IMO2020 was potentially a big trade in 2019, and is still potentially a big trade in 2020—though I confess I struggle to find any BIG WIN potential.

IMO 2020 stands for the International Marine Organization, a UN body. They have mandated that ships switch to much cleaner and more expensive fuel, starting January 1 2020.

Commercial shipping is incredibly pollutive—one stat I read stated that a cruise ship produces as much pollution a day as one million cars! So this truly is an issue worth pursuing if we want a greener planet.

US brokerage firm Raymond James hosted a big conference call on January 23 2020 to give investors an update on how IMO2020 was rolling out. They invited Pacific Green Technology CEO Scott Poulter (PGTK-NASD) to speak. PGTK makes a scrubber that ships can use to clean out the dirty ship fuel—which allows ships to continue to buy cheaper, dirtier fuel.

This initiative has mostly been pushed by Asia and Europe (the American gov’t meekly tried to fight it but to a small degree and ended up just followed along) and by all accounts, they are keen to see it enforced in their ports—where a ship not using cleaner fuel cannot come into port.

The Big Winner last year—if you timed it right—was LIQT-NASD; a Danish company called Liqtech. Our subscribers enjoyed a partial ride on their stock run in 2019.

The

company has great technology, but it became clear that the pace of orders from

the shipping industry would not be anywhere near as huge as the Market

guesstimated in early 2019, so I sold the stock and booked my profits. The

stock languished the rest of the year but has recently had a 50% bounce

in six weeks.

Pacific Green is focused emission control technologies. Using their

ENVI-Marine System product, the company installs scrubbers for the shipping

industry.

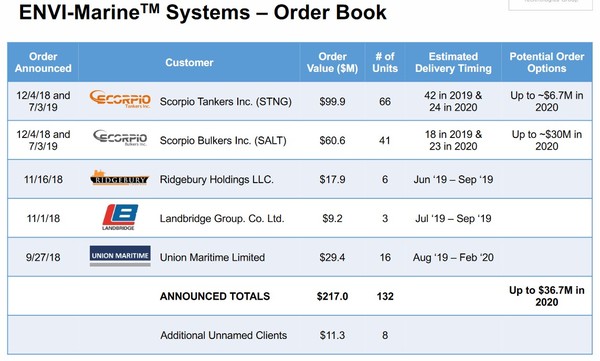

Over the last year Pacific Green has built up an order book of over 130

scrubber installations – with customers that include the Scorpio Group and

Union Maritime.

Source: Pacific Green Investor Presentation

Poulter was asked to give an update on scrubber dynamics now that IMO 2020 is

here – and now that shipping companies are seeing the impact of the rule

change.

To recap IMO 2020 – This is a new regulation to the shipping industry (that

began January this year) that limits sulphur emission. These limits

restrict the use of HSFO as a fuel source for most ships.

Unless a ship has a scrubber, it can no longer fill its fuel tank with high

sulphur fuel oil (HSFO).

Scrubbers Remain Economic

Poulter cleared up any confusion about the economics of scrubbers – they are even better

than expected for the large ships.

VLCC’s, containerships and other large carriers can see a payback in 5 to 7

months.

This may come as a surprise to some. The recent slide in very-low-sulphur

fuel (VLSFO) prices has led to some questions about whether scrubbers would

turn out to be worthwhile.

But while scrubber economics have narrowed since the beginning of January, they

remain quite favorable.

Throughout most of December, VLSFO prices rocketed to new highs. Since

January prices have fallen back down to earth.

Source: Sinagpore Bunker Prices – Ship &

Bunker

But the reality is that even at current prices, scrubber economics remain in

the black.

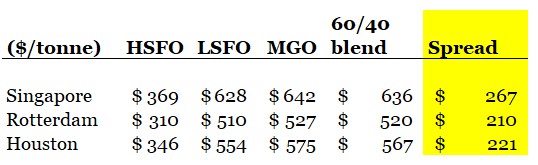

The spread at major fuel hubs still eclipses $200 per tonne based on a 60/40

blend of VLSFO and marine gasoil and current HSFO prices.

Source: Ship and Bunker, January 27, 2020 data

Last year shipowners were making the decision to install scrubbers at an

expected spread of ~$150 to $200 per tonne.

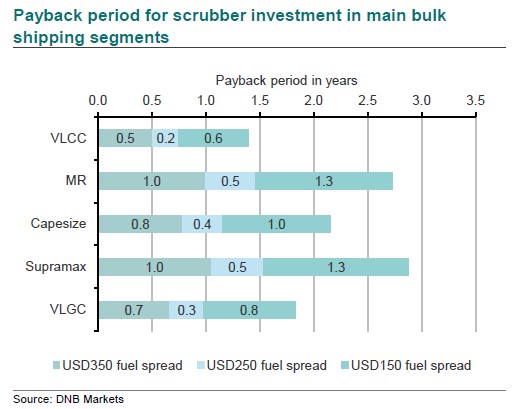

Depending on the ship size, this was the price level where payback was between

6 months and 1 year.

