This post Time to give Powell Truth Serum appeared first on Daily Reckoning.

The coronavirus has gone… “viral.” At the very least its media coverage has.

You may have therefore missed the news yesterday:

The Federal Reserve concluded its January FOMC meeting. It thereupon announced it is holding interest rates steady.

The federal funds target rate stays sandwiched between 1.50% and 1.75%.

Jerome Powell gave off his usual post-announcement whim-wham. He talked a lot, that is… but did not say much.

Example: A reporter rose before him with a question…

He asked the chairman if he feared withdrawing support for the “repo” market. The stock market may file a vigorous protest if he does, the implication being.

Powell came back at him this way:

In terms of what affects markets, I think many things affect markets. It’s very hard to say with any precision at any time what is affecting markets.

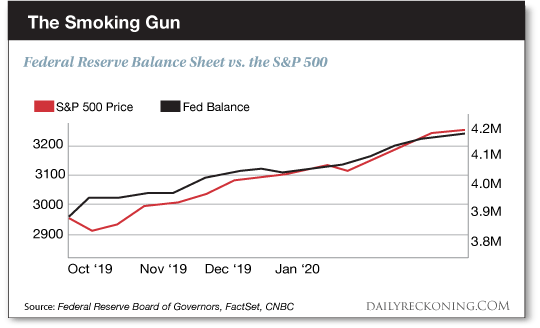

Yet here is the very picture of precision:

Here, once again, the precise union between the Federal Reserve’s balance sheet and the S&P 500.

The two have gone happily arm in arm, linked, since early October.

Yet a Federal Reserve chairman must master the artful dodge, the skill to pretend ignorance of the most elemental facts — even the evidence of his own eyeballs.

Imagine the scene…

You enter a dining room for your evening meal. Jerome Powell is by your side.

You are astounded to discover a behemoth draft horse lounging upon the dining table. Stunned, ruffled, gobsmacked, you solicit comment from your dining mate…

“What horse?” asks he. “I don’t see a horse.”

Do we condemn the chairman? Do we impugn him, belittle him, call him into ridicule?

No. We are actually in deep sympathy with him. What — after all — is this fellow to say?

Is he to concede that the stock market is a house constructed of playing cards… and that he is its foundation?

That it would come heaping down without his determined and continuous support?

An honest answer would take the floor out of a vast fiction — the vast fiction that the stock market goes by itself, that its own pillars hold it up.

Dose him with C11H17N2NaO2S — that is, dose him with sodium pentothal — that is, dose him with truth serum…

And the ensuing geyser of honesty would collapse the Wall Street stock exchanges… as surely as the ancient Israelites collapsed the walls of Jericho.

Here is a brief sample of what Mr. Powell would confess under chemical influence:

That he is a mediocrity, a blank, a preposterous formula…

That he is far out of his depth…

That he is as fit to chair the Federal Reserve’s board of governors as he is to chair a board of barbers…

That he cannot tell you the next quarter’s GDP at the price of his soul…

That his enflamed hemorrhoids torture him ceaselessly…

That he cannot possibly determine the proper interest rate for millions upon millions of independent economic actors…

That he wields far less influence over interest rates than commonly believed…

That the president of the New York Fed smells…

That there is no actual money in monetary policy…

That he clings yet to his boyhood fantasy of becoming a salesman of life insurance…

That his wife’s cooking is a daily source of agony…

That his — no, no — we had better stop here. Some truths must remain dark. That counts double for a man of Mr. Powell’s high station.

Instead, the good chairman will babble what the world wants him to babble. Like this, for example, from yesterday:

The committee judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions and inflation returning to the committee’s symmetric 2% objective.

Or this, also from yesterday:

[The] labor market continues to perform well… We see strong job creation, we see low unemployment [and] very importantly we see labor force participation continuing to move up.

And this:

Some of the uncertainties around trade have diminished recently and there are some signs that global growth may be stabilizing after declining since mid-2018.

Does Mr. Powell believe the words issuing from his own mouth? We are far from convinced.

Perhaps it truly is time to fill him with sodium pentathol…

Below, Jim Rickards shows you why the happy talk is simply that, and why the Fed has “never been more divided.” Read on.

Regards,

Brian Maher

Managing editor, The Daily Reckoning

The post Time to give Powell Truth Serum appeared first on Daily Reckoning.