Germany is hoping to engage Bolivia’s next government in talks over a scrapped joint venture deal to develop the South American country’s massive lithium reserves, as members of its car sector struggle to meet electric vehicles (EVs) production targets due to a supply shortage of battery cells.

Both nations signed a lithium partnership in 2018 following three years of intense lobbying from Berlin, which said a small privately-owned company from Germany was a better bet than its Chinese rivals.

Bolivia’s state-owned lithium

company YLB and Germany’s ACI System planned to install four lithium plants in

the Salar de Uyuni salt flats, which hold the world’s second-largest

lithium deposit.

The joint venture was also going to

build a factory for EV batteries in the country, which is sitting on about

nine million tonnes of lithium, or around 25% of the world’s known reserves.

The deal, however, was cancelled in

November following locals’ protests and a change of leadership at YLB following

president Evo Morales resignation.

Morales had fled Bolivia earlier in

the month after losing the support of the military and police amid widespread

protests over a disputed election. His supporters say he was the victim of an

orchestrated coup. Opponents argue he was forced from power after manipulating

the constitution to run for a fourth term in office then seeking to win that

vote with electoral fraud.

Bolivians will choose a new

president May 3 and Berlin is closely following related developments as the

cancelled venture is considered vital for the German auto industry’s plans to

develop electric batteries.

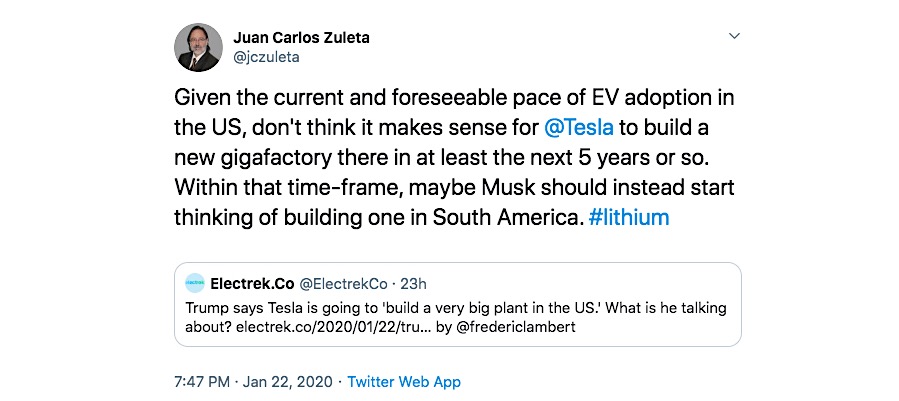

The new head of YLB, Juan Carlos

Zuleta, said last week the deal would not be revived, adding that the state-owned

company planned to apply strict limits to foreign investment in the extraction

and processing of the key element for the production of the batteries that

power EVs and smart phones.

Zuleta, however, doesn’t seem fully

opposed to letting foreign companies as he noted that a similar deal with China’s

Xinjiang TBEA was being reassessed. He also hinted recently that Tesla should

be considering building a plant in Bolivia.

Demand for the white mineral is

expected to more than double by 2025. The soft, light commodity is mined mainly

in Australia, Chile and Argentina.

Bolivia wants to strengthen local

know-how and become a producer, but its lithium is found at higher altitude and

contain more magnesium (Mg) and potassium than in neighbouring Chile and

Argentina, making the extraction process much more complicated and costly.

Uyuni’s higher rainfall and cooler

climate mean that its evaporation rate is not even half that of Chile’s Salar

de Atacama, where brine ponds evaporate quickly.

Germany’s push comes as some of its key auto industry actors are beginning to show signs of distress. Manager Magazin reported on Thursday that Daimler has been forced to reduce its 2020 production targets for the Mercedes-Benz EQC EV to 30,000 from about 60,000 due to a supply shortage of battery cells from LG Chem.

Daimler expected to sell around

25,000 EQC vehicles last year, but was only able to build around 7,000, the article

said.

German Economy Minister, Peter Altmaier, has urged local industries to secure raw materials for electric batteries to reduce dependence on Asian suppliers.