Source: Peter Epstein for Streetwise Reports 02/19/2020

Peter Epstein of Epstein Research profiles a company with a project in the highly prospective Red Lake area as well as properties in Argentina’s Lithium Triangle.

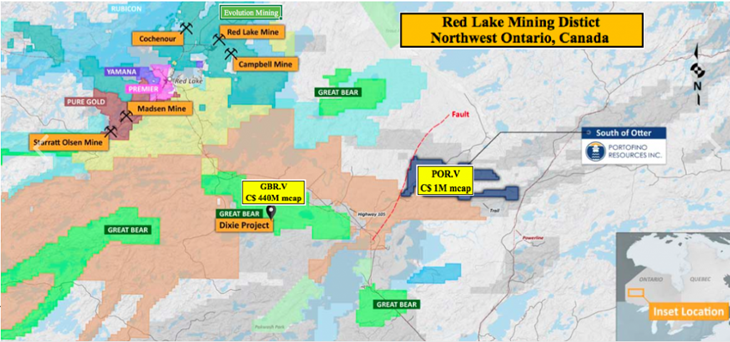

Last September Portofino Resources Inc. (POR:TSX.V; POT:FSE) announced a binding agreement for the right to acquire a 100% interest in mining claims in the famous Red Lake mining district of Ontario. Portofino joins both majors and juniors including Australia-listed Evolution Mining and Canada-listed Yamana, Great Bear Resources, Premier Gold Mines, Pure Gold, Rubicon Minerals, Pacton Gold, BTU Metals and GoldOn Resources.

Portofino’s block comprises 14 mining claims covering ~5,120 hectares. The claims are near investment crowd favorite Dixie project, being drilled out by Great Bear Resources (GBR). GBR’s latest results from a fully financed 200,000-meter drill program were impressive. One of several intervals was 48.7 grams per tonne (g/t) gold (Au) over 8.7 meters (m), including 1.2m @ 281.9 g/t Au.

Gold price had its best year (2019) in a decade….

So, ultra, high-grade Au mineralization, found at shallow depth (under 300m), across multiple drill programs in 2017–2019. GBR has a market cap of $440 million. Portofino’s 5,120- hectare “South of Otter” property is less than 10 km east of GBR’s 9,140-hectare flagship project.

If South of Otter hosts anything good, which remains to be seen, it might be high-grade Au, like Dixie, or high-grade copper (Cu) and zinc (Zn) mineralization, like that found on other nearby properties.

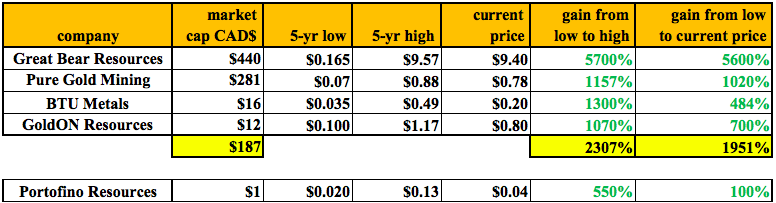

I’m shamelessly playing the close-olgy card here, but only because GBR is one of the best gold junior stories of the past decade, up ~5,600% from $0.165 in 4Q 2016 to $9.40 today. In fact, several juniors have done quite well. Pure Gold Mining is up ~1,020% since 4Q 2015. BTU Metals is up nearly 500% since 3Q 2018. One more, GoldON Resources, is up ~700% since 1Q 2019.

That’s four Red Lake juniors with spectacular share price success. Four out of roughly 16 (25%) publicly traded companies with all, or substantially all, of their gold and/or base metals assets in and around Red Lake, Ontario. Portofino, with a market cap of just $1 million is perhaps the smallest player in the entire district. Yet, its under-explored property is both sizable and meaningfully prospective.

South of Otter is located within a geological setting that hosts the past-producing South Bay Mine (1.6 Mt @ 11.1% Zn, 1.8% Cu and 2.1 oz./t silver (Ag). GBR’s Dixie project is also on this trend. In addition to being on trend, Portofino’s property lies in a similar geological and structural setting.

Two historical operators, Goldcorp (recently acquired by Newmont) and Tri Origins, compiled a vast amount of geophysical data that mapped structures within the South of Otter claims. Portofino has commenced geophysical and geochemical surveys to further understand the geology and mineralization associated with past discoveries, which lie just north of the property but strike onto Portofino’s claims.

