The issuance of green, social and

sustainability bonds, those where the proceeds will be exclusively applied to

eligible environmental and/or community projects, are expected to climb

24% to $400 billion in 2020 from a previous record of $323 billion achieved last

year, a report

published Monday shows.

“Across the financial sector,

market participants are increasingly integrating environmental, social and

governance (ESG) considerations and sustainability,” said Matthew

Kuchtyak, analyst at Moody’s Investors Service. “Governments and

regulators are also providing greater structure and clarity to the sustainable

finance market as their focus on climate change and sustainability grows.”

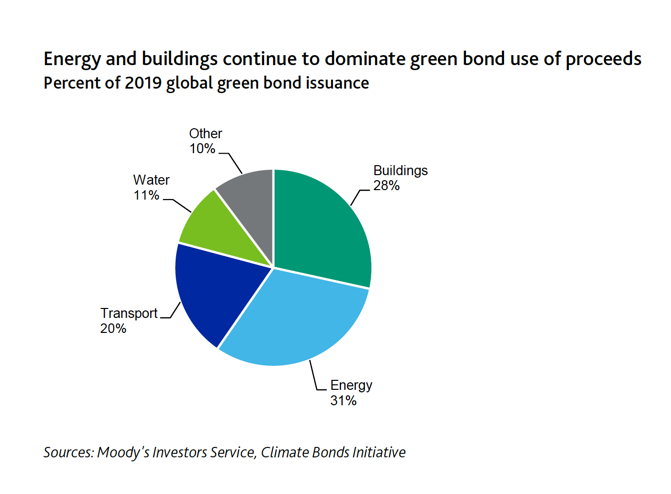

Green bond issuance will reach $300 billion this year, while social and sustainability ones will reach $25 billion and $75 billion, respectively, Moody’s says. As the social and sustainability bond markets grow and mature, the credit ratings firm expects issuance from these segments to become more diversified in terms of sector and region, similar to trends seen in the green bond market.

Moody’s expects that growth in

issuance from alternative sustainability-themed labels, such as transition

bonds, will accelerate given the market attention in this area. Those so-called

transition instruments are designed to help issuers in emissions-heavy

industries, such as oil production and coal mining, finance their shift to

cleaner ways of conducting business.

The difference between green and transition bonds is that the former are restricted to financing for projects that are environmentally friendly, while the other kind focus on an issuer’s behaviour — how committed it is to becoming greener.

Growth may be uneven over the near

term, however, due to the current lack of definitional clarity, Moody’s warn There’s

no

consensus yet on what types of commitments companies would need to make,

though it’s expected that borrowers would need to sign up to specific targets,

as well as broader sustainability goals.