This post Central Banker Comes Clean appeared first on Daily Reckoning.

Reuters broadcasts the confession:

I do think the growth in the balance sheet is having some impact on the financial markets and on the valuation of risk assets…

Here we have the unassailable and unimpeachable testimony of one Robert Kaplan. He, Mr. Kaplan, presides over the Federal Reserve’s Dallas branch office.

And so a central bank grandee gives it straight… and stamps our dark suspicions with an official seal.

For this has been our claim:

The latest stock market fever owes not to trade, not to economics, not to “fundamentals.”

It owes rather to a delirious four-month expansion of the Federal Reserve’s balance sheet.

Irrefutable Evidence

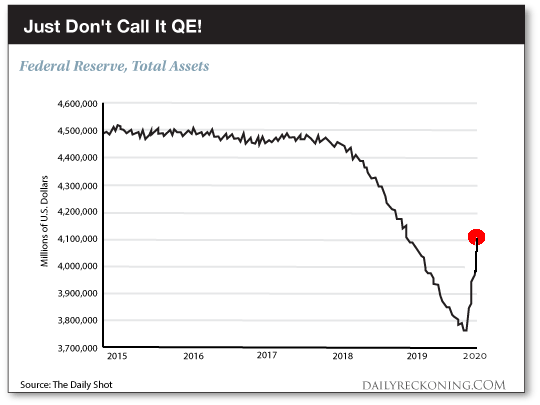

Let us re-enter Exhibit A into evidence:

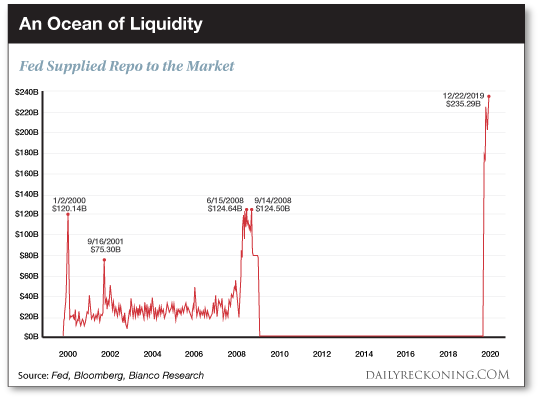

And Exhibit B:

This, as we have noted repeatedly, is a direct response to liquidity shortages in the short-term lending markets. In brief summary:

The Federal Reserve has expanded its balance sheet $400 billion these past four months — a $1.2 trillion annualized rate.

The same balance sheet presently rises near $4.2 trillion… a mere holler from its $4.5 trillion record.

As Goes the Balance Sheet, so Goes the Stock Market

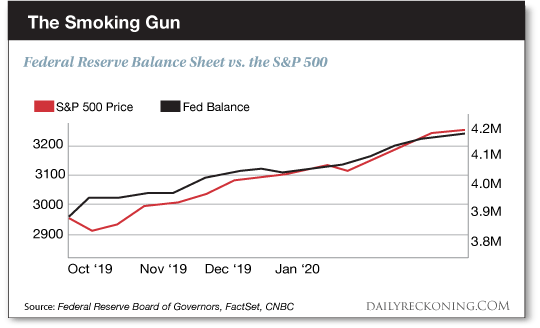

Now let Exhibit C go into the record:

As revealed, the stock market pandemonium since October matches nearly perfectly the balance sheet engorgement.

The Dow Jones once again crossed 29,000 today, as it did briefly last week. As last week, it lost its purchase… and skidded back down.

It ended the day at 28,939.

But tomorrow promises a fresh assault upon the peaks.

Should we then be surprised that investor sentiment presently runs to extreme greed?

Extreme Greed

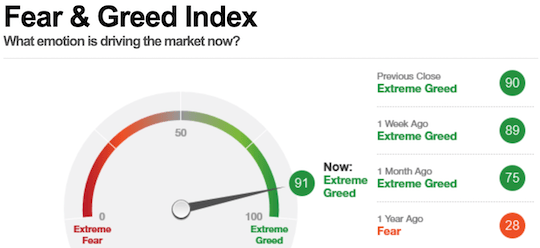

Behold CNN’s Fear & Greed Index:

This Fear & Greed Index presently reads a sinfully avaricious 90 — “extreme greed.”

What did it read one year ago today?

It read 30… verging on “extreme fear.”

But that was before the Federal Reserve furled back its sleeves, spat upon its hands… and set to work…

Before it began hacking interest rates, before it halted quantitative tightening — before it sent the balance sheet ballooning.

One year later the stock market rises to record highs and sentiment runs to extreme greed.