Red Lake exploration program started last week

These surveys will provide Portofino with the data required to effectively target both gold and base metal mineralization and identify similar structures for exploration that are being explored along trend by companies including Great Bear Resources and BTU Metals. BTU recently reported an intercept of 44.3m of 1.14% Cu Eq, with intervals of up to 5.56% Cu, 99.6 g/t Ag plus 2 g/t Au.

Portofino’s CEO David Tafel stated,

“We have been able to acquire a very prospective land package in a known gold mining camp proximal to the Dixie project which has recently produced multiple high-grade gold discoveries by Great Bear Resources. This acquisition allows us to diversify our project portfolio while we continue to advance our lithium projects.”

The South of Otter property is ~40 km southeast of the town of Red Lake, Ontario, and less than 10 km east of GBR’s Dixie Lake. Historical work on the claims included prospecting, sampling and limited diamond drilling.

With the gold price up US$300/oz (+24%) from the low of 2019, management is wisely seizing an opportunity to conduct meaningful programs that may, in part, be guided by ongoing successes at neighboring projects. Active drill programs are underway on properties in virtually every direction from Portofino’s South of Otter property. In fact, one of the most aggressive drill campaigns in Canada (200,000 meters) is being done by Great Bear.

Portofino Resources’ South of Otter Property

To earn 100% interest in South of Otter, Portofino has agreed to issue 500k shares and make payments over a four-year period totaling $70,000. The property vendor will retain a 1.5% Net Smelter Return (NSR), of which one half, (0.75%), can be purchased for $400,000.

Management has completed a review of all available historical assessment work on the South of Otter property and has announced an initial exploration plan starting this week. According to the press release,

“The first phase of Portofino’s 2020 exploration program consists of ~25-line km of ground VLF/EM geophysics and soil geochemistry surveys. The objective is to delineate mineralized structures related to past gold and base metal discoveries in the region and outline targets for follow-up trenching and drilling. Multiple gold, copper and zinc deposits / prospects have been discovered both immediately to the north and south of the claim boundaries.”

Utilizing historical geological and airborne magnetic surveys has enabled the company to advance its exploration program rapidly and cost effectively. Combined with the new data to be collected from the upcoming program, the company expects to delineate mineralized structures related to past gold and base metal discoveries and outline targets for follow-up trenching and drilling.

Portofino’s property contains excellent targets for both Red Lake-style Au mineralization as well as gold-bearing base metal prospects. Historical work includes prospecting, sampling, plus limited drilling, as well as airborne magnetic geophysical surveys commissioned by a previous operator.

Portofino’s brine lithium prospects in Argentina are highly prospective

Readers may recall that Portofino Resources is also known as a lithium play. It has locked up (through favorable option structures) three projects in the heart of the Lithium Triangle.

In the first half of 2019, Portofino continued to move the ball forward on two of its three projects. Although it’s too early to know if the company has good lithium assets, one of its projects, Hombre Muerto West (HMW), is in the single best salar in Argentina—salar del Hombre Muerto.

Neighbors in and around Hombre Muerto include Livent Corp. (formerly FMC), Korean giant POSCO and Australia-listed Galaxy Resources. Last year, POSCO famously paid ~$364 million to Galaxy for 17,500 hectares, that’s ~$20,800/ha. That land package reportedly had a 2.54 million tonne LCE Indicated + Inferred resource.

Over the past few months, a number of lithium juniors and producers have seen significant rebounds in their share prices. Eight well-known names—Neo Lithium, Advantage Lithium, Lithium Americas, Ganfeng, Livent, Wealth Minerals, Standard Lithium and Bacanora—are up an average of 125% from 52-week lows.

Gold sentiment is high and lithium sentiment might be turning. Portofino now has two segments (lithium and gold), each of which could be worth considerably more than the company’s entire market cap of just $1 million.

It’s early days, but a raging bull market in precious metals (underway?) and/or a bounce in lithium prices could draw attention to Portofino Resources (TSX-V: POR) this year and next.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed below.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Newmont Goldcorp, a company mentioned in this article.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Portofino Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares of Portofino Resources and Portofino was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

( Companies Mentioned: POR:TSX.V; POT:FSE,

)