DNB Markets put out this handy table of scrubber economics some time ago.

It is still instructive today:

Source: DNB Markets – SHIPPING SECTOR: Scrubbing

up nicely for IMO 2020

The reality is that at current spreads it still is very economic to install

scrubbers on the larger tankers and containerships.

That being said, scrubbers don’t make sense for all ships. Smaller tanker

like MR’s don’t consume enough fuel to make scrubbers attractive.

Also, there remains a risk though that if product demand disappoints, spreads

may tighten further.

VLSFO and another fuel that ships can blend marine gas-oil (MGO) are middle

distillate products that compete for refinery capacity with other fuels – most

notably diesel.

A weakening economy that pulled down the price of other distillates could

continue to squeeze low-sulphur fuel margins.

Poulter Says Demand for Scrubbers Remains Strong

The

pop in VLSFO prices in December made many ship owners take notice.

Consequently, scrubber inquiries have picked up now that IMO 2020 is upon

us.

Poulter says that Pacific Green has received more scrubber inquires in the past 23

days than they did in all of 2019.

While

smaller ships are less likely to install scrubbers, on a fuel usage basis –

scrubbers are viable for 75% of the fuel consumption of the sector based on a

12 month return on investment.

That makes for a large addressable market for scrubber manufacturers.

Is Compliance Happening?

One

of the uncertainties going into 2020 was compliance. Would ports enforce

the rules?

At one particularly bleak moment Indonesia even went so far as to say they

would explicitly not enforce IMO 2020 at any of their ports (they have

since backtracked on those comments).

According to Poulter, those concerns have diminished. He says they are

seeing–so far–is strong enforcement of compliance at all the major ports.

Even during scrubber installations Poulter says that compliance is closely

checked. When they bring a vessel into the yard for a scrubber retrofit

they are restricted from using HSFO even for the short-trip in.

Instead they have to use gas-oil, and once the scrubber is installed the vessel

has to get an exemption to do sea trials on the scrubber – in other words even

the most minor usage of HSFO is being scrutinized.

Pacific Green works primarily in China where they operate under a joint venture

with Power China. They see that the China government is being “very, very”

strict about the enforcement of the regulations right now.

Long Lead Times

Pacific Green has a 6-month lead time on new scrubber orders but Poulter says

theirs is one of the shortest lead times in the industry.

Because of their JV with Power China, Pacific Green has shipyard capacity that

other installers do not.

What they are seeing from their competitors are up to 12 months of

backlog. On average Poulter believes the backlog for the industry

is around 9 months.

Open-Loop versus Closed Loop

Meanwhile, as restrictions on fuels become strictly enforced, the shift is

being made to scrubbers that do not discharge the effluent water into the

ocean.

Open-loop scrubbers have, in the past, dominated the market – making up around

90% of scrubber installations up until last year. But that has changed.

According to Liqtech (LIQT – NASDAQ) CEO Sune Mathieson that number has shifted

to between 25% to 50% of scrubber installations being closed loop.

Closed loop scrubbers use filter technology to clean (or “scrub”) the effluent

water before discharging it into the ocean. Liqtech manufactures a

silicon-carbide filter that can filter out the sulphur from the water,

accomplishing this process.

A Bumpy Road

With the coronavirus hitting the shipping industry hard, it adds one more layer

of uncertainty to an already muddy picture.

On the one-hand, anecdotal reports point to shortages of low-sulphur fuel at

some ports and buildups of HSFO that has no where to go.

But so far these anecdotes haven’t shown up in prices as differentials between

high and low sulphur fuel have narrowed.

What’s more, indications are that U.S refiners are importing HSFO as feedstock

to replace lost Venezuelan and Iranian heavy crude. This is keeping a bid

under prices, at least in North America.

With so many factors influencing prices, trying to make a bet on where these

product prices go from here is very tricky.

What has to be always kept close at mind is that product prices are all

connected – if demand for one goes down, refiners will shift their output at

the margins to produce more of another that is more profitable.

Finally, for tiny suppliers like Pacific Green and Liqtech, the question that

looms is–can they actually generate Big Money from the scrubber boom.

That, perhaps is the biggest uncertainty of all. In Liqtech’s case, at

their recent investor day the company targeted 30% gross margins for the first

half of 2020 and guided to 40% gross margins by 2021.

This remains a far-cry from the 65% gross margins that the company had been

expecting once it had ramped production.

Pacific Green seems to be handling the sudden influx of back log a bit

better. In Q3 19 they earned 30c EPS – not bad for a $3 stock.

The scrubber opportunity will not last forever. Installations will likely

peak this year, and in a few more years of catching up to the retrofit backglog

it will only be new ships that will see installs.

That means these companies need to make hay while they can.

EDITORS NOTE: Winter natgas prices have rarely (ever?) been lower—but RENEWABLE natgas—RNG—trades actively for 10X the price. It’s actually highly profitable. I found the pick-and-shovel play in the RNG sector that is catching A LOT of investor interest—click HERE to get this winner before it climbs over $1!!!