Rio Tinto (ASX, LON, NYSE: RIO) will spend $1 billion over the next five years to reduce its carbon footprint and have net zero greenhouse gas emissions by 2050, but some analysts say the announcement is a minor step towards helping the mining industry achieve climate goals.

Delivering full-year results for 2019, in which the company recorded its highest profit in eight years, chief executive officer Jean-Sébastien Jacques said the world has got to a point where is necessary to sacrifice growth to meet climate targets.

“The challenge for the world, and

for the resources industry, is to continue the focus on poverty reduction and

wealth creation, while delivering climate action,” Jacques said. “This will

require complex trade-offs.”

Rio’s boss, at the helm since 2016,

said that lower consumption, growth and returns are some of the

sacrifices consumers, governments and shareholders must all be willing to make.

This is especially true for the natural resources industry, which has come

under increasing pressure to curb emissions.

“There are no easy answers,” Jacques told investors. “There is no clear pathway right now for the world to get to net zero emissions by 2050. The ambition is clear but the pathway is not.”

For Julian Kettle, Wood Mackenzie vice

chairman of metals and mining, Rio’s plans to decarbonize its

globe-spanning operations are a “small but significant” step in the

right direction.

“Setting Rio Tinto’s $1bn in

context, this represents just 16% of the dividend it distributed in 2019 or

just under 5% of its reported EBITDA of $21.2bn for the same year,” Kettle said.

“Put another way, on a 100% basis, Rio Tinto reported iron ore production of 327Mt in 2019. A $1bn dollar green investment, while laudable, could be funded by a 30c/tonne rise in the iron ore price. The industry needs to do much more,” he noted.

The no emissions goal would be easier

to achieve for Rio Tinto than other global miners, such as rival BHP (ASX, LON,

NYSE: BHP) because the world’s second largest mining company does not mine coal

or oil.

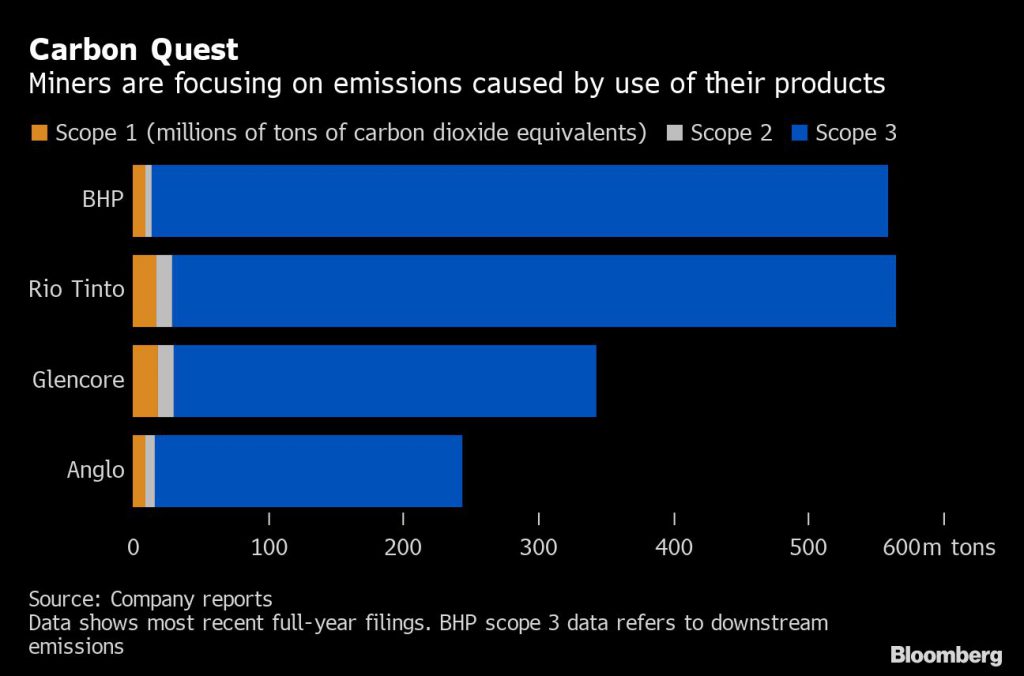

Unlike BHP, however, Rio has not set a target to reduce so-called “Scope 3” emissions — those produced when customers burn or process a company’s raw materials.

The company argues any targets on

its Scope 3 emissions would be impossible to meet because it has no control

over how steelmakers use the iron ore it mines.

Last year, Rio inked a preliminary deal with China’s largest steel producer, Baowu Steel Group, to develop new ways to cut carbon emissions along the steelmaking supply chain.

Coronavirus cloud

The group’s results, the best underlying

earnings since 2011, were partially clouded by warnings of the effect the

coronavirus epidemic may have in the business as more supply chains disruptions

and potential delays to projects in Australia are expected.

Rio said its products were

continuing to reach customers, but it was seeking ways to adjust to the impact

of Covid-19 virus will have over global demand for commodities in the months to

come.

The next six months could bring

some challenges,” Jacques said. “Today our iron ore books are full, but we are

likely to see some short-term impacts.”

China, where the virus originated,

is one of Rio Tinto’s main customers. The company is anticipating an impact in

its iron ore shipments to the regions during the first quarter.