The gold price was drifting sideways on Thursday, down some $50 an ounce from a brief (but glorious) near seven-year intraday high above $1,600 an ounce a fortnight ago.

But the metal remains firmly in a bull market with a 20%-plus rise over the past year. Going back 20 years and the rally is even more spectacular considering at the turn of the century gold was trading for a relative pittance of $270 an ounce.

Is gold overvalued at these levels? Has the rise been too far, too fast? Are gold bugs (once again) guilty of irrational exuberance?

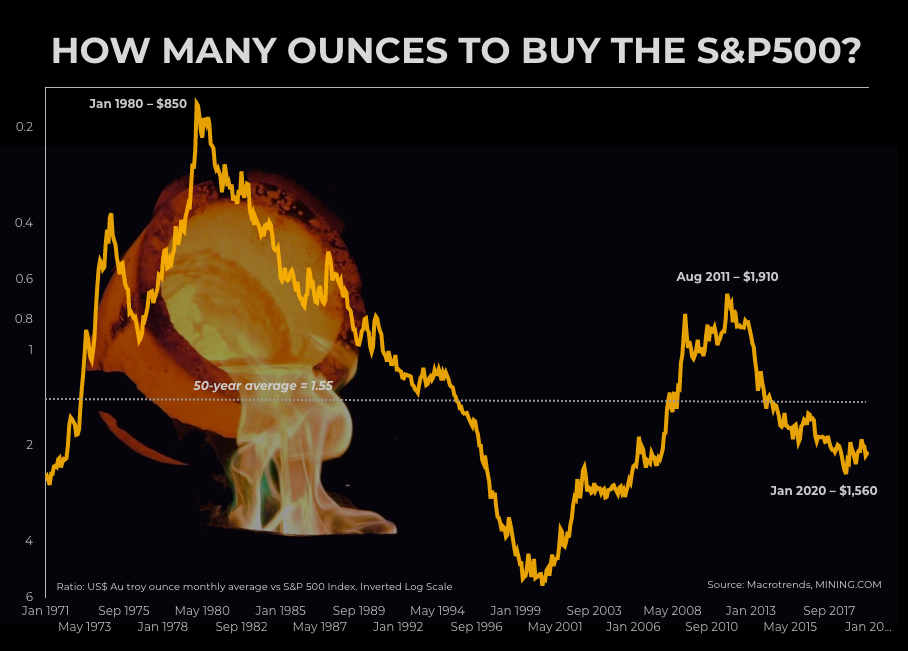

In comparison to stock markets the answer is a resounding no. The gold price’s underperformance relative to the record–setting S&P 500 Index is stark.

That implies a fair value for gold north of $2,400 which either means gold bugs’ party has only begun or stocks are in for a real beating.

Today you need little over two ounces to buy the market. The ratio was the same in September 2007 when an ounce of gold could be picked up for less than $600.

The average over the long term – and we’re talking 90-years here – is 1.31.

Since the US left the gold standard entirely in August 1971, it’s 1.55. That implies a fair value for gold north of $2,400 an ounce which either means gold bugs’ party has only begun or stocks are in for a real beating.

You can argue that during gold’s spike in 1980 to $850 an ounce – in inflation-adjusted terms still the all-time high – it lost touch with stock values (and some would say reality) entirely.

But the recent peak – when gold hit a record around $1,900 an ounce in 2011 – did not constitute a wild deviation from the norm and based on relative value could be in reach once again.