Seven straight sessions of gains lifted the gold price to a fresh 7-year high on Friday after renewed fears about the coronavirus sent investors scurrying for safe haven assets, equity markets fell and long-term US interest rates fell to a record low.

The gold price touched a new intra-day high of $1,652.10 on the Comex market in New York, up 2% or $32 an ounce from yesterday’s settlement and the highest level since mid-February 2013.

By midday trade already hit the highest volume for the year with more than 43 million ounces exchanging hands. Bullion is up more than $120 since the start of 2020.

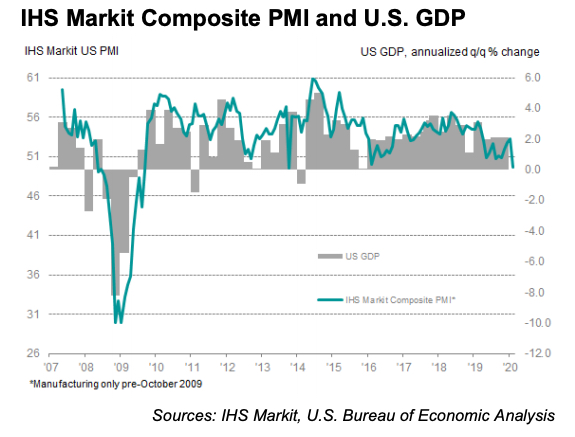

The yield on the US 30-year bond fell below 1.9% on Friday, a record low, after business activity in the US shrank for the first time in nearly seven years due to the pandemic’s disruption of global supply chains and travel.

The IHS Markit purchasing managers’ index measuring composite output at factories and service providers fell below 50 for the first time since October 2013. Readings below 50 indicate contraction and usually predicts broader economic slowdown.

Record highs in major currencies

“The persistent, cold-blooded and measured shift in gold higher, despite the U.S. dollar, is telling,” Nicky Shiels, a metals strategist at Bank of Nova Scotia, said in an emailed message to Bloomberg News. “The breakout is warranted and has legs.”

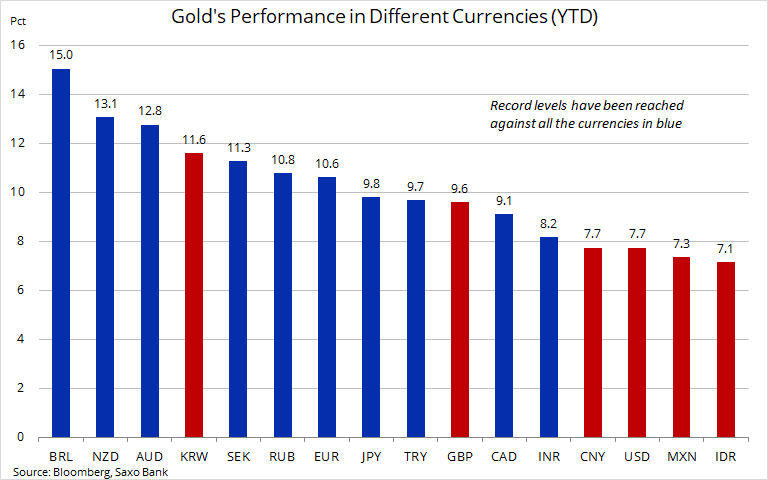

Gold hit record highs in 10 major currencies including the euro, Australian and Canadian dollars, the Indian rupee and Brazilian real.

Ole Hansen, head of commodity strategy at Saxo Bank, says in a research note that gold is in a perfect storm of price supporting developments and significantly is reaching new highs despite the strength in the US dollar.

The normal negative correlation has broken down and this has led to some significant gains against most major currencies, said Hansen adding that gold priced in dollars is the currency furthest away from hitting the $1,921 per ounce record from 2011.

It is difficult to see what at this stage can halt or pause the rally, Hansen said.

According to Bloomberg calculations holdings in physically-backed gold exchange-traded funds have climbed for 22 straight session, the longest unbroken run in the history of the industry.