“The Bullish Sentiment We’re Getting Now Has Reached the Uncomfortable Stage”

Here at The Daily Reckoning, our distrust of crowds approximates our distrust of politicians, sellers of used autos… and statistics.

When the crowd goes herding into the same railcar, we instinctively jump tracks.

And the railcar is filling fast…

“The bullish sentiment we’re getting now has reached the uncomfortable stage,” affirms Jeff deGraaf, chairman of Renaissance Macro Research, adding:

“Some of the levels we’ve seen are, frankly, similar to what we saw in January of 2018.”

In reminder: The stock market “corrected” over 10% between Jan. 26 and Feb. 8, 2018.

We believe it is preparing to correct again. But not until the market uncorrects further yet…

“Peak Bullishness and Dovishness”

Tomorrow the president puts his signature to the “phase one” trade accord with China.

The United States will cancel scheduled tariffs on Chinese wares… and China will agree to purchase additional American bounty.

The computer algorithms will pluck the joyful news from the wires. They will proceed to pummel the “buy” button.

Thus you can expect CNN’s Fear & Greed Index to lurch even further into greed.

Meantime, the Federal Reserve huddles at Washington in two weeks.

It will not lower rates — but nor will it raise them up. Federal funds futures presently give 87.3% odds that rates remain in place.

Conditions will remain accordingly benign. And markets can continue their journey into the record books, unruffled and undisturbed.

That is why Bank of America warns markets presently careen toward “peak bullishness and dovishness.”

What lies the other side of these lofty and treacherous peaks?

We hazard the stock market will correct in February, once across. We suspect it will correct on the same general scale as 2018.

Let us now turn our attention to the great bugaboo of today’s market, the skunk lurking in this growing woodpile…

Too Many Eggs in Too Few Baskets

Merely five stocks — Apple, Microsoft, Alphabet (Google’s parent company), Amazon and Facebook — presently constitute 18% of the S&P’s total market capitalization.

As Morgan Stanley reminds us, that is the highest percentage in history.

“A ratio like this is unprecedented, including during the tech bubble,” says Mike Wilson, who directs Morgan Stanley’s U.S. equity strategy.

These stocks account for much of the S&P’s 2019 outperformance. Apple and Microsoft accounted for nearly 15% of all S&P gains.

Rarely before, we conclude, have so many investors… owed so much… to so few stocks.

But what if these wagon-pullers crack under the strain — and throw off the burden of leadership?

CNBC:

These mega tech firms have been the front-runners in this record-long bull market as investors bet on superior growth and dominant market share in their respective industries. They were the biggest contributors to the market’s historic gains last year and the trend shows no signs of stopping in 2020. However, multiple Wall Street strategists are sounding alarms on the increasing dominance of Big Tech, warning of a potential pullback in the stocks ahead.

Will anyone carry the standard forward should the leaders falter?

No, suggests Goldman Sachs:

“Narrow bull markets eventually lead to large drawdowns.”

The Tide Rises, Until It Doesn’t

Next we come to the strategy of “passive investing.”

Passive, because it rises or falls with the prevailing tide.

After the 2008 near-collapse, the Federal Reserve inundated markets with oceans of liquidity.

The tide rose, and all boats with it.

Technology stocks like Apple and Microsoft have led the way up.

Much of Wall Street has poured into these stocks… sat back on its oars… and rode the current to record highs.

The biblical-level flooding flattened existing financial signposts. “Fundamentals” no longer mattered.

“Active” asset managers fishing for winners could no longer separate them from the losers. The nets came up full of winners and losers alike.

All is peace while the tide of liquidity rises. But the danger is this, as we have written before:

When the tide recedes… it recedes.

Panic Selling Begets Panic Selling

The same handful of stocks that hauled markets up on an incoming tide can drag them rapidly down on an outgoing tide.

Panic selling begins. And panic selling begets panic selling — which begets panic selling.

Explains Jim Rickards:

In a bull market, the effect is to amplify the upside as indexers pile into hot stocks like Google and Apple. But a small sell-off can turn into a stampede as passive investors head for the exits all at once without regard to the fundamentals of a particular stock…

The technical name for this kind of spontaneous crowd behavior is hypersynchronicity, but it’s just as helpful to think of it as a herd of wildebeest that suddenly stampede as one at the first scent of an approaching lion. The last one to run is mostly likely to be eaten alive.

Meantime, the Federal Reserve’s balance sheet continues to expand, the fools continue to rush in…

And the gods continue to plot.

Regards,

Brian Maher

Managing editor, The Daily Reckoning

The post Central Banker Comes Clean appeared first on Daily Reckoning.