of global reserves, a point of contention not unlike cobalt and the Congo (minus the child labour and ongoing violent conflict).

We lose money on every sale, but make it up on volume

Call them giga or mega, your average battery manufacturing plant is huge.

There are more than 100 megafactories in the pipeline around the world – 14 of them in Europe.

MINING.COM’s prediction is that 2019 wasn’t only the first annual fall in the index, but also the last

Last year battery power deployed rose 30% globally. In Europe gigawatt hours hitting the road grew 89%.

To feed those factories to power those cars requires the extraction of lithium, graphite, cobalt and nickel extraction to increase by magnitudes.

The MINING.COM EV Metals Index shows that the gap between future supply and future demand has become a chasm.

MINING.COM’s prediction is that 2019 wasn’t only the first annual fall in the index, but also the last.